Lido And The Merge

Too Long, Didn’t Stake:

If you’re already comfortable with your knowledge about the Merge (and what it does and does not do), here is a summary of how the Merge will affect Lido.

1. stETH will continue to exist post-merge

stETH will continue to exist and serve the same purpose it does now: act as an unlocked, liquid, and composable representation of the stake and staking rewards of tens of thousands of users. There will still be value in stETH as a deeply integrated DeFi Lego across the ecosystem allowing for customizable strategies. It will work the same way as it does now, and will also accrue additional rewards that will arise from the move from Proof of Work to Proof of Stake (more on that below).

2. The Merge will not allow users to unstake ETH

Withdrawals will only be possible in the hardfork following the Merge. Until then, users can swap their stETH for ETH or other tokens via secondary markets such as Decentralized Exchanges like Curve or Uniswap.

3. Lido is Merge-ready and will receive additional rewards for validators, which will have an upward effect on stETH APR

Lido completed an upgrade specifically designed for the Merge, and Lido node operators participate in merge testnets following the requirements and guidance for node configuration. As of now, Lido validators have reported that their nodes have been correctly configured.

In PoS Ethereum, validators will take on the role of (Execution Layer) block proposers, and thus receive rewards via priority fees and potential Maximal Extractable Value (MEV) rewards. These rewards (less protocol fees) will be available directly on the Execution Layer and will be staked by Lido, which will increase the rewards that stETH users will receive. Lido has already implemented this mechanism on Ethereum mainnet, and additional rewards will start accruing immediately once priority fees start coming in post-Merge.

4. Lido is working with its community and Node Operators to determine what to do with MEV and rewards

Lido is engaged in an open and transparent process to come up with a policy to:

- Determine how and when MEV may be extracted and rewards received

- Share MEV rewards with stakers

- Ensure that Node Operators are in compliance with the DAO-approved approach

Like priority fees, MEV rewards will also increase the rewards that stETH users receive.

What the Merge is (and what it isn't)

What exactly is Merging?

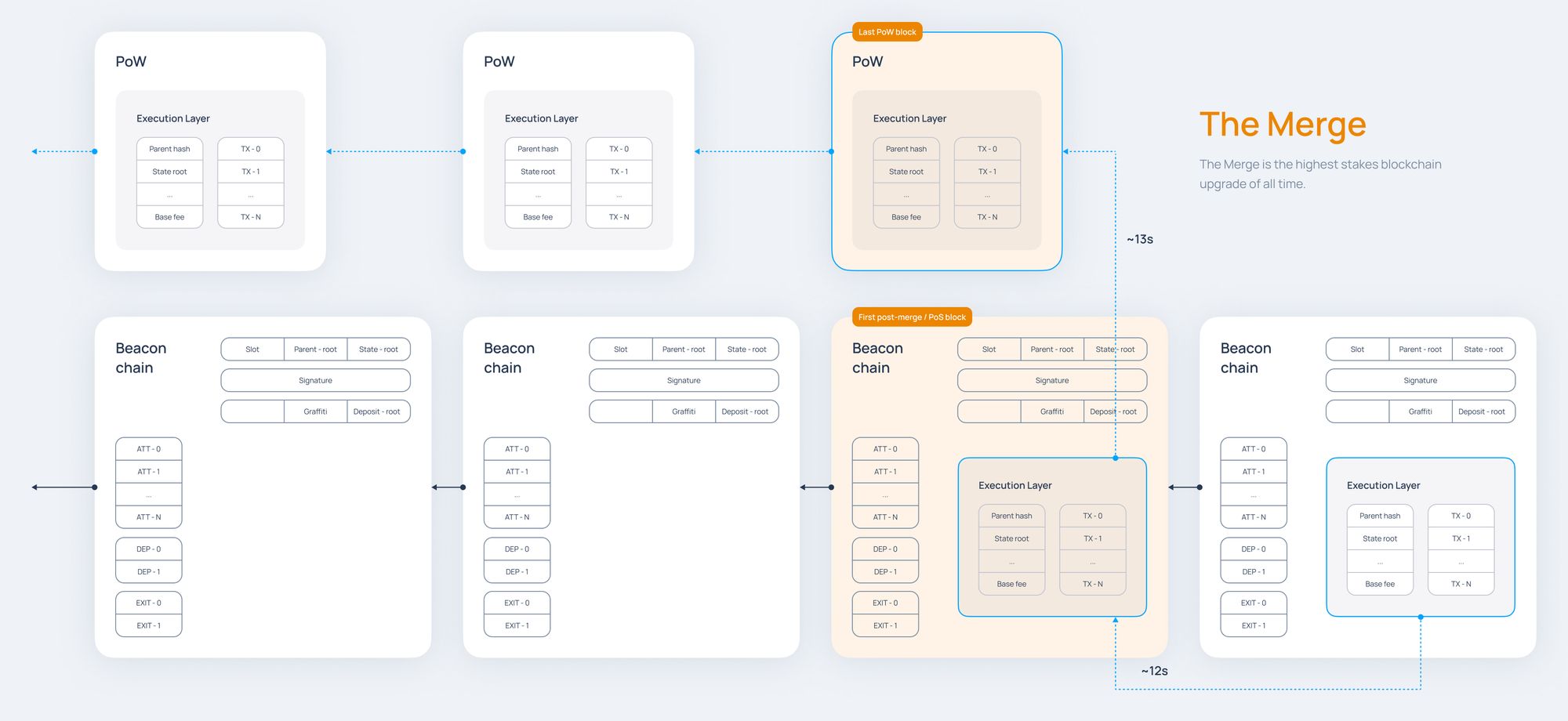

Ethereum is essentially composed of two layers: a consensus layer and an execution layer. For most of Ethereum's history, this hasn't been readily apparent to the average user. Even from a technical perspective, they have been so tightly coupled that they were considered to be operating as one. The original version of Ethereum is generally referred to as Proof of Work (PoW) Ethereum.

The Consensus Layer is the networking mechanism through which nodes achieve agreement as to which chain is the canonical one, and the Execution Layer is the mechanism through which nodes execute EVM operations, propagate transactions, and manage state and historical data.

Following the launch of the Ethereum Beacon Chain (Ethereum’s Proof of Stake Consensus Layer) in December 2020, what we consider as Ethereum has been composed of two independent blockchains: the canonical Proof of Work (PoW) Ethereum chain, and a Proof of Stake (PoS) network designed to eventually act as Ethereum’s sole Consensus Layer. With the Merge, PoW Ethereum will essentially “dock” into PoS Ethereum, and the PoW Consensus Layer mechanism will be shed in favor of the PoS one.

It's important to note here that there is no "second Ethereum". "Ethereum 2.0" or "Eth2" were used in the past to refer to a series of improvements to the Ethereum protocol, one of which was the introduction of PoS. Although the Beacon Chain is technically an independent blockchain, it is not a new Ethereum, it's just a new consensus mechanism that will house the Execution Layer, which is where all the content of Ethereum rests.

The Merge will occur following the Bellatrix and Paris hardforks (for the Consensus and Execution layers respectively). For The Merge to occur, the Beacon Chain must first be upgraded to "host" the transactional payloads of the Execution Layer. This upgrade is called "Bellatrix". Once this happens, the current PoW network will be ready to move its consensus to Proof of Stake. This transition is triggered upon hitting a specific PoW Total Difficulty. Once this happens, the current PoW chain stops listening to PoW as its consensus mechanism and will instead follow the Beacon Chain. It is important to remember that the Merge isn't the end of Ethereum's evolution. The Merge is an integral piece - but just a piece -- of Ethereum's overall evolutionary roadmap.

What will happen as a result of the Merge?

As explained above, the purpose of the Merge is to deprecate the PoW consensus mechanism in favor of PoS, and ensure that the original Execution Layer and the new Consensus Layer fit together so that Ethereum keeps moving. The most important effect of this transition is that mining will no longer have a place in Ethereum, as blocks in Proof of Stake are produced by validators, which are incentivized to perform well due to incentives (known as staking rewards) and disincentivized from under-performing or harming the network through penalties (for inactivity) and slashing (for malicious activity).

Since the PoS Ethereum Beacon Chain has already been running since December of 2020, there are already validators who have been receiving staking rewards, and they will continue to do so following the Merge. Note that the rewards that stakers have been receiving for performing validator duties accrue within the Beacon Chain (the Consensus Layer) (this is important, and we'll explain why below). The Merge will also slightly affect the requirements for running a proper validator in Ethereum; users running validators will have to ensure that they are running an Execution Layer node (see FAQ) and will not be able to rely on third party node providers like Infura, Alchemy, or Pocket Network post-merge.

Thus, if all goes well and the Merge is successful, it is expected that the number of validators and stakers in Ethereum will grow for two reasons:

- The technical risk associated with the Merge is non-negligible, and thus some would-be stakers are hesitant to engage in validating as they are worried that they may not be able to retrieve their stake (necessary funds deposited to a validator so that it can be considered active). Upon successful Merge this risk is drastically reduced (but not zeroed out, more on that below);

- Block proposers (i.e. validators proposing a specific block) will receive additional rewards that were previously going to miners: priority fees and MEV rewards. These rewards will increase the return on investment for those running validators.

However, there is an important clarification that needs to be made: The Merge will not enable withdrawals from the Execution Layer of the rewards that have been accruing to stakers on the Beacon Chain, or of their initial stakes (and thus will not allow for them to be used in DeFi, re-staked, sold, or withdrawn from Ethereum via exchanges or off-ramps). That being said, the rewards that accrue to block proposers in the Execution Layer (priority fees and potential MEV rewards) will be immediately available to validators, since they are paid directly in the Execution Layer.

Given that block space is scarce, users compete against each other to get their transactions included in blocks, and they do that by paying a total transaction fee, which is broken up into a base fee and a priority fee. Priority fees – often referred to and thought of as a “tip” – are basically the gas that is left over in a transaction after the base fee (the minimum cost to transact on the network at a given time) has been burnt, and this remainder is used to incentive miners (in PoW) and validators (in PoS) to process a user’s transaction(s). MEV rewards for validators can similarly be thought of as the portion of MEV extracted which searchers or block builders are willing to pay to miners or validators in order to incentivize them to include the relevant MEV opportunities.

Withdrawal functionality will only be introduced to Ethereum later, in the first hardfork following the Merge, which is estimated to follow 6-9 months later. Among other important things, the hardfork will introduce “withdrawal operations”: a mechanism for stakers to fully exit their validators and withdraw their stake from the Beacon Chain back to the Execution Layer.

When will the Merge happen?

The Merge has already been tested on numerous special-purpose testnets (e.g. Kintsugi, Kiln, etc.), previous Ethereum testnets which will be deprecated in the future (Ropsten), as well as others that may remain into the future (Sepolia). Goerli underwent a successful merge, etc. Merge for mainnet Ethereum is targeted for September 15, 2022.

Lido has been working diligently with its Node Operators, its users, Ethereum developers, and third parties such as Flashbots who are the driving force behind advances in MEV on Ethereum, to prepare for the Merge and what is to come.

How does the Merge affect Lido?

At this point, a reader unfamiliar with what Lido and other liquid staking solutions offer may recognize that there is room for a type of asset whereby users who are willing to take the financial risk of staking, but not the technical or operational risk and associated costs, and share staking rewards between operators who can provide this service and the protocol that enables this service to take place.

In late 2020, this is exactly what Lido set out to do: Lido created stETH, one of the first liquid staking tokens on Ethereum. stETH is a way for users to deposit any amount of ETH (vs the minimum of 32 ETH needed to participate as a solo staker) to contribute towards securing the Ethereum PoS network, and share in the rewards that accrue to validators. Most importantly, stETH enables a mechanism for the staking rewards that have accrued – as well as the original principal – on the Beacon Chain to be made available (at a slight discount) on the Execution Layer via a token that is deeply liquid, and which has the potential to be a key building block within DeFi.

Users of Lido sometimes ask, "Once the Merge has occurred, what happens to stETH? Does it stop existing or having value?" The simple answer is: Νothing happens to stETH. stETH will continue to exist and serve the same purpose it does now: act as representation of the stake and staking rewards of tens of thousands of users, unlocked, liquid, and composable.

Additionally, as we discussed above, the move to PoS will increase rewards to validators in the form of Priority Fees and possible MEV rewards, which will accrue to stETH holders similarly to how staking rewards accrue today. Let's examine the potential changes one at a time.

Withdrawals and Redeemability

The Merge will not enable users to "unstake'' their ETH, since withdrawals will not yet be enabled. Once withdrawals are enabled in the next hardfork, one of the original stated benefits of stETH will diminish (i.e. staked Ether will go from non-redeemable due to technical reasons to redeemable). That said, stakers may experience (potentially large) delays when redeeming ETH from the Beacon Chain.

The same way that validators entering the Beacon Chain are placed in a queue, validators exiting the chain (a necessary condition for the full value of a validator to be redeemed) are also queued. This exit queue is in place to help ensure that malicious participants could not quickly take over or exit substantial parts of the total validator set. In a hypothetical (and realistic) scenario where tens of thousands of validators are being exited at the same time, the queue can rise to weeks if not months in duration. Partial withdrawals (the ability to "skim" any ETH on a validator that is above the 32 ETH minimum required for a validator to be active) will certainly help abate the number of validators that need to be exited at any one point in time, but it's possible that some stakers -- especially early ones -- may want to fully exit their validators for a variety of reasons (e.g. to cycle the Ether, to change withdrawal credentials, etc.).

Thus, in this respect, stETH (via its liquidity on secondary markets) will continue to serve as the quickest way to enter or exit a position in staked Ether, although it is possible that doing so may incur a slight premium. For those not in a rush, the ability to properly unstake stETH will allow users who are willing to wait for the withdrawal period to benefit from arbitraging the price of stETH between the primary and secondary markets, so being patient can literally pay off!

Returns to stakers

The Merge will also, at least in the short to medium term, increase the rewards that stETH stakers are receiving for their stake. This will happen due to three mechanisms: Priority Fees, MEV rewards, and eventually – once withdrawals are enabled – compounding of staking rewards. That being said, an important caveat is that staking rewards to all stakers reduce as the number of validators on Ethereum grows. As a result, the issuance-based rewards may decline for each validator as the addition of post-Merge priority fees and MEV rewards incentivize more validators to join the network. Stakers should expect total rewards to be volatile until a new equilibrium is found. Based on estimates, overall stETH APR will likely increase from current 3.9% to a range of 5 - 8.2%, depending on how much activity is happening on the network.

Priority Fees

As mentioned earlier, in PoS Ethereum validators will receive rewards in the form of priority fees. Priority Fees are the "tip" that is left over after the required gas for a transaction as per the EIP-1559 mechanism has been burnt. Previously, these priority fees were going to miners, and post-Merge they will be going to validators. These priority fees can be quite large, and increase in value when the network is congested.

Lido has already rolled out changes to its mainnet contract code, in which Priority Fees will be re-staked in the protocol with the same fee structure as normal staking (90% to stakers, 5% to the protocol, and 5% to Node Operators). This will have an upward effect on the APR that stETH holders receive.

MEV Rewards

Similar to priority fees, validators will also be able to extract additional value from blocks due to MEV. Lido is working on a policy that will describe what process and infrastructure the protocol and its constituent Node Operators would be able to use to extract MEV and share rewards with stakers. Although the policy is not finalized, as there is still testing to be done to assess the required infrastructure and implementation decisions to be made, it is likely that Lido will source blocks from open and transparent builder markets, receive them in an encrypted manner, and publish them (potentially through infrastructure such as MEV-boost). Rewards from this process will be similarly shared with stakers, and a consequent upward effect on APR for stETH holders is expected.

Compounding of staking rewards

Following the hardfork that will allow for withdrawal operations, Lido will also likely engage in the compounding of staking rewards. It will probably do this through a combination of cycling (i.e. exiting and then re-depositing the ETH from validators) and partial withdrawals (skimming ETH from validators with balances > 32 ETH), which will further increase rewards for stETH holders.

Conclusion

The Merge is the most important milestone for the Ethereum blockchain since its launch seven years ago. Lido is proud of its role in democratizing access to staking on the Beacon Chain and playing a part in bringing its economic security to the level it has reached today. Everyone in the community is looking forward to Merge as the ‘man on the moon’ moment that it will be for a liquid staking protocol like Lido.