Guide: Use stETH as Collateral With Inverse Finance

Inverse Finance has added support for Lido's staked ETH (stETH) 🏝️

This guide brings you an overview of Inverse Finance, Anchor and how you can deploy your stETH as collateral to borrow assets.

Summary

- What is Inverse Finance

- What is Anchor

- How to deposit stETH into Anchor

- How to borrow assets

- How to repay loans to withdraw collateral

- How to get stETH

What is Inverse Finance?

This week, Inverse Finance passed a governance proposal to list Lido's stETH on Anchor. Anchor is the second money-market protocol to list stETH, making it possible to lend and borrow against your stETH. Because stETH grows in value through staking rewards, it means you can borrow against an asset that is earning staking rewards!

Inverse.finance is a suite of permissionless decentralized finance tools governed by the Inverse DAO, a decentralized autonomous organization running on the Ethereum blockchain.

Their main products are Anchor, DOLA and DCA Vaults.

Inverse.finance is governed and run by its community of token holders (numbering over 2000 holders) and elected delegates.

What is Anchor?

Anchor is a money-market protocol similar to Maker, Compound and Synthetix, but one that facilitates capital efficient lending & borrowing via the issuance of synthetic tokens (eg. DOLA) & non-synthetic credit (eg. borrowing tokens such as ETH). Those familiar with Lido's integration with Terra/Luna should not be confused with Anchor Protocol. Inverse Finance's Anchor is a separate entity from Terra/Luna's Anchor Protocol.

Anchor launched on the 25th of February, 2021.

The Anchor System Overview:

- DOLA - the first tokenized synthetic asset issued by Anchor.

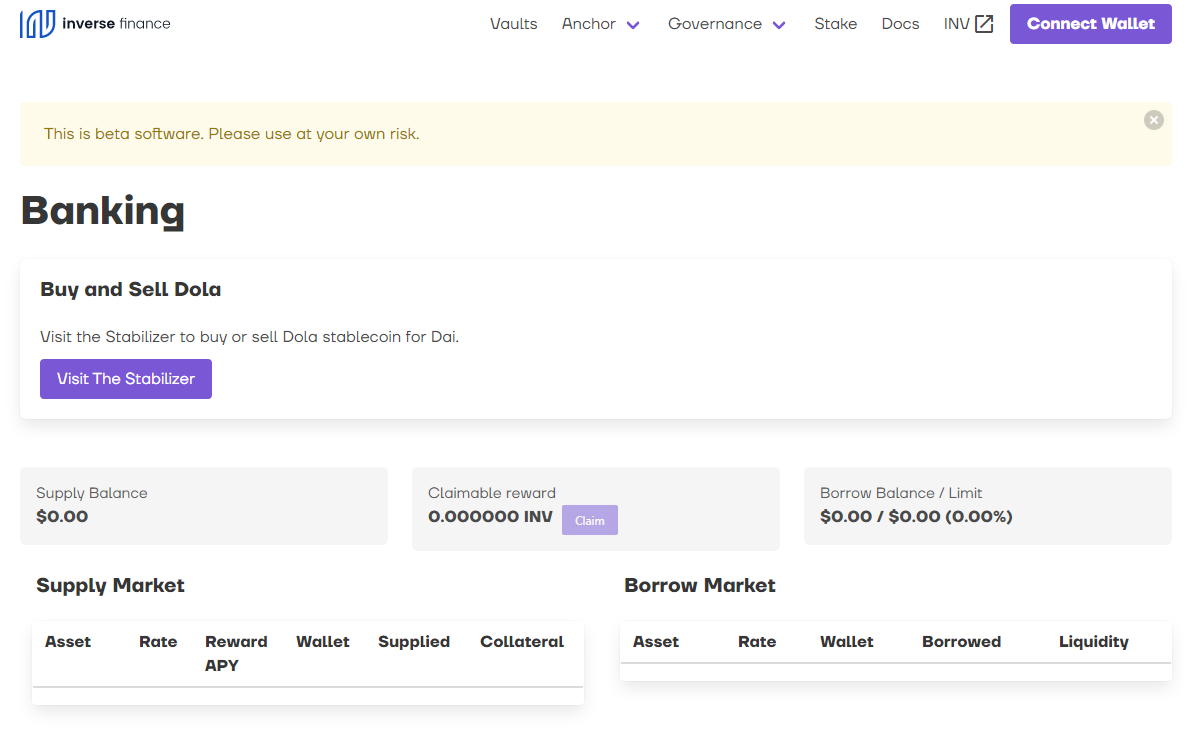

- Banking - the Anchor money market.

- Stabilizer - mint & burn DOLA for Dai at 1:1 price.

- Liquidity Pools (Curve & Uniswap) - for DOLA liquidity & stability.

From a capital-efficient money market, to tokenized synthetic assets, legacy finance is about to be invaded.

How to deposit stETH into Anchor

When supplying stETH as collateral into Anchor, users will be able to borrow assets based on their stETH up to a 60% collateralization ratio.

- Visit Inverse Finance Banking

- Connect your wallet by selecting "Connect Wallet" at the top right of your screen

- Connect using MetaMask or WalletConnect if you are using a Mobile wallet like Argent or Rainbow wallet.

- Find stETH under the "Supply Market". Select it and input the desired amount of stETH you would like to supply to Anchor.

- Once you approve the transaction, you will see your deposit under the "Supplied" column.

When supplying assets as collateral in Anchor, users will be able to borrow assets, and depending on the asset, they may also earn INV rewards. This is highlighted under "Rewards APY", the INV rewards you are entitled to. stETH is currently not receiving any INV rewards, but this can potentially change in the near future.

Users can claim these INV rewards on the Banking page. Select the "Claim" button, and confirm the transactions. INV rewards do not currently apply to stETH but may in the future.

How to borrow assets

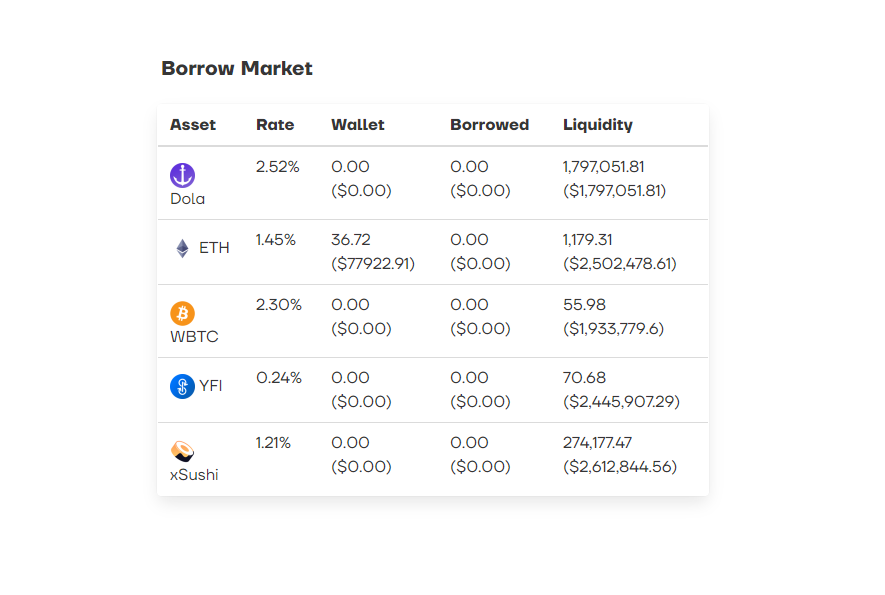

Now that you have supplied stETH as collateral, you are free to borrow a loan. When borrowing assets, you must pay interest, embodied in the "Rate" percentage under "Borrow Market".

When borrowing assets, users must be weary of their collateral ratio in order to not get liquidated. Liquidations force suppliers to lose their collateral in order to pay back their outstanding debt. If you intend to borrow assets from Anchor, please refer to this document addressing Anchor liquidations before you do so!

- Select one of the assets you would like to borrow under the "Borrow Market".

- Input the amount you would like to borrow, respective of the amount you supplied as collateral. If you have deposited collateral, you will the see maximum amount you can borrow of an asset under "Max Available to Borrow". You can borrow up to a maximum 60% of your deposited collateral, which equates to a 180% collateralization ratio.

- Select "Borrow".

- Finalize the transactions.

How to repay loans to withdraw collateral

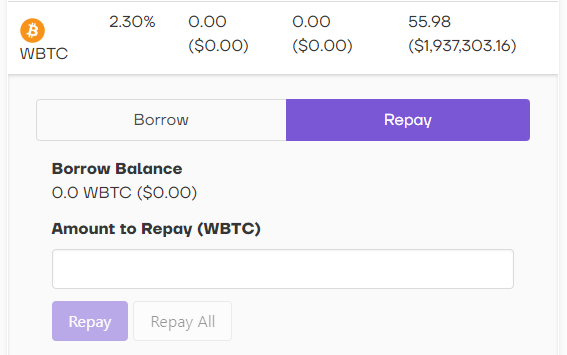

To withdraw collateral, users must pay back their loans along with the interest owed.

- Select the asset you need to repay your loan for.

- Select "Repay" to the right of "Borrow".

- Input the amount you would like to repay.

- Select "Repay" or alternatively, select "Repay All" and confirm the transactions to erase your debt. You can now withdraw your initial collateral. Select "stETH" under "Supply Market".

- Select "Withdraw" to the right of "Supply".

- Input the amount you would like to withdraw, or alternatively, select "Withdraw All".

- Confirm the transactions to claim your staked collateral.

How to get stETH token

You can find a guide on how to stake ETH for stETH here. You can also purchase stETH through Curve by swapping ETH for stETH with minimal slippage.

What’s to come?

There are many plans for stETH to be used in a variety of DeFi protocols in the future such as other lending protocols, farming strategy protocols, aggregators, and many more to come. These are outlined in more detail here:

We highly encourage users to submit their proposals on the Lido forums to share their ideas to the community.