Case Study: Comparing Liquid Staking Tokens, Native Token vs Fiat as Collateral Alternatives when Selling Call Options

Introduction

In the world of cryptocurrency options trading, there is more nuance to choosing the right collateral compared to traditional finance. Different collateral alternatives can impact both payout and operational efficiency. This case study compares three different collateral types when selling ETH call options: USD (fiat), ETH (native token), and stETH (liquid staking token).

First, we take a look at how the total payoffs differ between the scenarios. Then, we analyze how margin management can determine the operational burden to market participants, depending on the type of collateral.

How does the payoff curve differ?

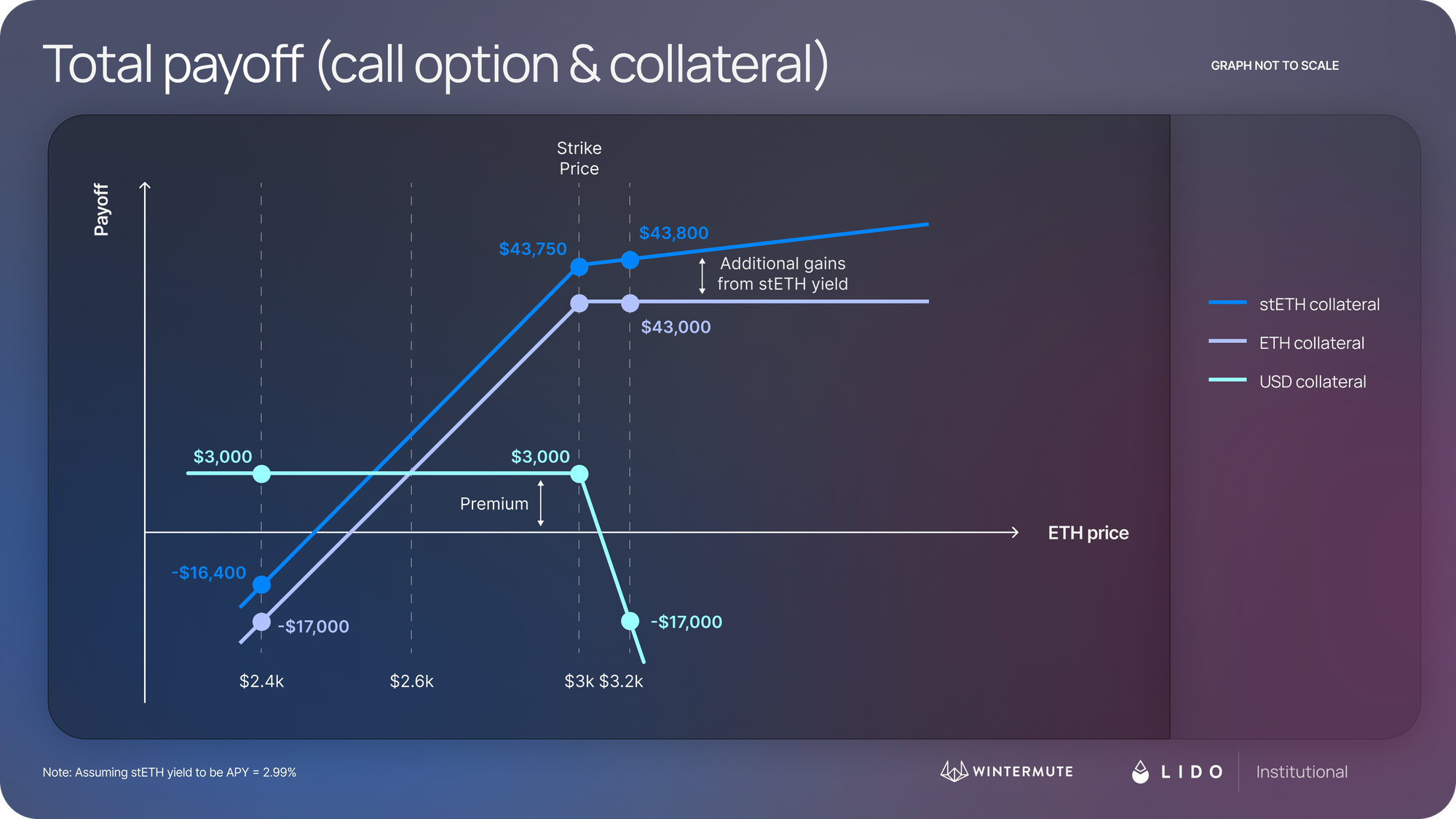

The payoff curves show the profit or loss of the option, depending on what price the underlying asset trades at the expiry of the option. In this example, a trader sells the following ETH call option:

- Underlying: ETH

- Option type: Call option

- Contract size: 100 (quantity of underlying the call option contract represents)

- Spot price: $2,600

- Strike price: $3,000

- Option tenor: 1 month

- Premium: $3,000

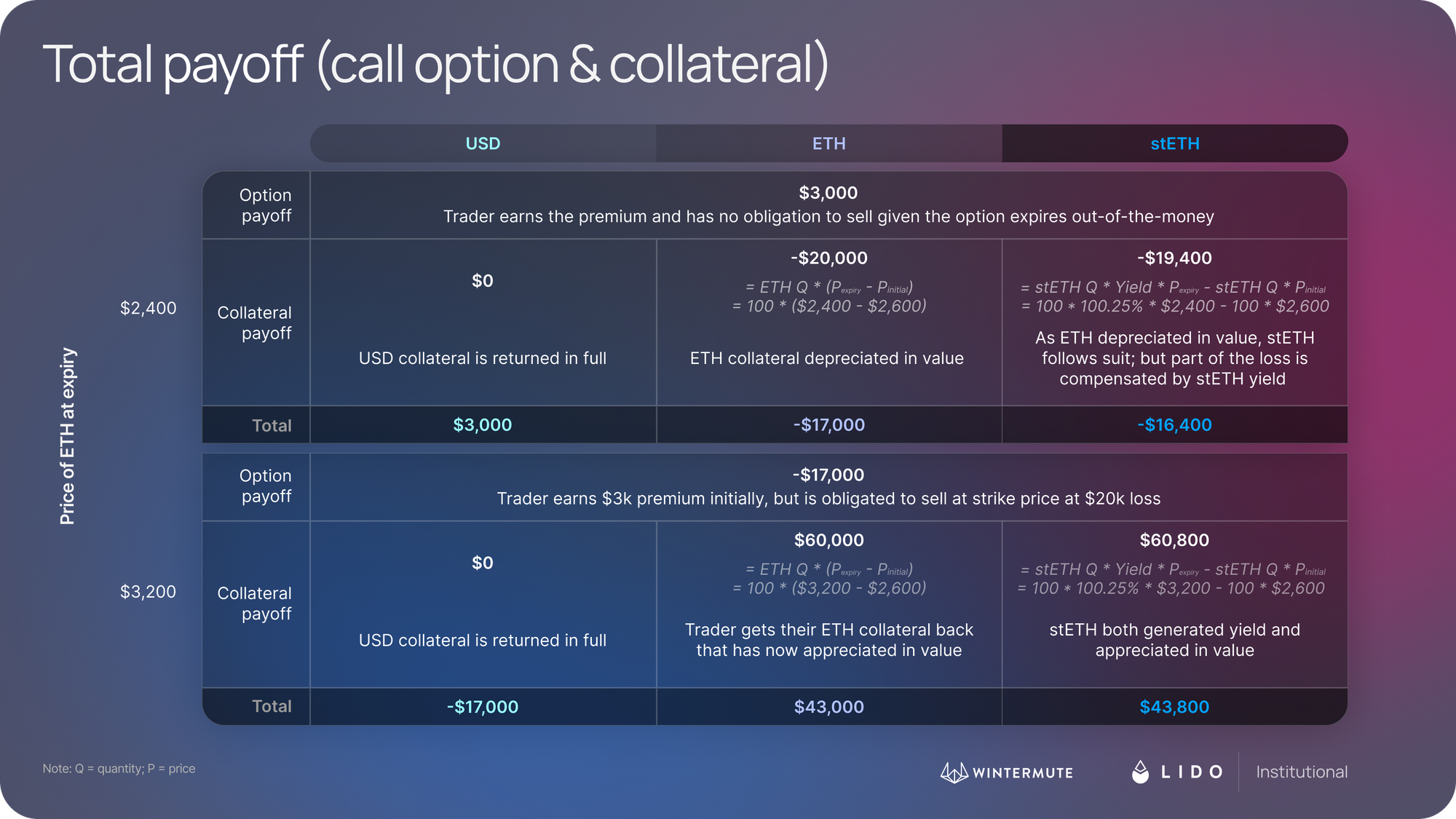

Depending on the collateral used, the payoff curves can significantly differ.

- Fiat (e.g. USD): Trader would need to post USD of $260,000[1] as collateral. This results in a classical payoff curve, where the payoff is equal to the premium up until the price of the underlying ETH hits the strike price, after which the returns scale down as the trader is forced to buy ETH on the spot market and sell at the lower strike price to the party who is long this call option. The potential risk and downside are potentially limitless.

- Native underlying token (e.g. ETH in ETH call option): Trader would need to post 100 of ETH ($260,000[1] equivalent) as collateral. This results in a covered call payoff, because the trader already holds ETH in their portfolio and hence can benefit from the price surge of the underlying. Please read our previous case on “Generating additional return on crypto holdings with covered call options”, that explains how this popular strategy works in detail. The potential risk is more limited to the extreme sell-off of the underlying in the market.

- Liquid staking token (e.g. stETH): Trader would need to post 100 of stETH ($260,000[1] equivalent) as collateral. This results in a covered call payoff curve, but gives additional yield via staking rewards (with an average APY of 3% in 2024, translating to 0.25% monthly yield). Given LST of the underlying generally tracks the token in value and accrues rewards denominated in the native token, the overall payoff curve sits above Scenario b.

[1] For the purposes of comparability in this case study, all trades assume full 100% funding for margin collateral, regardless of the type of collateral. In practice, funding a short call position in-kind or via LST of the underlying can lower the initial margin requirements, as it is right way risk.

Let’s dig into the specific figures across the payoff curves. The table below shows the different payouts across various price levels for the underlying at expiry.

Results: Posting stETH as collateral generates additional yield compared to ETH

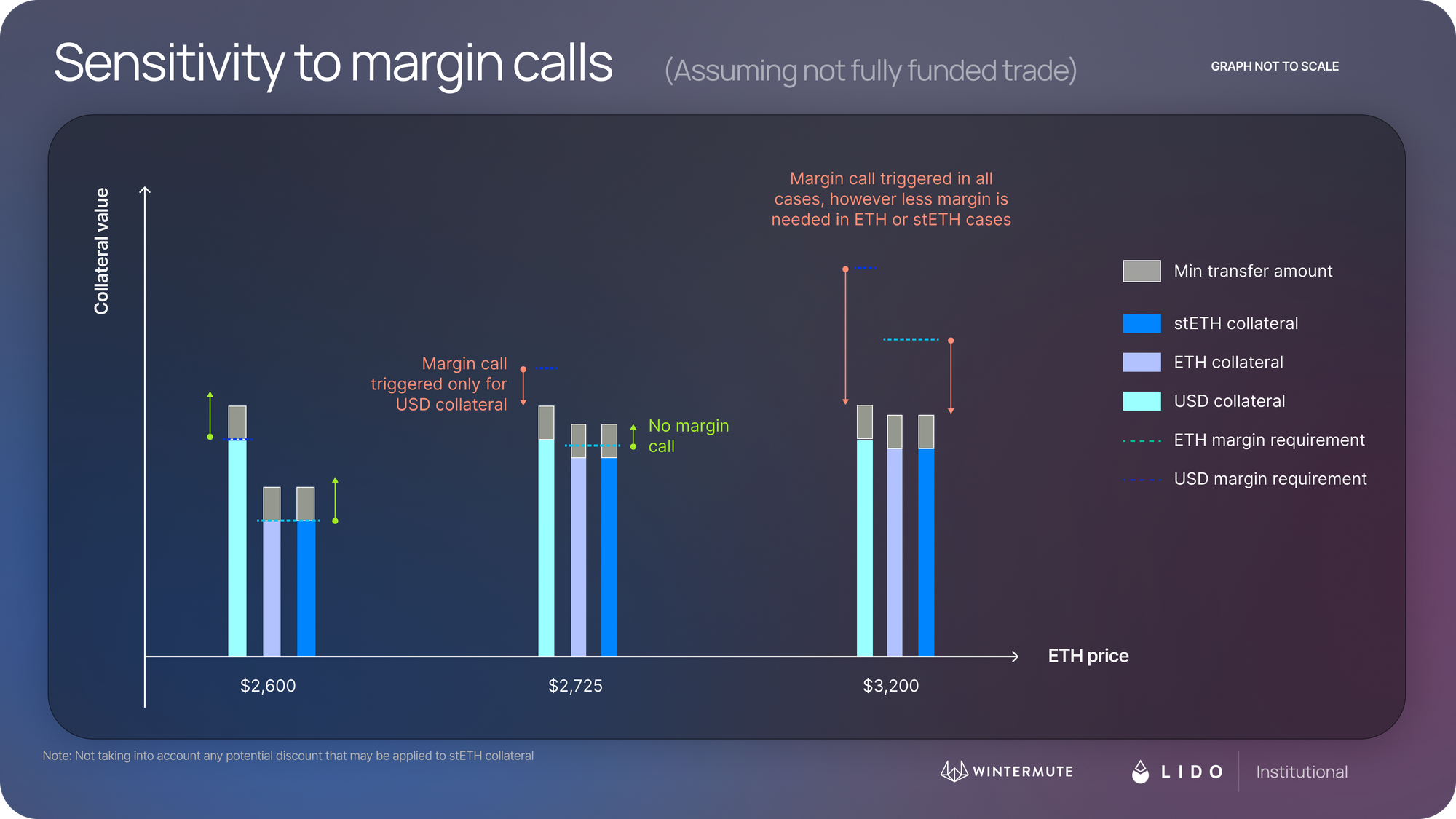

How does the margin management differ?

Another key aspect in options trading is margin management. Margin requirements are standard in both TradFi and crypto options trades to cover the counterparty risks introduced by the open position.

If the current price of the underlying ETH increases, the variation margin for a short call option increases to cover the additional risk associated with the short position. By plotting the three scenarios we have on a graph, we can see the impact of the type of collateral on margin management.

- Fiat (e.g. USD) in light blue: For margin posted in USD, its value will remain unchanged no matter the changes of the underlying ETH.

- Native underlying token (e.g. ETH in ETH call option) in purple: If the underlying native token is posted as collateral, its value will rise and fall together with the current market price of ETH.

- Liquid staking token (e.g. stETH) in blue: Similar to the case when posting the native token ETH, however with additional accrual from staking rewards (note, these rewards are not pictured in graph, since they depend on time elapsed).

Results: Posting collateral in either the native token or liquid staking version of it can decrease the likelihood of margin calls, making daily margin operations easier.

Key Takeaways

It is important to consider the payoff and margin management impact of the type of collateral one posts for an OTC trade. We have illustrated how liquid staking tokens can provide higher total payoff in certain trades and (alongside native tokens) result in a smaller operational burden on margin management.

In addition, it is key to understand that for the same native token, there are various different available LSTs, so deciding where to stake your assets is an important precursor. Different staking providers offer different yield, withdrawal mechanics, basing operations and other considerations important in evaluating the overall risk and reward of using LSTs.

Explore more on the topic

Interested to learn more about LSTs and how they work? We have linked a few comprehensive articles to help you navigate the landscape:

- Lido's stETH: The mechanics of staked ETH

- stETH Use Cases within the Institutional Ecosystem

- Guides for using stETH across Defi

Disclaimer

This material is presented to you on an “as is” basis and provided by Wintermute Asia solely for general informational purposes, and is intended only for sophisticated, institutional investors. Specifically, derivatives trading with Wintermute Asia is not suitable for retail persons in the United Kingdom. Trading and investing in digital assets and derivative transactions involve significant risks including price volatility and illiquidity and may not be suitable for all investors. Wintermute Asia is not liable whatsoever for any direct or consequential loss arising from the use of this material. This material does not constitute an offer or commitment, a solicitation of an offer, or commitment, or any advice or recommendation, to enter into or conclude any transactions, or to provide investment services, products or services in any state or country where such an offer or solicitation or provision would be illegal.

Wintermute Asia does not give any representations or warranties in relation to the accuracy, validity or complicity of the information of this material, including without limitation the factual information obtained from publicly available sources considered by Wintermute Asia to be reliable; and do not accept any liability for any consequences of using the information contained in this material, and for the applicability of this material for the specific purposes and objectives of this material recipients. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Neither this material nor any copy thereof may be taken, reproduced, or redistributed, directly or indirectly, without prior written permission of Wintermute Asia.

The content in this opinion piece may include information, views and opinions posted by third parties. Such content, views, comments and/or opinions posted in this opinion piece are made independently by and belong personally to these third party posters, and may not purport to reflect the views, comments or opinions of any projects or organizations that they might support in any capacity; and correspondingly, the posting of such content by third parties in this opinion piece is not intended to be and shall not be construed as an endorsement of the views or opinions stated, or the reliability or accuracy of the information specified therein. Posters or any organizations or projects associated with them shall therefore not be liable or responsible for any errors or omissions, or for the results obtained from your use of such information. Where such content includes links to third-party sources, please also note that such links and the contents stated therein are also not under the control of the posters. Posters or any organizations or projects associated with them therefore shall likewise not be responsible for the reliability and accuracy of such third-party sites and their contents.

You are solely responsible for your own decisions in this regard, and no one assumes any duty of care, responsibility or liability for any losses that you may suffer as a result of relying on the above opinion piece. The content in this opinion piece shall not be construed as financial, legal, tax or any other type of professional or regulated advice.