The Case for Staked ETH in Corporate ETH Treasuries

Corporate treasuries holding ETH face a strategic decision about how to deploy that capital.

One path is to leave it unstaked. This means missing the staking rewards that accrue to active network participants. Approximately 30% of all ETH is now staked, and for treasuries with significant positions, the cumulative cost of missed rewards grows over time.

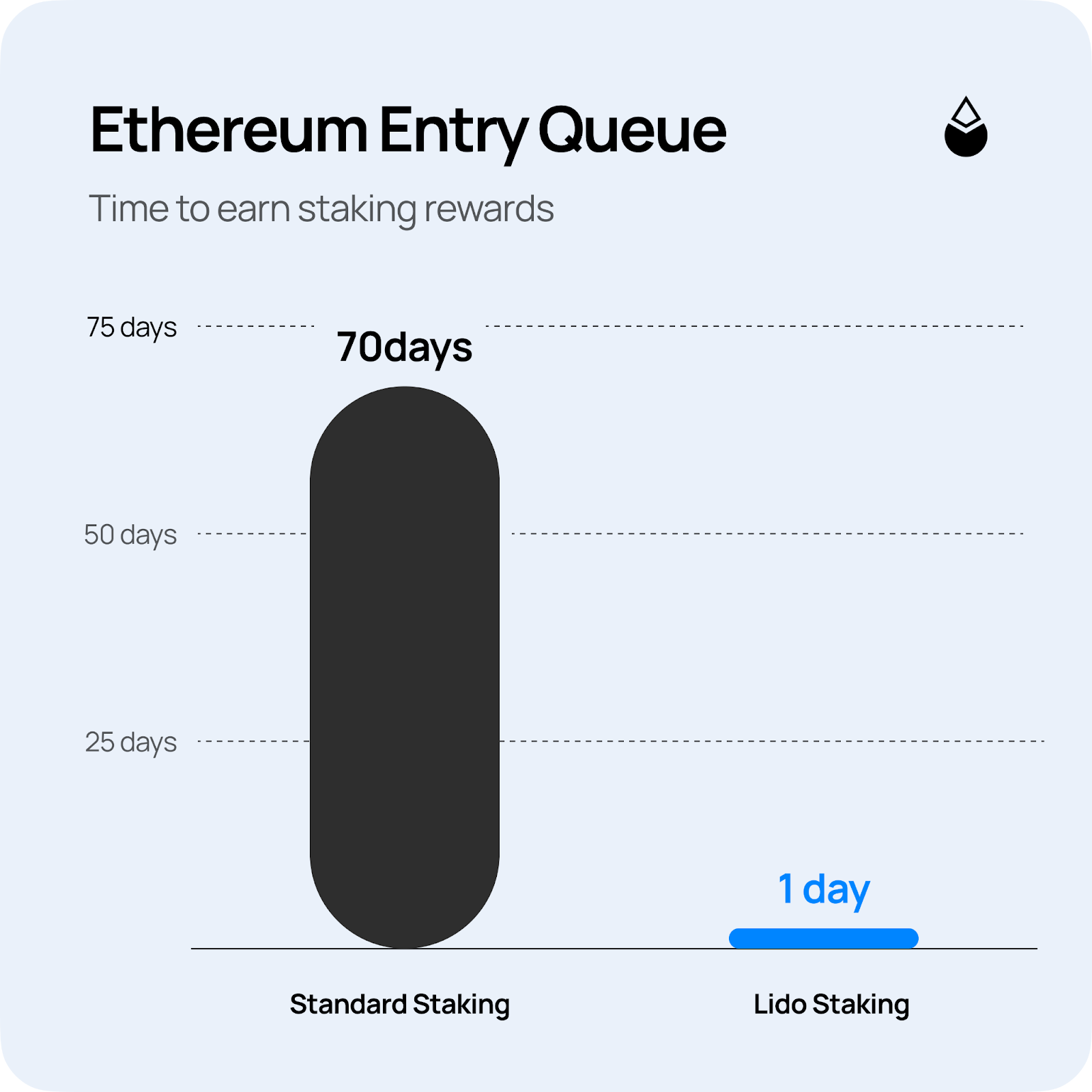

Another path is native staking. This captures rewards but introduces friction. The validator entry queue currently sits at nearly 70 days, with over 4 million ETH waiting for activation. A treasury staking natively today would wait nearly two months before receiving any rewards. And once staked, that capital is locked - exit timing is governed by protocol mechanics, not treasury needs. Beyond the liquidity constraints sit operational requirements that many treasuries are not structured to absorb: infrastructure decisions, key management, and slashing exposure.

For teams that want capital efficiency, liquidity, and operational simplicity, neither option works.

Rewards From Day One

Liquid staking addresses this gap. When ETH is staked via the Lido protocol, the staker receives stETH immediately - a liquid token representing the staked ETH and any accrued rewards. Staking rewards begin accruing from day one. There is no entry queue and no activation delay. The position remains liquid: stETH can be held, redeemed, used as collateral, or sold on secondary markets with deep liquidity.

Approximately $100 million of stETH is executable within 2% of redemption value, and roughly $10 billion sits active as collateral across Aave, Morpho, and Maker. In practice, this means a treasury exiting a $50 million position can do so without meaningful price impact. That liquidity matters when a position needs to work in practice, not just on paper.

Built for Institutional Scale

For many institutions, custody determines what's viable. Custodians including Fireblocks, BitGo, and Copper all support stETH natively, with minting and redemption available directly within existing workflows. For treasuries already using these platforms to custody ETH, stETH is accessible without new vendors, new integrations, or new operational processes. The infrastructure is already live.

Regulated product issuers have followed. WisdomTree launched Europe's first 100% staked ETH ETP in December 2025, with $50m AUM at launch. VanEck filed for the first US Lido Staked ETH ETF in October 2025.

As staked ETH products enter regulated markets, the benchmark is shifting. Treasuries holding unstaked ETH now face comparison against ETFs and ETPs that capture staking rewards by default. The performance gap between idle ETH and a 100% staked product compounds over time - and becomes harder to justify to boards and investors.

The underlying infrastructure supports this scale: over 650 node operators back stETH, distributed across curated, DVT, and community staking modules. No single-operator concentration, no dependency on one infrastructure provider. This distribution reduces exposure to any individual operator's performance or operational failure. For treasuries that need more control - specific compliance, reporting, or operational requirements - Lido V3 introduces stVaults: isolated staking environments with custom validator configurations and full onchain transparency, while retaining access to stETH liquidity.

This infrastructure depth - 100+ protocol integrations, native custody support, deep liquidity - is why stETH backs the majority of institutional liquid staking on Ethereum.

The Cost of Idle ETH

Holding unstaked ETH carries an opportunity cost that compounds daily. Native staking addresses the reward problem but introduces queue delays and operational overhead that sit outside most treasury mandates. stETH offers a path through: staking rewards from day one, liquidity when needed, and integration with the custody and trading infrastructure that institutions already use.

To discuss how stETH fits your treasury strategy, get in touch with the Lido Institutional team.