Lido Poolside Recap: Tokenholder Update, August 2025

In the first Tokenholder Update call, Vasiliy, Executive Director of the Lido Labs Foundation, delivered updates on Lido's current status, Lido Labs' leadership changes and business approach, key growth priorities, and buyback proposals.

Read the highlights below or watch the full 50 minute recording.

Agenda

- Current State of Lido

- Staking Market Overview

- Lido Labs Leadership

- New Business Approach

- Restarting Growth: Key Segments

- Buyback Proposals

Main Highlights

New Leadership and Structure

Lido Labs Foundation has adopted a new leadership structure with clear hierarchy and defined reporting lines.

Vasiliy Shapovalov has transitioned from Research Lead to the newly created position of Executive Director, with Isidoros Passadis as Chief of Staking, and Sam Kim as Chief Legal Officer & Chief Operating Officer.

New Business Approach

The business strategy is now anchored in developing Ethereum's premier staking product while increasing surplus for LDO holders.

Growing Beyond LST: Low-Risk and APR Maxis Segments

Lido remains the largest liquid staking provider, ready to expand beyond simple LST into APR Maxis and low-risk markets, targeting different customer types with specific products.

- APR Maxis: Targeting advanced, yield-seeking stakers with new high-yield products, such as Lido Earn – stETH powered vaults for advanced DeFi strategies

- Low-Risk Staking: Launching customizable stVaults and custodial wrappers tailored for institutions and risk-averse users.

Buyback Proposals

Several buyback mechanisms are being discussed. The first proposed step is to develop NEST (triggerable rails to buy LDO with stETH, compatible with any mechanism). It builds a foundation and flexibility for any approach selected in the future.A detailed proposal outlining the chosen mechanism will be published by the end of the year.

1. The Current State of Lido

Business Model

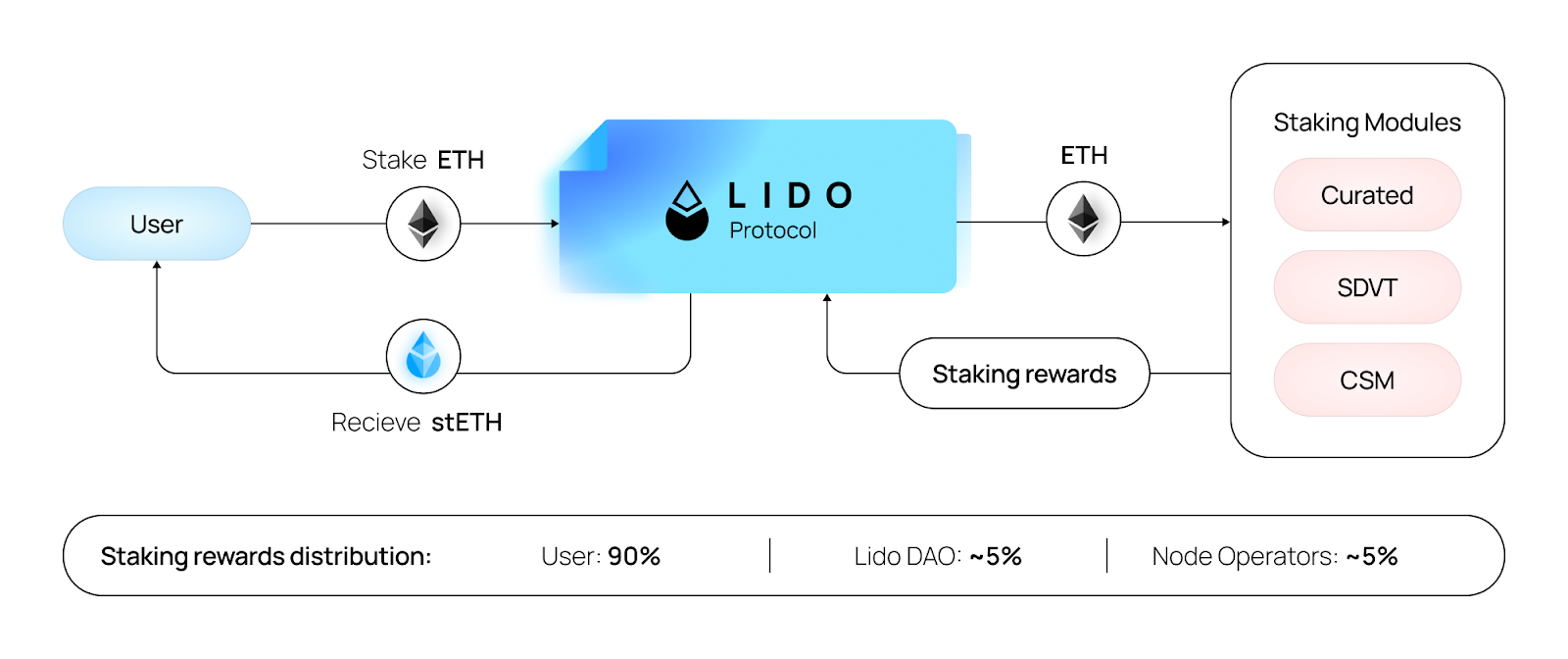

Users deposit ETH to the Lido protocol and receive stETH (staked ETH) in return, a liquid token that can be utilized across the broad DeFi ecosystem.

The ETH is allocated through the Staking Router into various Staking Modules.

Staking rewards flow back to the Lido protocol, with 90% distributed to stakers, approximately 5% (depending on the Staking Module) allocated to Node Operators, and the remainder directed to the Lido DAO Treasury.

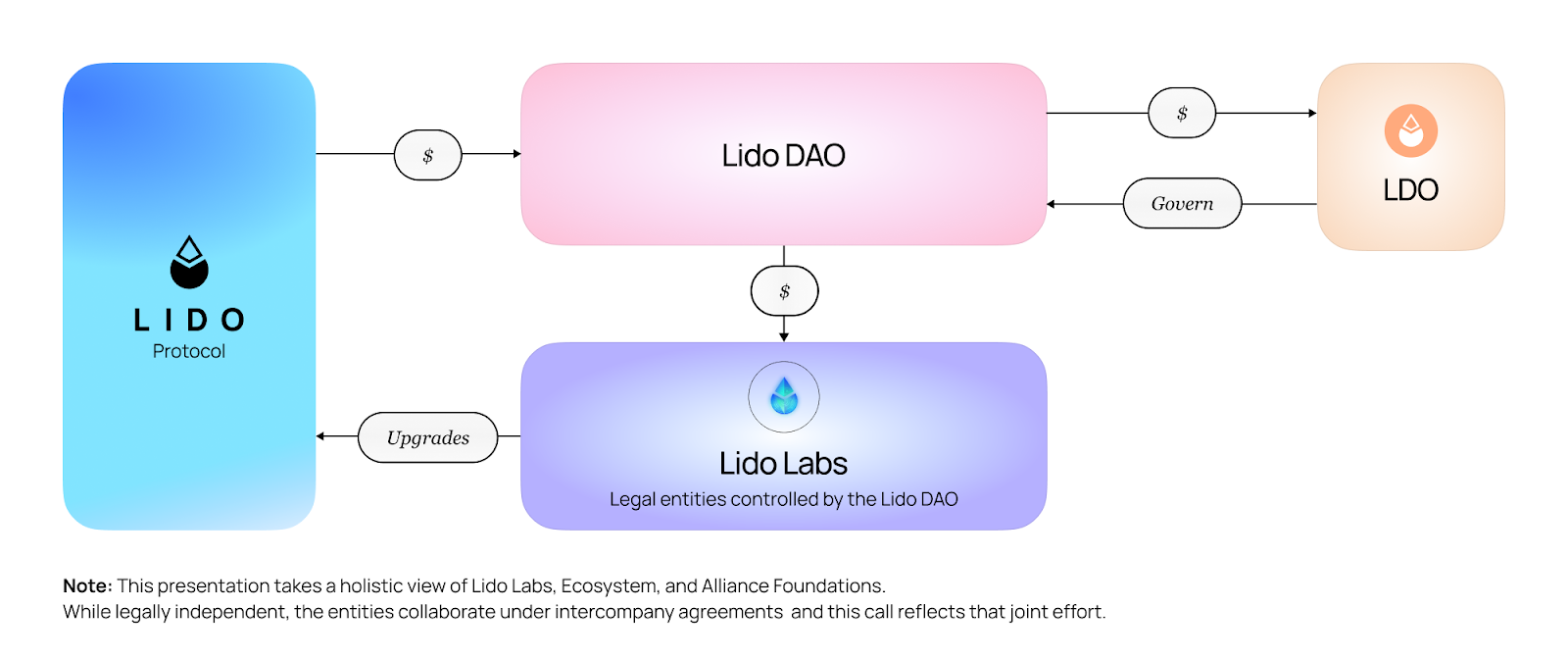

Lido DAO is a decentralized organization governed by the LDO holders. Through the governance process, the tokenholders oversee upgrades and changes to the Lido protocol and manage the Lido DAO Treasury, which funds operations for Lido Labs Foundation and other foundations contributing to the protocol.

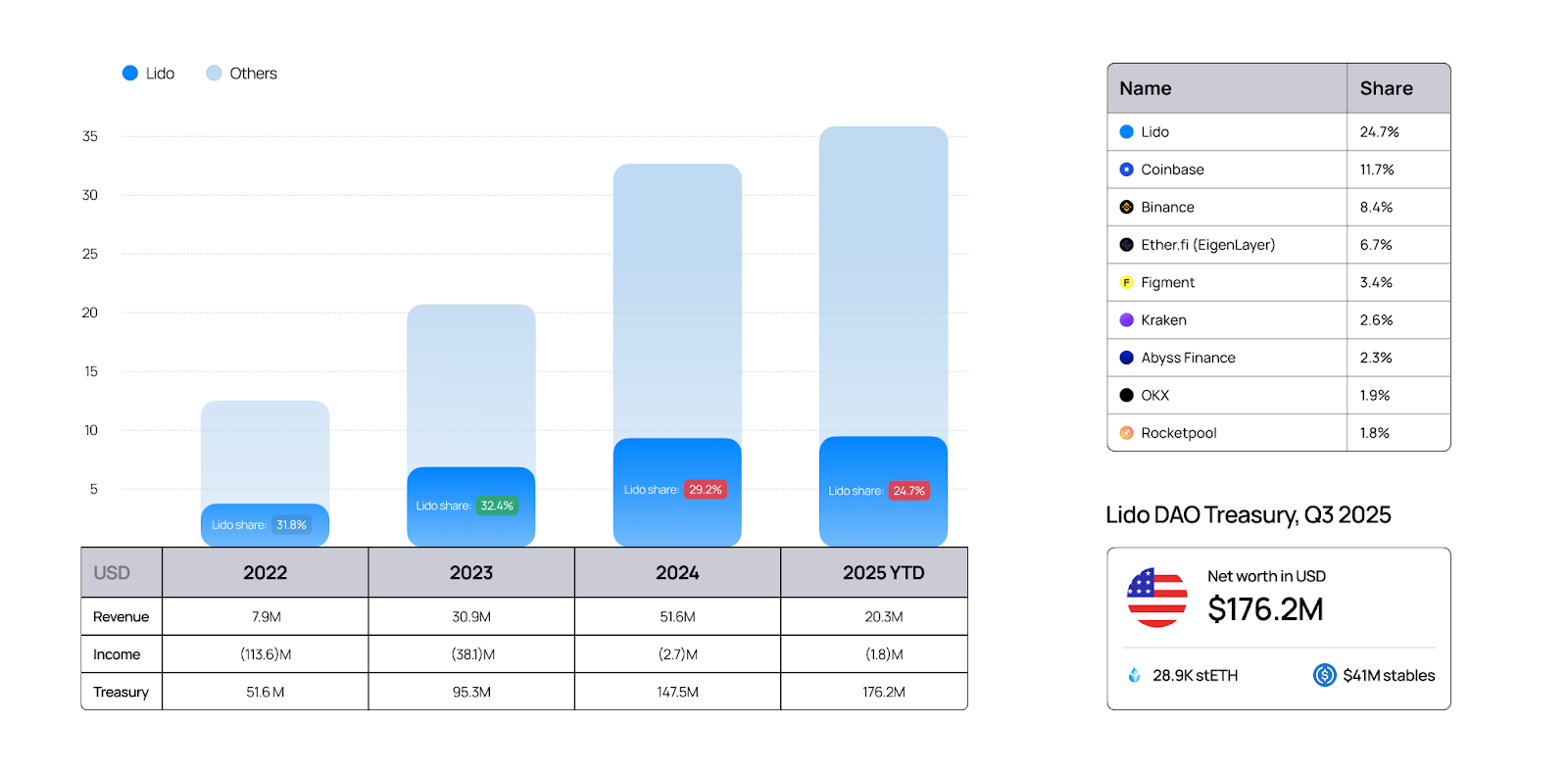

Financials

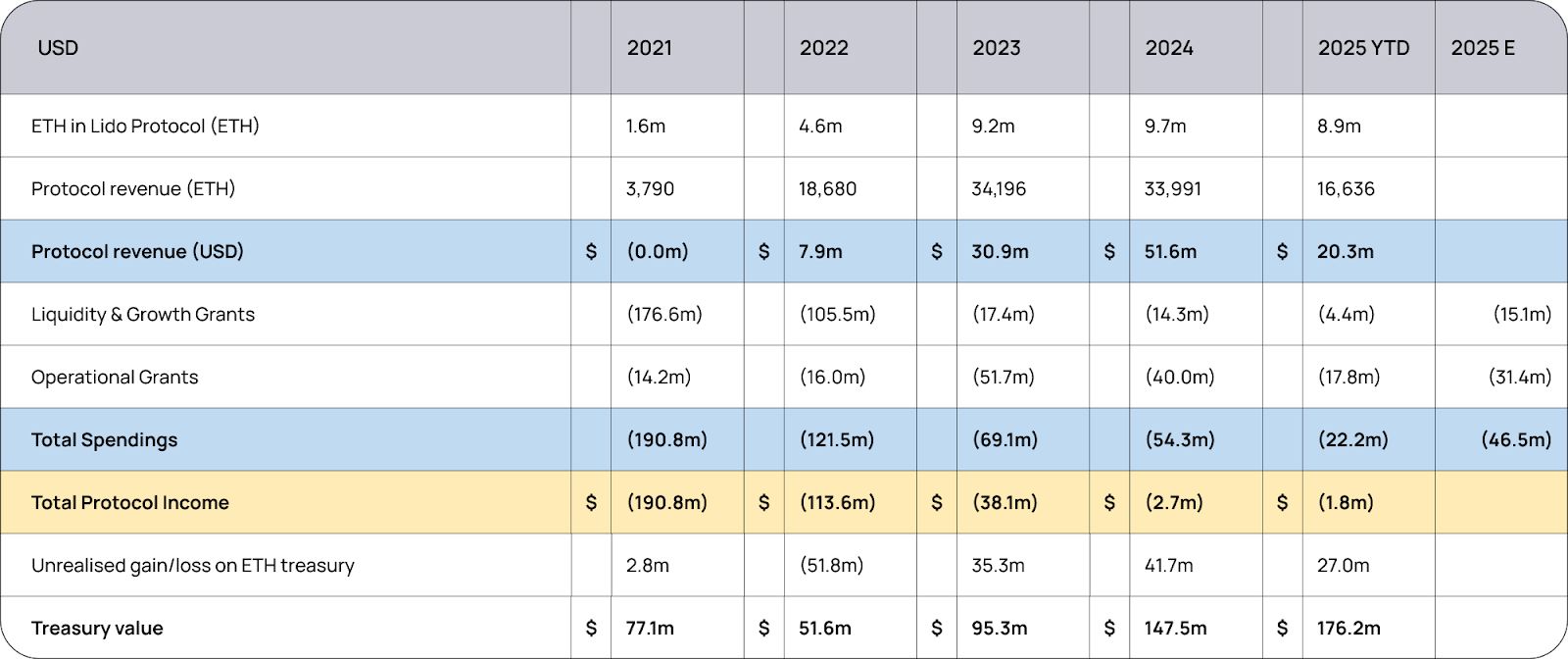

Since launching in December 2020, Lido has grown from 1.6M staked ETH (2021) to a peak of 9.7M ETH (2024).

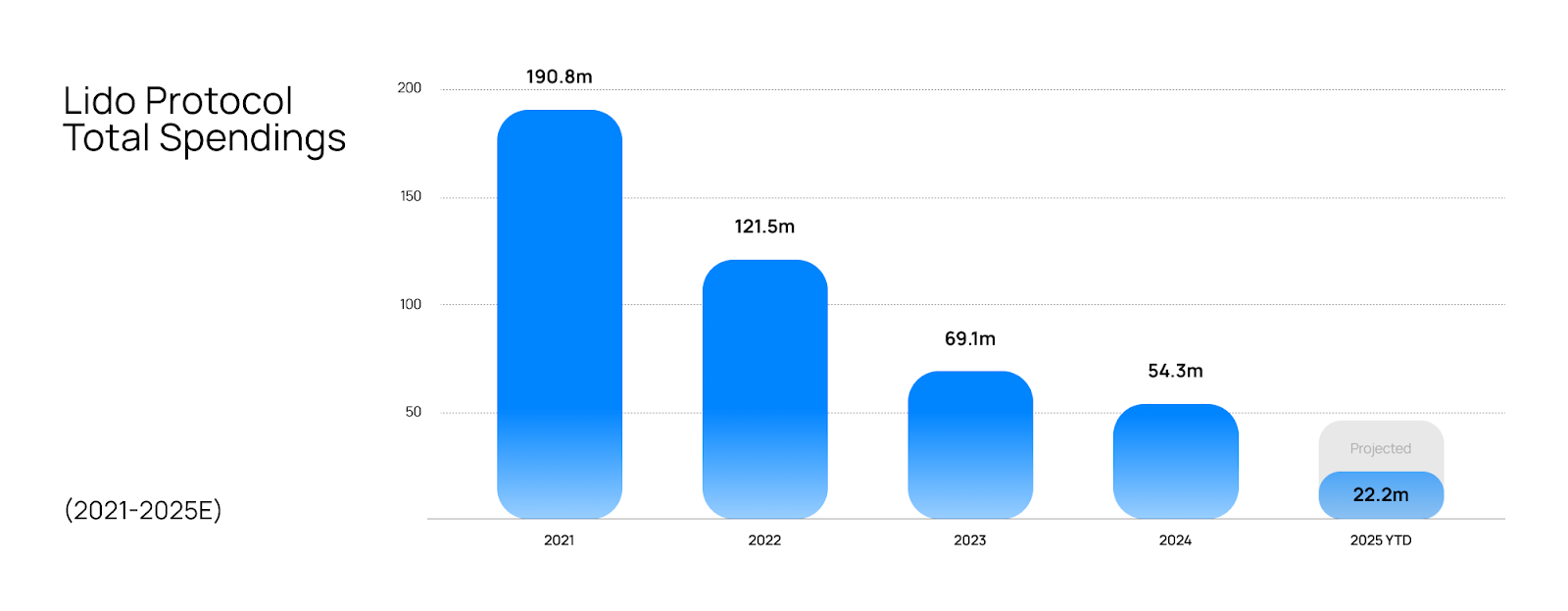

Same time total spending decreased from $190.8M (2021) to a projected $46.5M (2025).

This reflects evolution from a growth-stage protocol requiring heavy liquidity incentives to a sustainable business model.

For deeper insights, refer to the Lido Protocol Economic Reports: dune.com/steakhouse/lido-safu

2. Staking Market Overview

Lido’s Protocol Market Share

Lido remains the largest liquid staking provider, commanding 24.7% of all staked Ethereum—well ahead of Coinbase (11.7%) and Binance (8.4%). However, while Lido’s total ETH staked has continued to grow, its overall market share has declined as new staking segments have emerged and expanded more rapidly.

More details in the Extended Lido Analytical Dashboard on Dune.

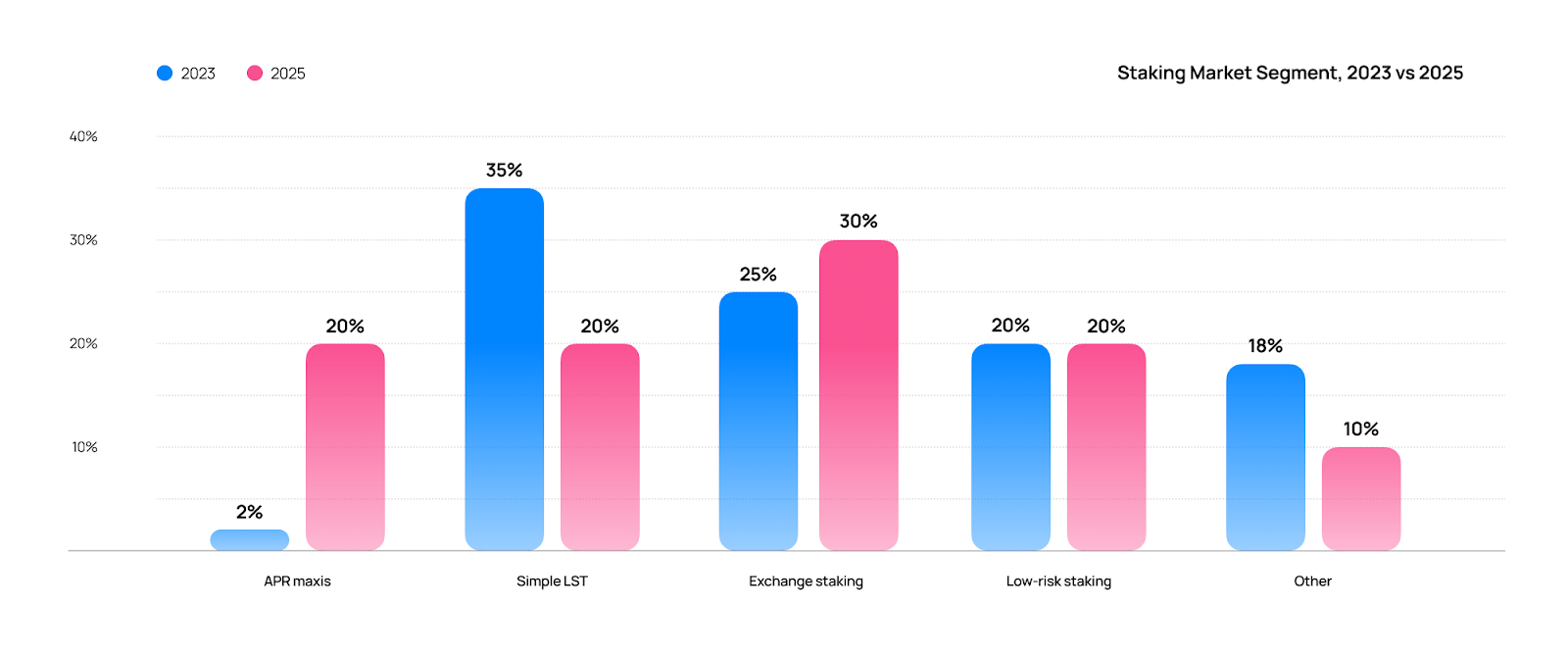

This trend can be understood by looking at the evolving landscape of Ethereum staking. The market could be fragmented into five key segments: APR Maxis, simple LST users, exchange staking, low-risk staking, and other—uncategorized stakers like home stakers.

Staking Market Segments

- APR Maxis: In 2023, only 2% of staked ETH was used in yield-enhancing strategies due to limited available options. By 2025, that share grew to 20%, driven by the rise of restaking, leveraged staking, junior tranches in fixed-yield protocols, liquid vaults, and other advanced staking mechanisms.

- Simple LST: The largest segment in 2023 at 35% shrank to 20% by 2025.

- Exchange staking: Grew by 5 percentage points from 25% to 30%.

- Low-risk staking: Remained fairly constant at 20%—typically delegated staking for high-net-worth individuals, institutions, and funds.

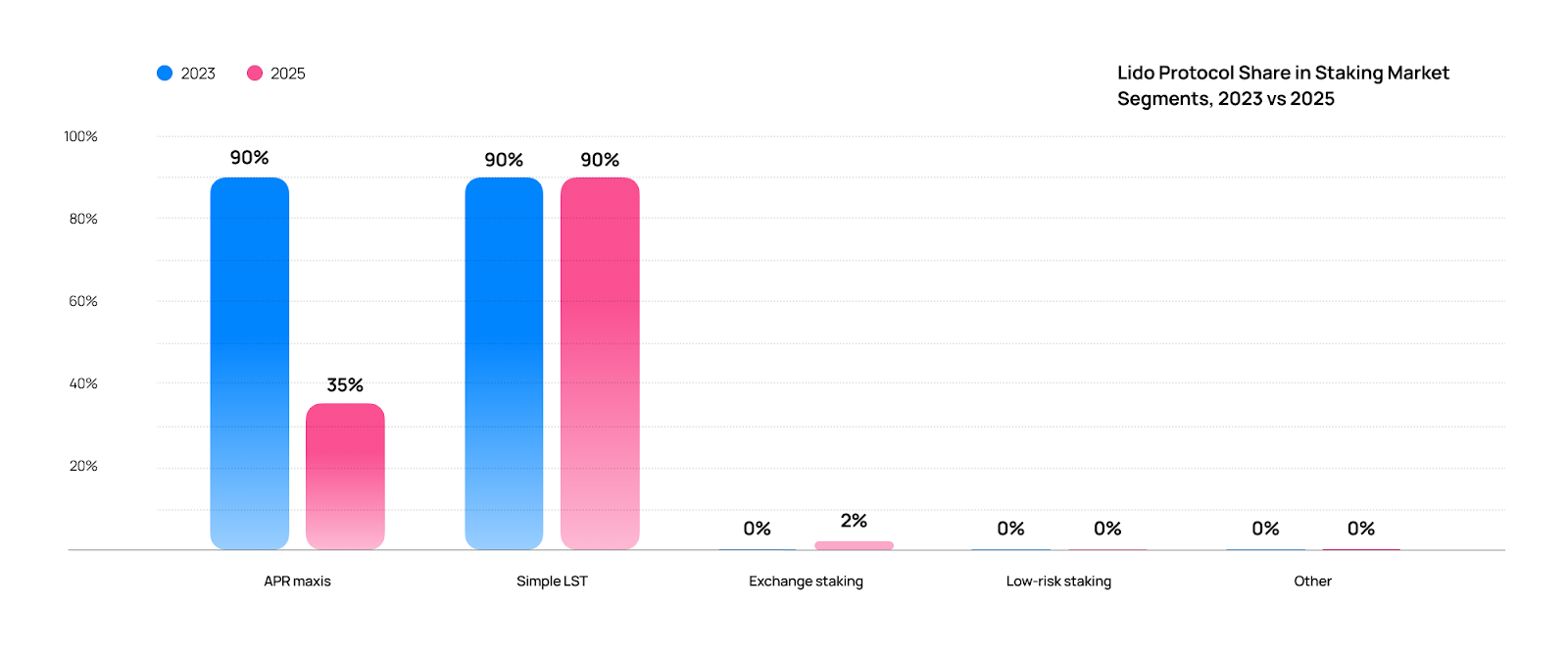

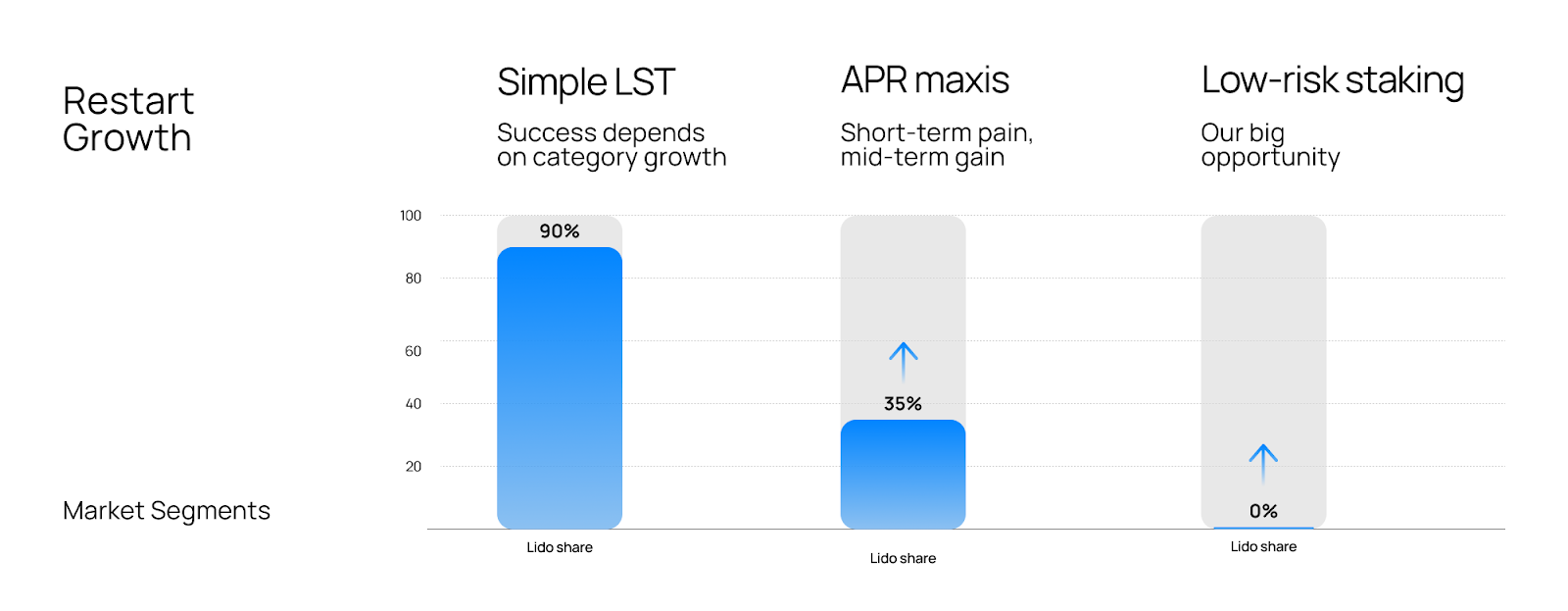

Lido’s Position Within Each Market Segment

Lido protocol continues to lead the Simple LST segment with 90% market share, while the segment itself has contracted from 35% to 20% over the past two years.

The biggest growth category has been APR Maxis, where Lido is actively used, but the competition in this category has grown significantly compared to 2023.

Exchange staking has also expanded, though this segment remains not easily accessible for non-exchange providers.

3. Lido Labs Leadership

In response to evolving market conditions, to strengthen Lido's presence in the segments driving today's growth, Lido Labs has restructured its leadership and developed a more focused business strategy.

Established earlier this year with a horizontal structure, Lido Labs Foundation has now adopted a new leadership structure with a clear hierarchy and defined reporting lines.

While the core team remains largely unchanged, the key development is Vasiliy Shapovalov’s transition from Research Lead to the newly created position of Executive Director, with Isidoros Passadis as Chief of Staking, and Sam Kim as Chief Legal Officer & Chief Operating Officer.

4. New Business Approach

The new leadership team formulated a strategic business approach aligned with the protocol mission.

- Long-term success will be measured by developing Ethereum's premier staking product while increasing surplus for LDO holders;

- All proposals and products must demonstrate clear commercial value.

To support these priorities, the budget has been restructured: core business maintenance is maintained at breakeven, while a separate budget is committed to growth initiatives:

- Base: $31M

- Growth and liquidity: $17M (10-15% of treasury).

Directions for Surplus Growth

- Growing share in staking:

- Capture time-limited opportunity as institutional vehicles like ETFs and treasury companies enter the market.

- Target the APR Maxis segment by creating high-yield products, as user capital in this segment is highly yield-sensitive and can be captured with superior APR offerings.

- Increasing revenue of market share: without raising fees, which could risk losing stakers. It can be addressed through V3 stVaults pricing and synergistic products, including liquid vaults and lending markets.

- Reducing the cost of revenue: Community Staking Module serves as an example of this approach in practice.

- Reducing operating expenses: The number of contributors was reduced by 15% to improve operational efficiency.

- Diversifying revenue streams

5. Restarting Growth: Key Segments

In past years, Lido DAO prioritized foundational improvements over short-term market capture tactics. Investments in the Dual Governance and Community Staking have strengthened the protocol's security, decentralization, and long-term sustainability. For progress tracking on these goals, refer to the Lido on Ethereum Scorecard.

Now, Lido stETH stands as the best-in-class LST product. With $176M in treasury, Lido is well positioned for growth, fueled by strong liquidity, brand recognition, and an extensive network that enables entry into new, more customized market segments.

Combined with the expectation of rapid market expansion, this creates the perfect momentum to push forward.

Expanding Beyond LST

Lido is ready to expand beyond the simple LST category into APR and low-risk staking, using LST liquidity while targeting different customer types.

APR Maxis

Lido protocol is positioned to recapture leadership in the APR-maxis segment through V3 vaults and strategic DeFi integrations, transforming short-term market pressures into mid-term competitive advantages.

Existing products:

- stETH looping

- stETH collateral in LRTs

Low-risk Staking

This segment remains a big greenfield opportunity for Lido as it offers

- stVaults - customizable staking solutions with access to best-in-class liquidity.

- Custodial wrapper products - institutional-friendly packaging

Vaults are great for Insti because of full customization while still giving access to best-in-class liquidity, as evidenced by the recent win. Starting in a few months, ETH bridged to @LineaBuild will be automatically staked on the Ethereum mainnet through Lido v3.

V3 Vaults for Delegated Staking (Delegation++)

The low-risk category is mostly delegated staking with Node Operators like Figment and P2P running expert sales teams to get customers. At the moment, they have no incentive to recommend liquid staking or DeFi strategies since they would lose those customers, and have very few customization opportunities.

Node Operators struggle with differentiation—staking is essentially the same service regardless of provider, with only minor setup differences that many stakers don't understand or care about.

Lido V3 allows node operators and channel partners to offer liquidity and DeFi participation without losing clients or staking fees—it's an enhanced delegation model.

For more details on the staking market segments, proceed to the full recording of the call.

6. Buyback Proposals

Several buyback proposals are being discussed on the Research forum (1, 2 and 3). While this aligns with the directional goals for this year, further evaluation is advised, as major improvements in regulatory clarity are expected within weeks, and possible mechanisms (manual, semi-automated, or fully automated) need to be agreed on.

Proposed solution

- Implement NEST (triggerable rails to buy LDO with stETH, works with any future mechanism).

- Research and select the best framework.

- Make a holistic decision on the exact approach as a part of GOOSE-3 (the Guided Open Objective Setting Exercise) and EGG (Ecosystem Grants gRequest) proposals for 2026.

The formal proposal is published; for further details, check the Research Forum.

7. Next steps

- Start building on the stVaults testnet.

- Signal demand to your custodian or exchange, or express interest in deploying capital for stETH ETPs or ETFs via this form.

- Vote or delegate your LDO and participate in governance.

To dive deeper, watch the full Tokenholder Update Call that covers detailed financial breakdowns, technical roadmap insights, and an extended Q&A session.

The next Tokenholder Update will be held in Q4 2025. Community calls with special guests will continue monthly – stay tuned for announcements.

Disclaimer

This material is for informational purposes only and is not investment, legal, or tax advice. No representation or warranty, express or implied, is made as to its accuracy, completeness, or timeliness. Any opinions or forward-looking statements reflect the current judgment of the presenter as of the date of this presentation and are subject to change without notice.