Guide: Providing Liquidity on Uniswap

Uniswap is an automated market maker that allows for quick and efficient on-chain token swaps on Ethereum. Built around a set of smart contracts, Uniswap creates a system for peer-to-peer market making opening up for permissionless trading across Ethereum.

In addition to swaps, Uniswap has been revolutionary through allowing users to earn rewards by providing liquidity to liquidity pools.

In this guide we'll walk you through how to provide liquidity on Uniswap using Lido’s wstETH, covering the following topics:

- Why Provide Liquidity on Uniswap?

- Guide: Providing wstETH Liquidity on Uniswap

- FAQ

Why Provide Liquidity on Uniswap?

Uniswap plays the role of regular exchange or trading platform, allowing for users to swap in and out of different tokens. However, Uniswap replaces the centralised order book with an Automated Market Maker (AMM) built around liquidity pools to determine token pricing. These liquidity pools are created by LPs - liquidity providers - who earn LP tokens in exchange for providing liquidity to the pools.

When you provide liquidity to a certain token pool on Uniswap you receive a share of the trading fees generated by the pool.

Despite the possibility of added income from LP’ing, it does not come without risks and the value of your LP position can ultimately be worth less than you put in. To get a thorough understanding of the risks of LP’ing, check out the following article: Uniswap: A Good Deal for Liquidity Providers?

Guide: Providing wstETH Liquidity on Uniswap

Due to complexities associated with the rebasing nature of Lido’s stETH, Uniswap uses wstETH - the wrapped version of stETH. As such, Lido users can add liquidity to the wstETH/ETH pool on Uniswap.

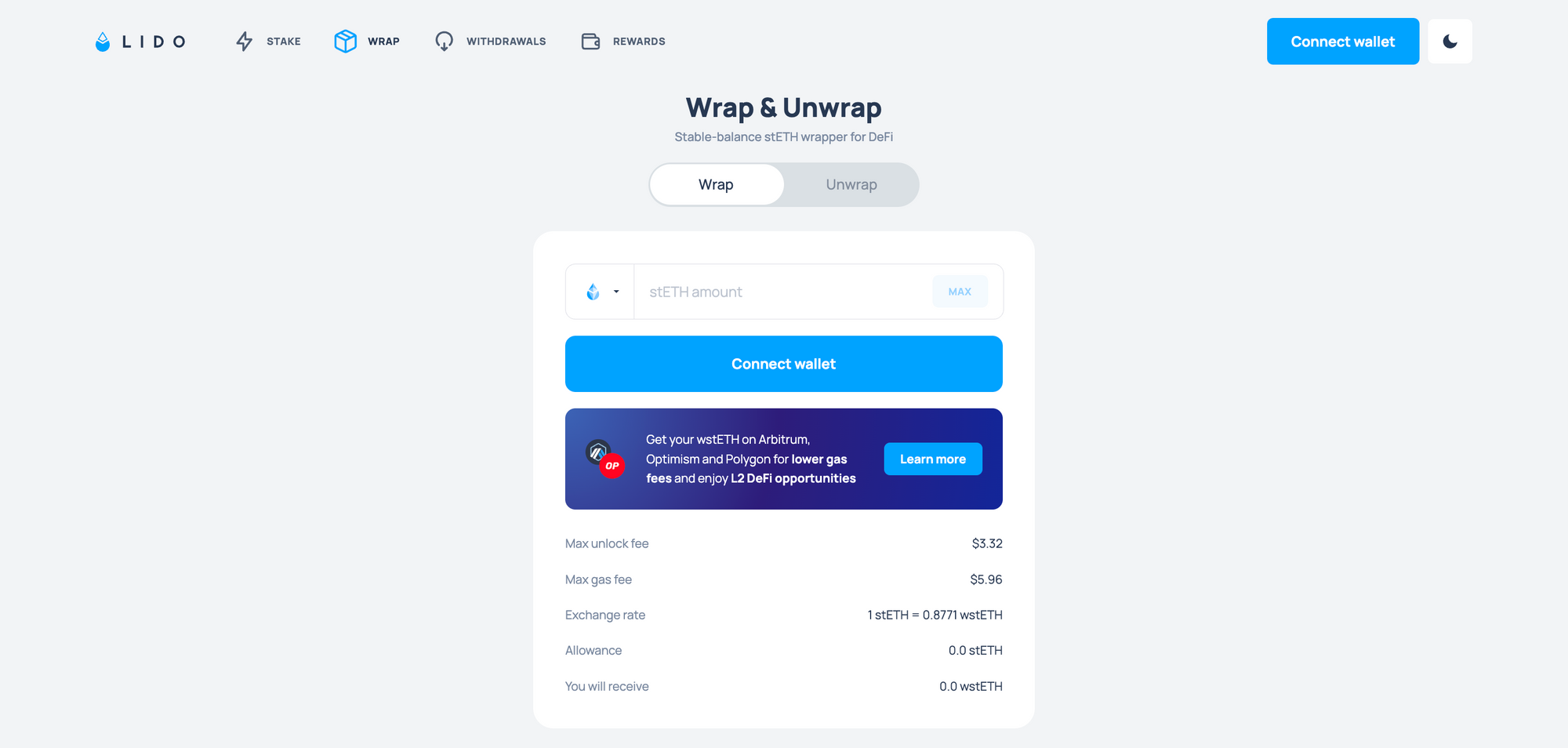

Step 1: Get wstETH

Before you start, you need to make sure you have wstETH in your Ethereum wallet. To wrap your ETH or stETH to wstETH, visit stake.lido.fi/wrap.

Step 2: Choose the token pair, or pool, to add liquidity to

As stated above, you can choose any token pool to add liquidity to, with the wstETH/ETH pool being the largest TVL pool for Lido users. You can head to info.uniswap.org/#/pools for an overview of all Uniswap pools.

The wstETH/ETH pool can be found here.

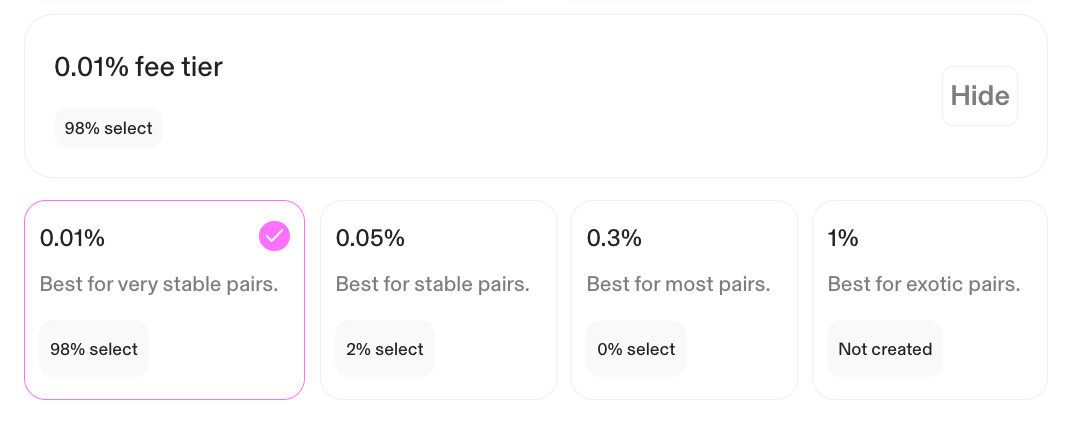

Step 3: Select the fee tier

The next step is to select the fee tier - 0.01%, 0.05%, 0.3% or 1%. This allows you to choose margins depending on expected volatility. With more correlated token pairs, like wstETH and ETH, a low fee tier is the most common choice. For more information on this, check out the Uniswap Docs.

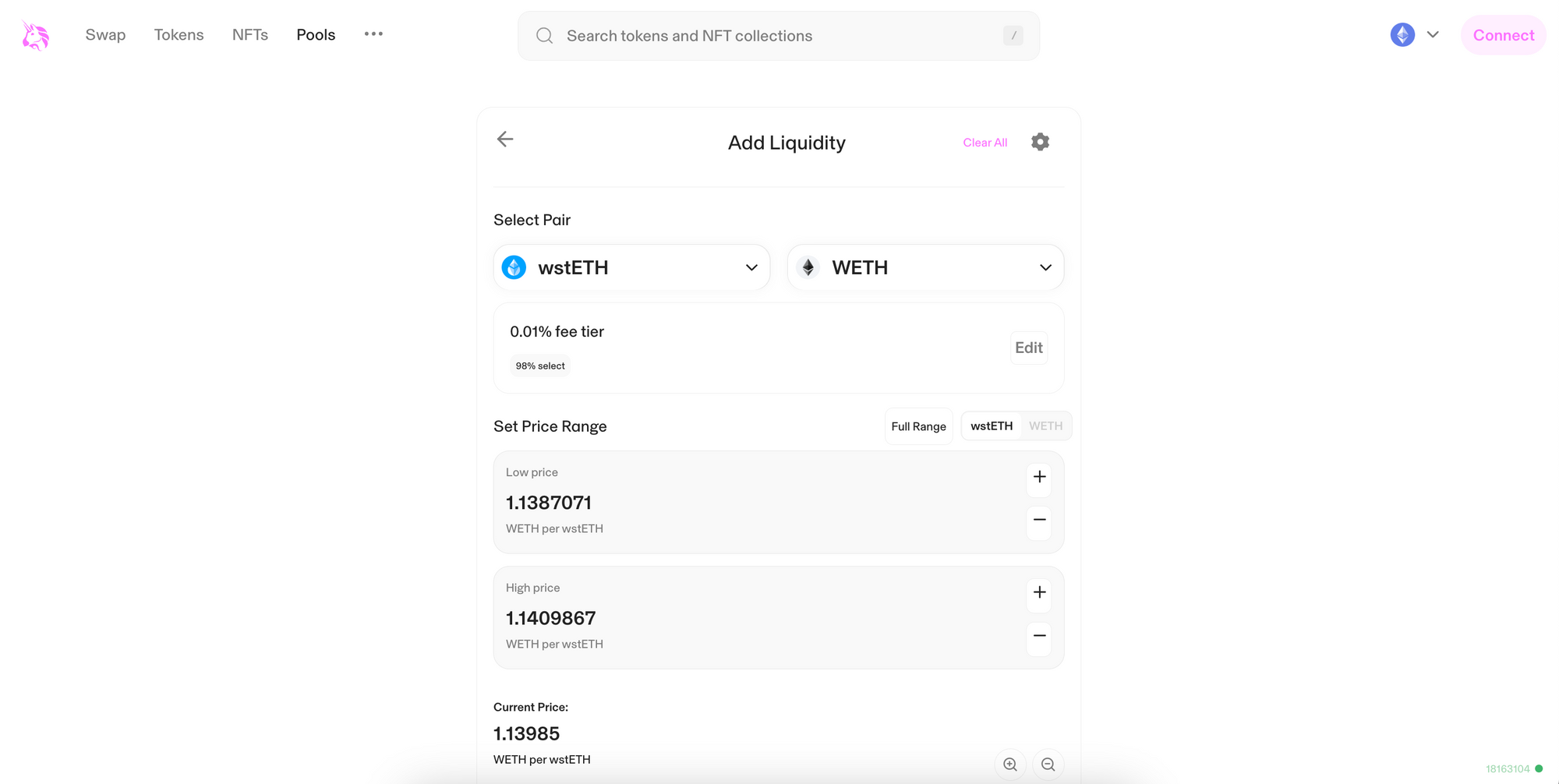

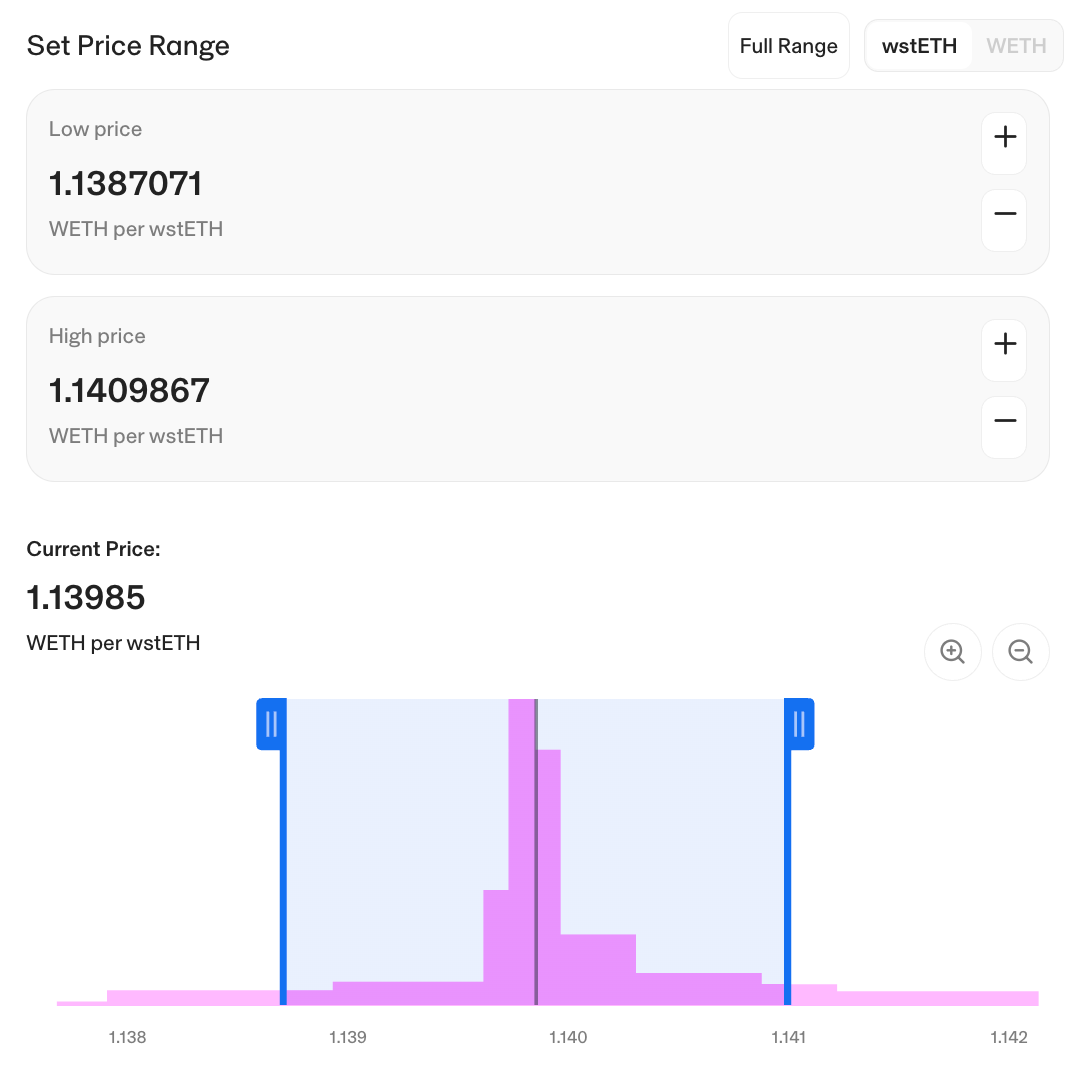

Step 4: Select the price range

Next up you can choose the price range to add liquidity to. You can choose the entire price range, or choose to add liquidity to a specific price range. If the token price moves out of your chosen price range, you will not earn fees on trades.

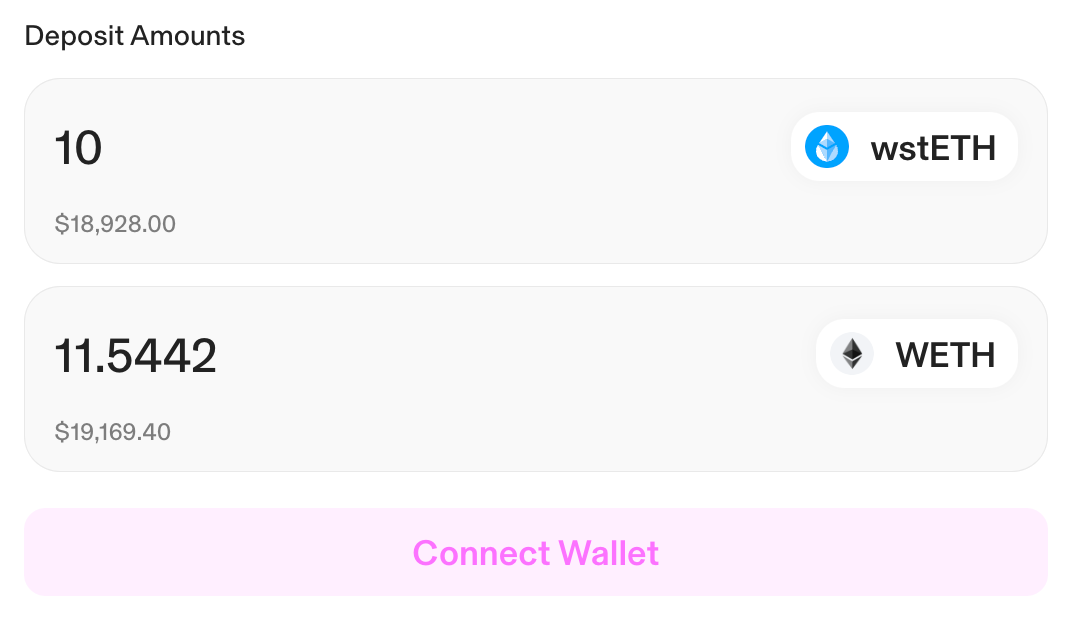

Step 5: Choose amount of tokens to add as liquidity

Choose the amount of tokens to add to the pool, adding a balance between the two tokens. Once you choose how wstETH to add, the amount of ETH needing to be added will automatically be shown.

Step 6: Preview and Add

Last step is to review your configuration and add it. This will require the approval of a transaction using your chosen wallet. Uniswap will automatically calculate your share of the pool and provide you with LP (Liquidity Provider) tokens representing your share.

Once the transaction is confirmed, you are now a liquidity provider on Uniswap and you'll start earning a portion of the trading fees. You can review your position on app.uniswap.org/pools.

Providing liquidity on Uniswap is a great way to earn rewards while contributing to the liquidity and efficiency of the underlying market. As stated above, this does not come without risk and it’s important that you fully understand the underlying risks before committing to this.

Frequently Asked Questions

What is wstETH?

wstETH is a wrapped version of Lido’s stETH which is more DeFi compatible. To learn more about wstETH, check out our explainer here: What is wstETH

Why am I using wstETH and not regular stETH?

Due to complexities surrounding the rebasing of Lido’s stETH, a number of DeFi protocols have chosen to add wstETH. wstETH is non-rebasing, and network rewards are reflected through an increasing price of wstETH as opposed to daily rebases.

Is it safe to provide liquidity on Uniswap?

Providing liquidity on Uniswap is a common DeFi activity but does not come without risks. For more information on the risks of providing liquidity on Uniswap, check out: Uniswap: A Good Deal for Liquidity Providers?

How do I withdraw my liquidity from Uniswap?

You can withdraw your liquidity at any time by going to the Uniswap pool and selecting the "Remove Liquidity" option.

What returns can I expect from providing liquidity?

Your returns depend on the trading volume of the pool. You'll earn a share of the trading fees proportional to your liquidity share.