Lido’s Roadmap to Pectra: Navigating Complexity and the Path Forward [Pt 2]

A previous Pectra explainer examined key Ethereum Improvement Proposals (EIPs) included in the Pectra upgrade. Pectra introduces EIP-7251, allowing validators to consolidate up to 2048 ETH. This discussion explores the risk-reward trade-offs that inform the integration of new functionalities.

- Ongoing research shows minimal changes in slashing risk beyond 100 validators per host, with faster response times being key to mitigating losses.

- While larger validators see slight APR improvements, consolidation offers no major financial incentive.

- Lido v3 & stVaults will be ready to immediately support consolidation without requiring changes, allowing for an easy transition.

- Rolling out consolidation to existing modules (starting with the Curated Set) requires research and technical upgrades, which are currently ongoing with expected support to start in Q1 2026.

- Additionally, this discussion provides an overview of EIP-7002, detailing the motivation and technical specifications for triggerable withdrawals.

Pectra brings new opportunities for validator set structure through EIP-7251, enabling validator consolidations and validators to now have effective balances up to 2048 ETH, and EIP-7002, introducing a voluntary withdrawal (either partial or full, via an exit) operation triggered by a validator’s Execution Layer (EL) withdrawal credentials. These changes involve trade-offs in slashing risks, potential rewards, and technical and operational considerations for the Lido Protocol.

This article reviews Lido DAO contributor research on these trade-offs, helping staking ecosystem participants make informed decisions on Pectra functionalities.

Background & Rationale

The advent of increased max effective balance (MAX_EB) and validator consolidations will significantly contribute to Ethereum’s evolving staking landscape, particularly for protocols like Lido. EIP-7251 enables certain validator types to have effective balances (i.e. ETH that counts as "stake weight" and is eligible for duties, rewards, and penalties) up to 2048 ETH vs the traditional 32 ETH maximum.

Protocols may benefit from this feature, which helps reduce network congestion, by either using this validator type for new validators, and/or consolidating existing validators into this new type. Consolidations facilitate a shift toward a new equilibrium between larger and smaller validators, optimizing network composition and stake allocation. This transitional process also introduces challenges, including potential slashing risks, governance complexities, and increased development effort for decentralized protocols, which must implement changes entirely on-chain.

Unlike centralized entities that can adapt quickly off-chain, in order to implement the functionality enabled by changes like EIP-7251 and 7002, decentralized staking solutions like Lido require careful considerations with respect to changes of on-chain design and protocol economics, rigorous testing in a permissionless manner in cooperation with Node Operators who use the protocol, and deep analysis on protocol impact.

The conducted research aims to assess the trade-offs of different consolidation levels for large on-chain staking protocols like Lido and the node operators that use them, as well as thebroader impact on the Ethereum ecosystem, and attempt identify a robust process for consolidation and usage of larger MAX_EB validators that balances that with overall goals of protocol decentralization, security, and network stewardship.

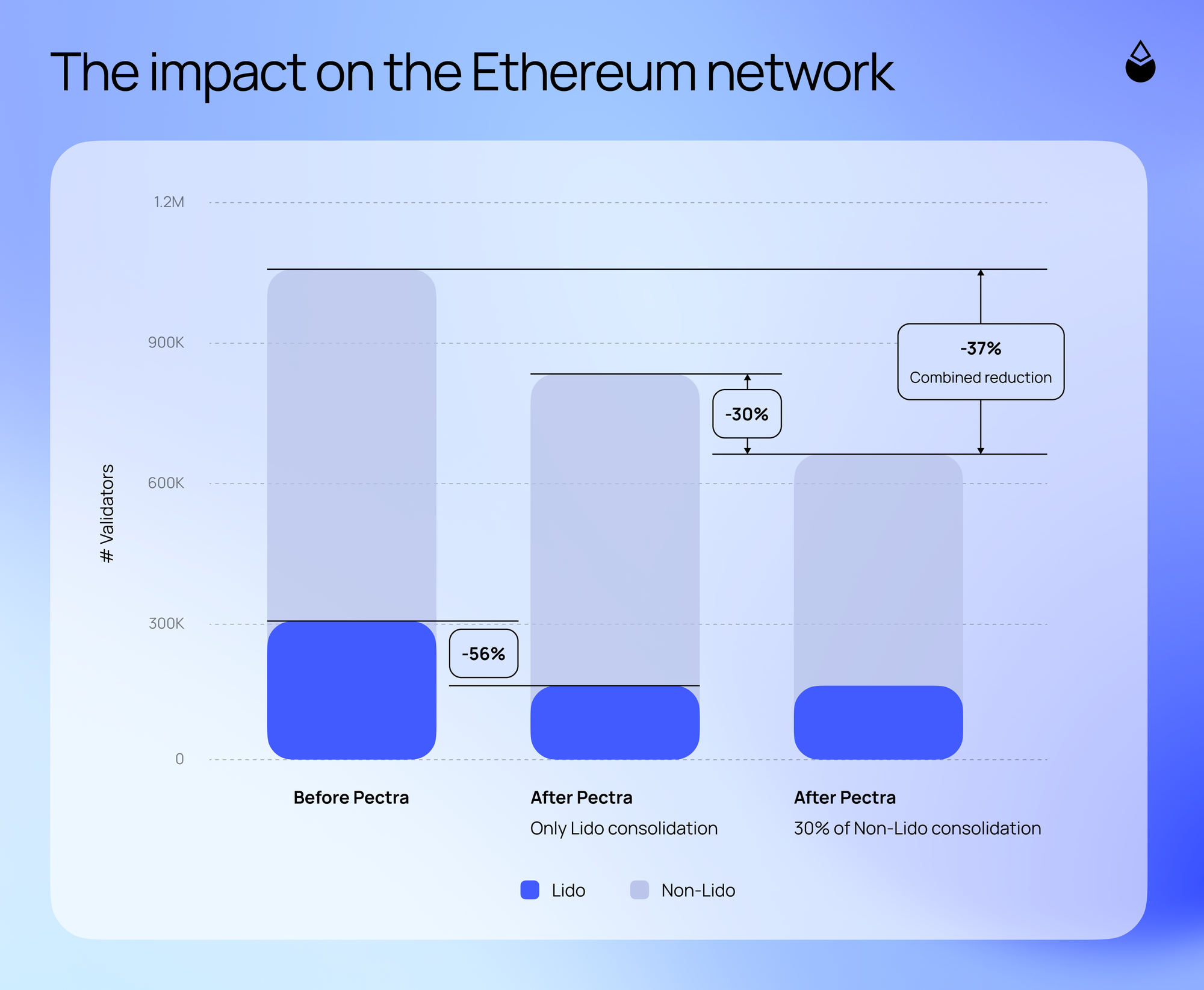

The impact on the Ethereum network, particularly in reducing the number of attestation messages and overall bandwidth load, could see a decrease of up to one-third (or even more) depending on the extent of consolidation adoption.

The following example provides an illustrative scenario of this impact, assuming:

- 60% of Lido Curated Module validators consolidate to 2048 ETH.

- A 30% reduction in the total number of non-Lido validators due to consolidation.

Activating Triggerable Withdrawals

EIP-7002 introduces "Triggerable Withdrawals" (TWs), finally addressing the key trust issue in delegated staking, where stakers depend on node operators to process withdrawals. This EIP lets stakers withdraw ETH independently of the validator’s signing key, using a new voluntary withdrawal operation tied to the validator's withdrawal credential.

For a protocol like Lido, motivations for supporting TW include reducing reliance on trusted entities, enabling permissionless staking modules, providing a fallback for lost validator keys, and supporting Dual Governance by allowing stETH holders to withdraw funds autonomously.

Integrating TWs into the Lido protocol requires updates to on-chain contracts like the Withdrawal Vault, Accounting Oracle (AO), Validator Exit Bus Oracle (VEBO), CSM contracts, and Staking Router. Off-chain tools, including Oracles and the Ejector, also need modifications, alongside new mechanisms for triggering withdrawals and reporting delinquent keys.

TWs would operate in two phases: first, trusted protocol components (e.g. Oracles) submit a report hash to the VEB contract; then, anyone could potentially "unpack" and publish the report data to trigger exits, subject to certain limitations (like safety rate limits). This approach enhances protocol security and robustness by reducing reliance on node operators and oracles, and enabling permissionless exits.

Goal

This summary highlights key findings from an earlier study that provided a model for how consolidating parts of the protocol into large validators impacts slashing risks and staking dynamics, with a particular focus on economic factors. Concretely, it explores the security implications of larger validator balances and how changes to the validator set affect reward skimming, fee distribution, and network efficiency.

Assumptions

The analysis of validator consolidations relies on the following key assumptions about Ethereum’s staking and slashing dynamics:

- Slashing risk focuses on attestation double votes, primarily caused by running the same validator key(s) on multiple instances with differing chain views.

- Slashing penalties scale linearly with a validator’s effective balance.

- Double attestation slashings occur only in rare divergent slots, with estimated divergent slot rates ranging from 0.01% to 0.2%.

- Node operators typically respond only after an initial slashing event, with reaction times varying from 16 to 7,200 slots.

- Attestation frequency remains one per epoch per validator, regardless of balance.

- Entry queue size varies between 200 and 20,000 validators, while reward skimming takes an average of 8.54 days.

- Gas prices range from 30 to 35 Gwei per month, based on 2023 data.

- Total stakeis approximately 31.39M ETH.

- Execution layer (EL) APR is 0.425%, with network rewards tied to validator set size and EL market conditions.

Slashing Risks: A Closer Look

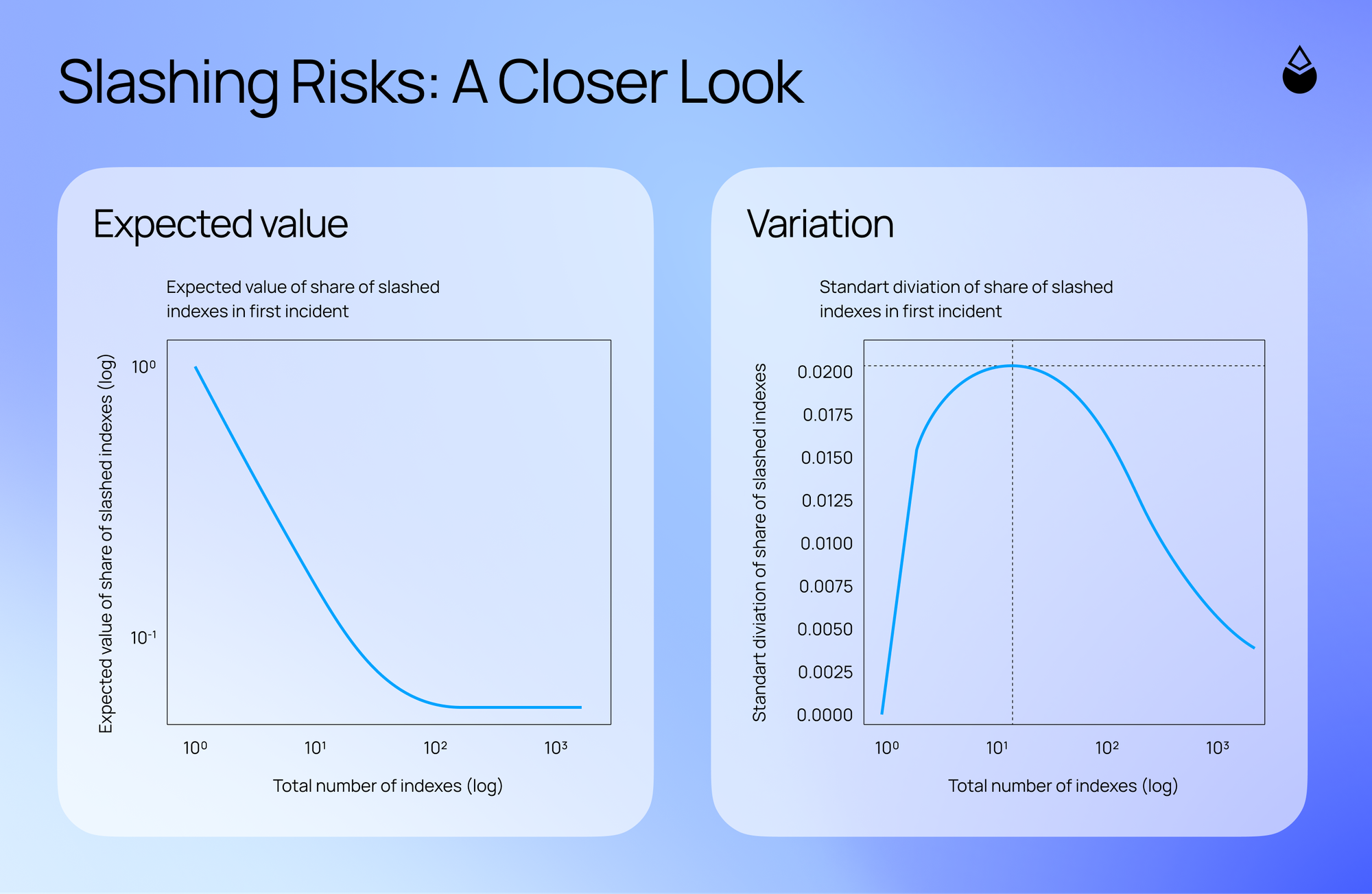

The analysis reveals several factors that influence slashing risks, emphasizing the impact of high-value consolidations, reaction times, and network conditions on expected losses:

- Insight #1: Consolidating into only a few validators (e.g. using two 128 ETH validators instead of eight 32 ETH validators) can lead to higher initial losses in the event of a slashing. In contrast, spreading stake over more than 100 validators tends to lower these initial losses, though further increases in validator count yield diminishing benefits.

- Insight #2: The speed of response is critical. A prompt response can substantially decrease realized losses. For instance, reacting in about 12 minutes instead of an hour can cut expected losses by nearly three times. However, if reaction times extend to a full day, validator losses may increase to the full amount hosted in a single machine under the study’s model.

- Insight #3: While consolidation across a large number of validators may reduce expected losses, it simultaneously increases variance, introducing greater overall uncertainty into risk outcomes. Under stressful network conditions, such as prolonged activation delays or high gas fees, the benefits of consolidation become less significant.

Rewards: Dissecting the Potential Gains

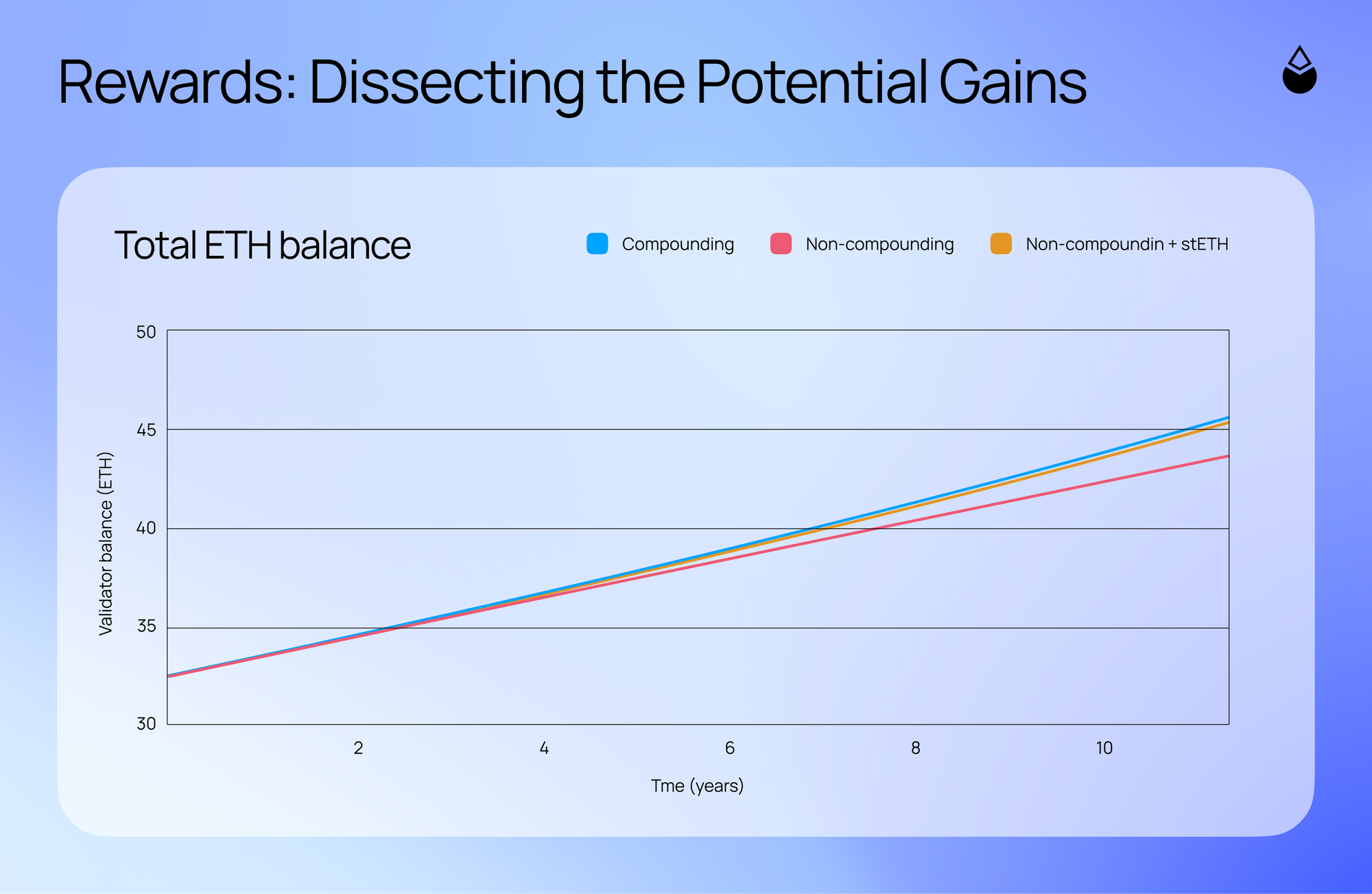

The results indicate a modest potential for increased APR through validator consolidations, hard to translate in real impact for small and large validator sets. Some factors like larger validators and certain network conditions provide the most notable benefits:

- Insight #4: The potential increase in APR from consolidation is modest, with estimations of no more than 0.002% increase under reasonable conditions. Noticeable APR enhancements are primarily limited to very large validators (with balances of 1700+ ETH). In the long run, the compounding of rewards will result in greater returns compared to standard rewards, but again representing a very subtle increase.

- Insight #5: Validator performance is directly linked to network conditions and overall network health. In cases of activation delays or transaction pool congestion, 0x02 validators can operate more efficiently than the 0x01 validators used by large staking pools.

- Insight #6: The distribution of validator balances plays a crucial role in total rewards. Employing strategies that involve 0x02 validators (compounding) and leveraging EL-inflows (either from EL rewards or skimmed CL rewards) to create new 0x01 validators can optimize long-term returns.

Release Timeline & Future Roadmap

What does this mean for Lido?

Validator consolidation presents both opportunities and risks. Although it can lead to minor APR improvements under specific circumstances, it might also amplify slashing risks. The risks are more pronounced when validator numbers are low, and reaction times are slower. It is critical to account for infra setup misconfiguration, where double attestation can lead to slashing. Effective strategies include quick responses to slashing alerts, and Node Operators can minimize slashing costs by immediately shutting down an affected cluster.

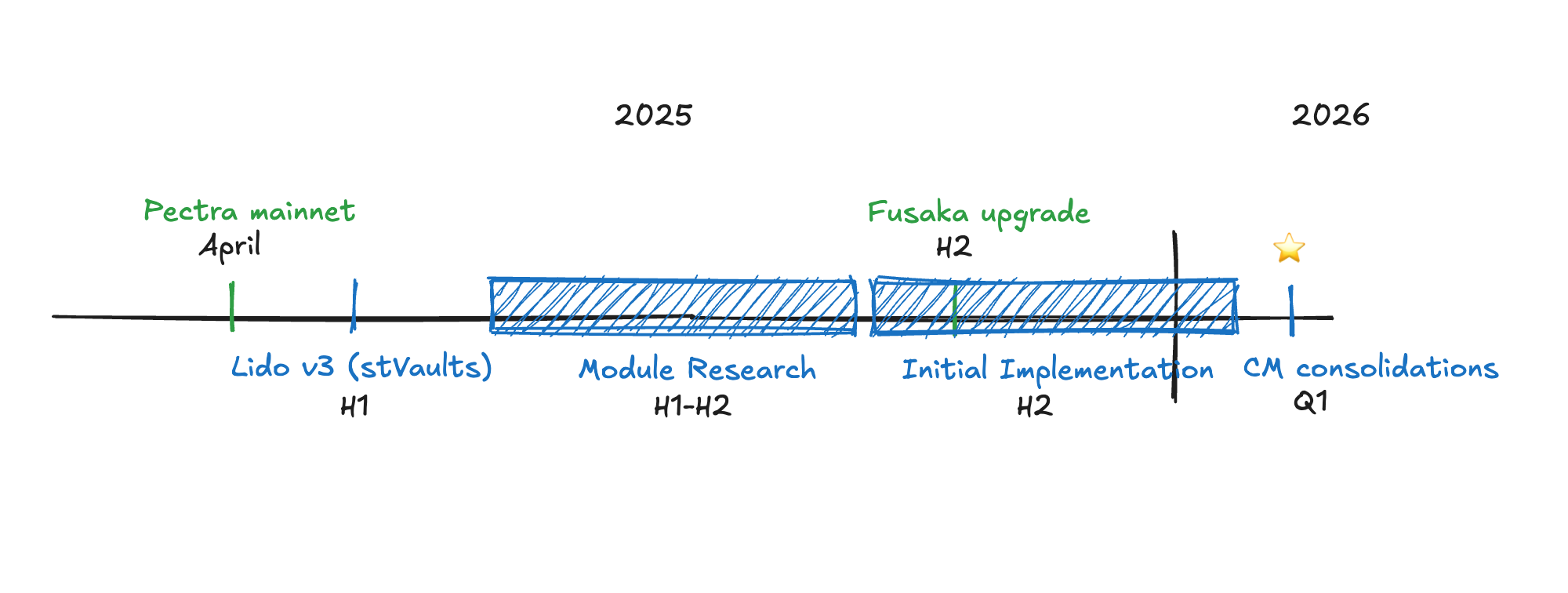

Usage of larger validators and consolidation operations in the Lido protocol will follow a phased implementation approach:

- Phase 1 – stVaults Launch (2025 Q2-Q3): Lido v3 and stVaults are designed to support larger MAX_EB validators from the get-go. stVaults operate using the concept of “vault balances,” independent of the number of operator keys. This architecture enables immediate adoption of the 0x02 withdrawal credentials type while maintaining compatibility with the protocol. This allows stVaults to serve as the initial Lido protocol implementation for larger validators, with support being added to Lido Core sometime thereafter.

- Phase 2 – Module and Marketplace Research (2025 H2 – 2026 H1): The second phase of the MAX_EB and consolidations implementation will focus on setting the foundation for a gradual rollout of consolidations across Lido v2 Modules, starting with the Curated Set.While stVaults are already compatible with consolidation, integrating this functionality into Lido Core and its existing modules requires careful planning and re-architecting of base protocol accounting.

What's Next

Research is ongoing to define key consolidation parameters, target values, and a full migration strategy that ensures security, efficiency, and minimal disruption.Beyond operational feasibility, this phase will involve designing and implementing necessary on-chain and off-chain code changes, a process expected to start taking place in the second half of 2025.

Given the complexity of these upgrades, it is estimated that Lido Core will begin supporting larger MAX_EB validators and consolidations in Q1 2026.Additionally, migration functionality between Node Operators and modules, through the use the consolidations mechanism, are being actively researched, aiming to refine stake allocation and reallocation strategies.

This research, already underway, will continue throughout 2025 to assess how these mechanisms could optimize the protocol towards a robust market of staking products.Based on the above timelines, it is estimated that a Lido protocol optimal distribution of both 2048- and 32-ETH validators will likely take shape by mid-2026.