Lido stAssets Collateral Risk Monitoring

Lido, being the leading liquid staking protocol and the second largest DeFi protocol by TVL, has been integrated across a number of DeFi protocols. Lido integrations aim to let its depositors use their Lido staked assets (stAssets) to earn rewards and also use them in DeFi. In other words, you may use your stAssets (tokens which already earn daily staking rewards) as collateral for lending, leveraged staking, rewards farming, hedged farming and more.

We all know that there is no reward without risk; at the same time Lido works to maintain healthy integrations. This article provides you with a short overview of how the risks of stAssets-collateral are managed by Lido: from risk classification to risk monitoring, liquidity sufficiency analysis and alerting.

Lido team does a lot to ensure the health of collateral and to keep risks under control:

- Lido monitors the collateral risks for a number of pools. The risk of collateral may change over time, so it is monitored automatically on DeepNote and Dune (links are provided in the chart below). The information is updated every hour on DeepNote and by request even more often on Dune.

- For pools with multi-collaterals and multi-loans we divide stAssets into bins to analyse the risks separately for different types of collateral and loan.

- In the event of a liquidation, collateral will be sold to cover the debt. To ensure that there is always enough liquidity on the market we perform liquidity sufficiency analysis using aggregated indicators.

- If the number of collaterals in the risky zone grows significantly, we alert our users via LidoFinance Twitter, and the Lido team - by means of Collaterals Alerts Bots.

All these steps are open and transparent to help our actual and potential partners to make informed and balanced decisions.

Let’s start from the quick note of where you may deposit your stAssets and use them as collateral, and then proceed to the risk management algorithm.

Lido Integrations to use stAssets as collateral

For now the Lido ecosystem allows its users to put their stAssets (stETH, wstETH, steCRV, bETH, bLuna, stSOL) as collateral in the following protocols integrated with Lido: AAVE and Maker DAO - on Ethereum; Anchor - on Terra; Solend, Larix, Port Finance, Francium - on Solana.

The list below summarises tracked Lido integrations to use stAssets as collateral.

List of Lido Integrations:

Ethereum

- Protocol: AAVE

Collateral token: stETH / multi-collateral

Loan token: ETH / the other tokens / multi-loans

TVL (collateral value), May 2022: > $2.9B

Liquidation: LTV = 73%, the liquidation threshold = 75%

Dashboard: AAVE stETH on Dune, AAVE stETH on DeepNote

- Protocol: Maker DAO

Collateral token: wstETH

Loan token: DAI

TVL (collateral value), May 2022: > $410M

Liquidation: Liquidation ratio = 160%

Dashboard: Maker wstETH on Dune, Maker wstETH on DeepNote

- Protocol: Maker DAO

Collateral token: steCRV

Loan token: DAI

TVL (collateral value), May 2022: > $3.6M

Liquidation: Liquidation ratio = 155%

Dashboard: Maker steCRV on Dune, Maker steCRV on DeepNote

Terra

- Protocol: Anchor

Collateral token: bETH / multi-collateral

Loan token: UST

TVL (collateral value), May 2022: > $1.34B

Liquidation: LTV = 75%

Dashboard: Anchor bETH on DeepNote

- Protocol: Anchor

Collateral token: bLuna / multi-collateral

Loan token: UST

TVL (collateral value), May 2022: > $881M

Liquidation: LTV = 80%

Dashboard: Anchor bLuna on DeepNote

FYI:

- LTV (loan-to-value) is a ratio of the liability to the collateral value that limits the loan a user can get within given collateral. For example, AAVE stETH Vault max LTV equals 73%, it means that the user may get a loan within 73% of collateral value. In practice AAVE stETH Vault also exploits the liquidation threshold of 75%, i.e. liquidation starts when the liability equals 75% of the collateral.

- Some platforms use the indicator inverted to LTV - Liquidation ratio. Liquidation ratio is a ratio of collateral value to liability (collateral-to-loan) when the loan position gets into the liquidation queue. For example, Maker DAO set up a 160% liquidation ratio for wstETH collateral, and 155% - for steCRV collateral.

Risk Rating

Risk management requires a classification of risks. To classify collateral stAssets according to their risk level we exploit a risk ratio model.

FYI:

- The risk ratio characterises a position's riskiness (nominated in %).

- RiskRatio = Loan / (Collateral value * maxLTV).

- The loan position with a risk ratio of 100% and more gets in the liquidation. In general, loan positions with a risk ratio of 80% and below may be considered as safe from under-collateralization.

- If we invert the formula of risk ratio we will receive the collateral-to-loan ratio: Collateral value / Loan = 1 / (RiskRatio * maxLTV) = k*x

where k is a varying coefficient (1/RiskRatio) and x is a constant that equals 1 / maxLTV.

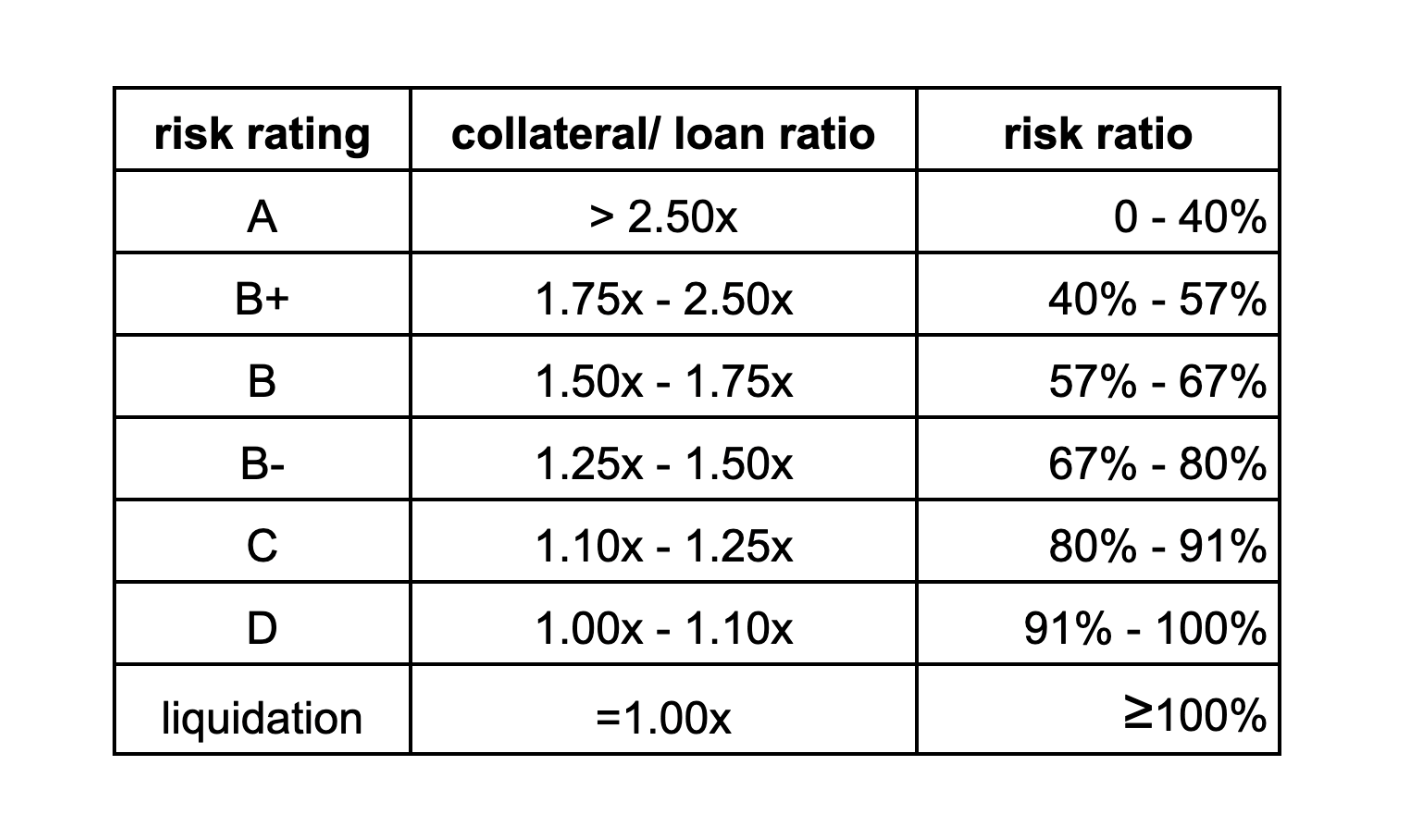

We use two types of risk rating scale: standard and reduced.

Standard risk rating scale is applied if the collateral and loan are nominated in the different tokens. For now it is applied to the Anchor pool (bLuna collateral and UST loan, bETH collateral and UST loan), AAVE pool (in case of stETH collateral and non-ETH loan), Maker DAO (wstETH collateral and DAI loan, steCRV collateral and DAI loan).

We departed from the collateral-to-loan ratio of 2.50x, 1.75x, 1.50x, 1.25x, 1.10x, 1.00x (where x = 1/maxLTV) and divided the loans into 7 groups. 1.00x (or less) collateral-to-loan ratio means risk ≥100% and leads to liquidation of collateral to redeem the debt. The distances between the coefficients were chosen in such a way that each lower risk is harder to hit.

We consider groups ‘A’ and ‘B+’ as ‘safe zone', ‘B’ and ‘B-’ as ‘middle-risk zone’, while groups 'C', 'D', and 'liquidation' (C+D+liquidation) as 'dangerous zone'.

Below you may see our standard risk rating scale. For example, it is used for Bin2 AAVE Vault.

FYI:

AAVE Vault allows its users to supply stETH as collateral (while still retaining Ethereum staking rewards) and take a loan. Multi-collaterals and multi-loans are also taking place.

To monitor the collateral risks we divided AAVE Vault into three Bins:

- Bin1: AAVE users with ≥80% collaterals in stETH and ≥80% debt in ETH.

- Bin2: AAVE users with stETH collateral and ≥80% debt in not-ETH.

- Bin3: All the others AAVE users with stETH collateral.

Our standard risk scale is applicable for Bin2 and Bin3 where collateral and loan are nominated in the different tokens, but not for Bin1.

Lido standard risk rating scale used for AAVE Vault Bin2 (stETH/non-ETH)

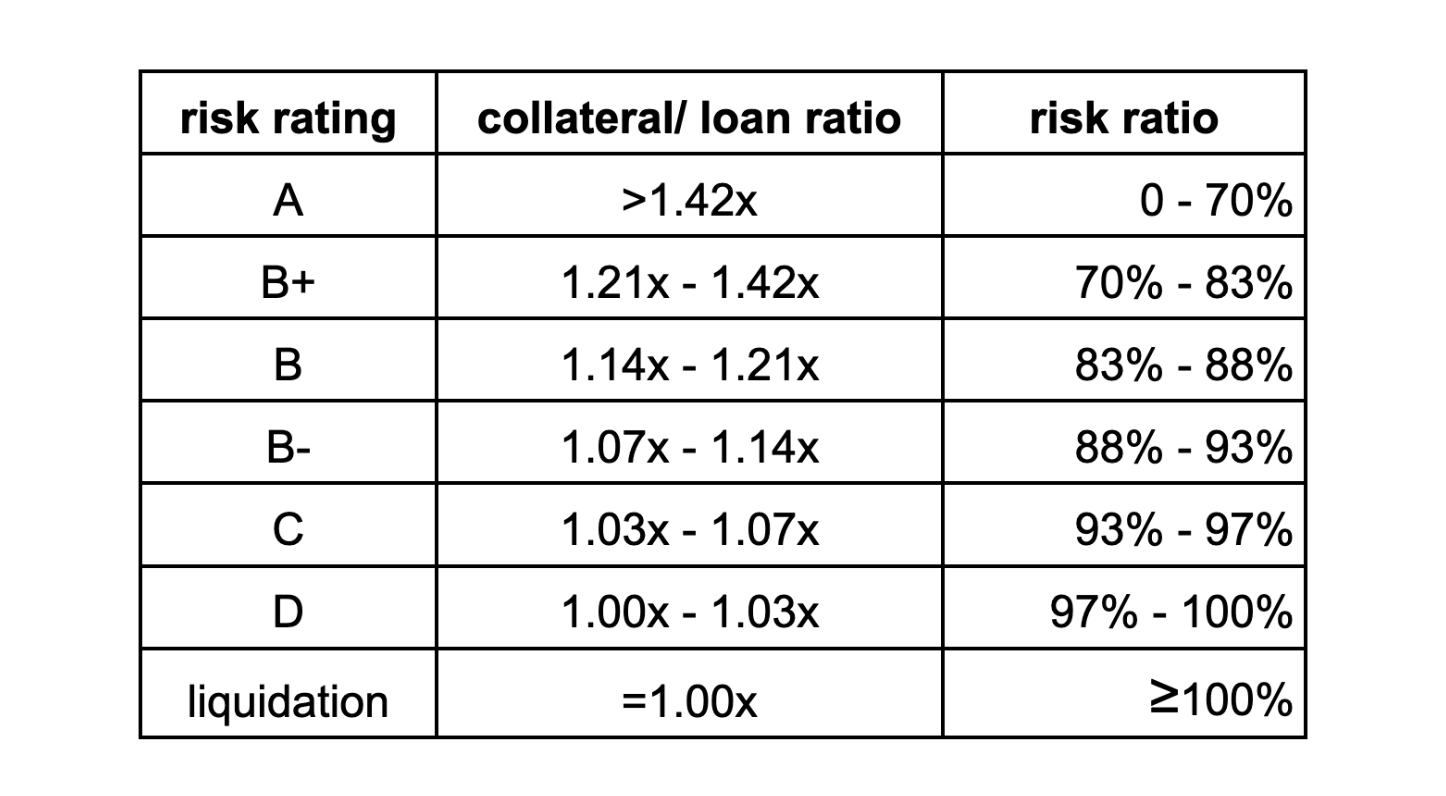

Reduced risk rating scale is used when collateral and loan tokens are related to each other (e.g. ETH and stETH), the standard risk rating scale is not applicable because of the reduced price volatility in a pair of tokens.

For example, the reduced risk rating scale was developed for Bin1 of AAVE Vault where stETH is the main token of collateral, and ETH - token of loan. stETH is related to ETH that significantly reduces the risk of the price change. On the basis of the historical data on daily stETH-ETH price drops and daily stETH-ETH price volatility and taking into account a structure of the bin we developed the risk scale for Bin1.

Reduced risk rating scale for AAVE Vault Bin1 (stETH/ETH)

While LTV is a metric set by the protocol, the collateral and liability values are the actual numbers that change over the time due to changes in the positions and the assets’ prices. These changes consequently lead to the update of the actual collateral to liability ratio, and may change the risk rating of collateral. That’s why collateral monitoring is needed in real time.

Risk Monitoring

For now Lido has automated stAssets-collateral risk monitoring on AAVE, Anchor and Maker DAO based on the hourly updated positions and token prices. Lido users may have free access to the monitoring placed on deepnote.com and dune.xyz that allows them to check the health of the lending pool.

Integration Monitor Dashboard on Dune provides you with actual and historical data on stAssets amount locked in the pools, $TVL and charts of stAssets dynamics.

Aggregated collateral risk monitor on DeepNote presents the aggregated metrics (like aggregated total collateral value, aggregated risky collateral value, pool liquidity) for the pools using ETH as collateral (AAVE, Maker DAO, Anchor) and also provides risk monitoring for each pool (current risk rating and dynamics of total collateral and risky collateral).

More detailed information may be found on Dune for Maker DAO WSTETH-A, Maker DAO steCRV dashboards including $TVL, liquidation ratio, total amount of collateral and total debt, collateral and debt dynamics, collateral risk structure, liquidation tracker etc.

AAVE stETH Vault on Dune presents $TVL, LTV, Liquidation threshold, total amount of collateral, collateral dynamics, liquidation tracker.

Detailed analysis for Anchor bETH (for bETH and bLuna), AAVE stETH (for all three bins) pools on DeepNote includes risk rating, collateral dynamics of total collateral and risky collateral, liquidation tracker.

Let’s consider the typical risk monitoring of stAsset-collateral that you may find on DeepNote using the example of Bin2 AAVE stETH Vault (AAVE users with stETH collateral and ≥80% debt in not-ETH, standard risk rating scale).

1. Current collateral risk structure.

The calculation of the risk rating is based on the current prices of collateral and loan tokens, and collateral to loan ratio. In the table you may see the distribution of collateral on the risk rating scale. Each table also shows total amount of stAssets-collateral locked in a pool, $TVL, number of collateral deposits, percentage of collateral in the safe and dangerous zones.

In the example below you may see that 2% of stETH-collateral amount is in danger.

2. Collateral dynamics.

If the table above reflects the current state of collateral, the chart shows its dynamics including total collateral amount and risky collateral amount (C+D+liquidation).

For example, in a chart below you may see that the total amount of stETH collateral grew significantly during the last month. The amount of the risky collateral also grew, but not faster than total collateral that tells us about the good health of collateral.

3. Liquidity sufficiency analysis.

If a significant amount of collateral falls in the risky zone, we need to be assured that there is enough liquidity on the market to cover liquidations.

For the aim of liquidity sufficiency analysis we use two metrics:

- Ratio of total collateral to pool liquidity, %;

- Ratio of risky collateral (C+D+liquidation) to pool liquidity, %.

Pool liquidity is an aggregated indicator of liquidity available on the market.

FYI:

- To calculate pool liquidity for ETH-related collaterals we sum up the value of native tokens and stablecoins deposited in the Curve ETH/stETH, Sushi DAI/wstETH, Balancer WETH/wstETH and TerraSwap UST/bETH liquidity pools (pools where native tokens or stablecoins are paired with stAssets tokens).

- For bLuna collaterals, pool liquidity is calculated as a value of Luna locked in TerraSwap Luna/bLuna and Astroport bLuna/Luna liquidity pools.

The results of liquidity sufficiency analysis are presented in charts. Orange line shows a ratio of total collateral to pool liquidity, and dark violet line - a ratio of risky collateral to pool liquidity.

For example, in the stETH Anchor chart below we may see that the ratio of risky collateral to pool liquidity (dark violet line) fluctuated between 2% and 9% during the last month.

4. The liquidations tracker.

To check the number of liquidations and liquidated stAsset collateral amount you may use the liquidation tracker (we have it for AAVE on Dune).

Aggregated liquidity sufficiency analysis

For aggregated liquidity sufficiency analysis we sum up the total collateral value and risky collateral value locked in the pools and calculate the ratio of total collateral to pool liquidity and ratio of risky collateral to pool liquidity.

The chart below presents the aggregated liquidity sufficiency analysis for ETH-related collateral locked in AAVE, Anchor, and Maker pools. The ratio of risky collateral to pool liquidity exceeded 60% recently that requires more attention to manage the risks.

Alerting

The monitoring provides data for alerting the Lido team and Lido users that allows them to de-risk in time. Lido already exploits several tools for alerting:

- Collaterals Alerts Bot on AAVE and Anchor automatically warn Lido team about risky collateral, when the number of collateral stAssets in the dangerous zone grows.

- Lido provides users with information about significant changes in collateral risk via Twitter account.

We also plan to expand monitoring and alerting by:

- Adding Collaterals Alerts Bot on Maker;

- Implementing automated monitoring on Solana;

Conclusion

To wrap it up, stAssets-collateral risk management is vital for the healthy integration of Lido with the other protocols.

On the one hand the integration provides more opportunities for stAssets holders - you may deposit stAssets and get more rewards beyond staking rewards, or use your collateral for lending to get more liquidity for leveraged staking, etc. On the other hand - using stAssets as collateral brings a risk of a loan position liquidation that leads to a liquidation penalty and destroys your strategy, but moreover rocks the boat of the pool. To navigate the risks Lido team provides stAssets-collateral risk monitoring.

Automatic monitoring, liquidity sufficiency analysis and alerting are the main components of the stAssets-collateral risk management. We monitor collateral risks from different perspectives (using indicators for a pool, dividing a pool on the bins by different tokens, and even implementing aggregated indicators to analyse the liquidity sufficiency for a bunch of integrations) to see the whole picture.

To conclude, Lido moves heaven and earth to surface and show the collateral risks and allow you to make informed decisions. Stake with Lido, be prudent when you lever up on Lido integrations and stay safe!

Authors' contributions:

- Irina Katunina / @ikatunya: original idea, conceptualization and methodological framework, supervision, project administration, review & editing.

- @ppclunghe: code writing, data analysis, visualisation, validation, review & editing.

- Grigorii Shestakov: data fetching, data analysis, visualisation, validation.

- Yulia Fomina / @YuliaFominaA: original draft writing and editing.