Lido Monthly Report: March 2024

Welcome to the March edition of the Lido Monthly Report, a comprehensive source for insights into all of the latest developments.

This report reviews another month of noteworthy metrics, new collaborations, and ongoing developments that highlight the overall performance and progress of the Lido middleware solution.

TLDR:

- TVL increased by 6.97% despite a slight dip in staked ETH & MATIC.

- Increased incentives boosted wstETH on Layer 2 networks - especially Base.

- Four proposals passed on Snapshot: wstETH Bridge Control (Scroll), InfStones Node Operator return, new Rewards-Share Program, and Simple On-Chain Delegation for LDO holders.

- NOCC Call #16 covered CSM architecture, Staking Router mechanism research, and the finalised D.U.C.K. framework.

- New collaborations with eBTC lending protocol and Bebop DEX.

- wstETH was officially deployed on Scroll.

- New reports on monthly validator performance and the future of Lido middleware on Layer 2.

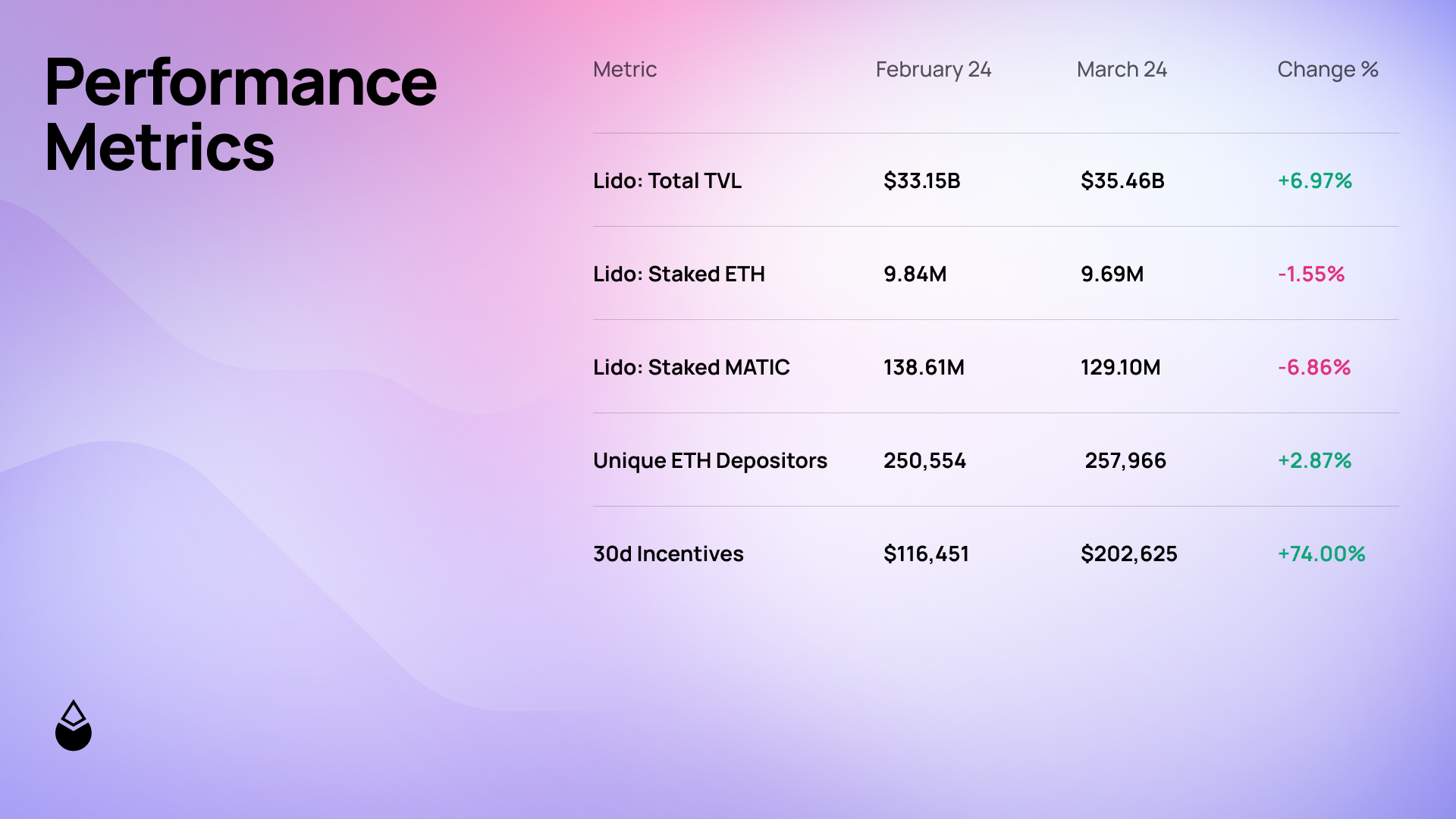

Middleware Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the Lido middleware over the month of March.

- Despite a slight decrease in the total ETH and MATIC staked through the Lido middleware, the total value locked (TVL) surged by 6.97% as a result of ETH's price appreciation during the month.

- A total of 7,412 users began staking for the first time through the Lido middleware.

- The significant rise in LP incentives was primarily driven by increased rewards offered on Layer 2 networks, particularly Base and Optimism.

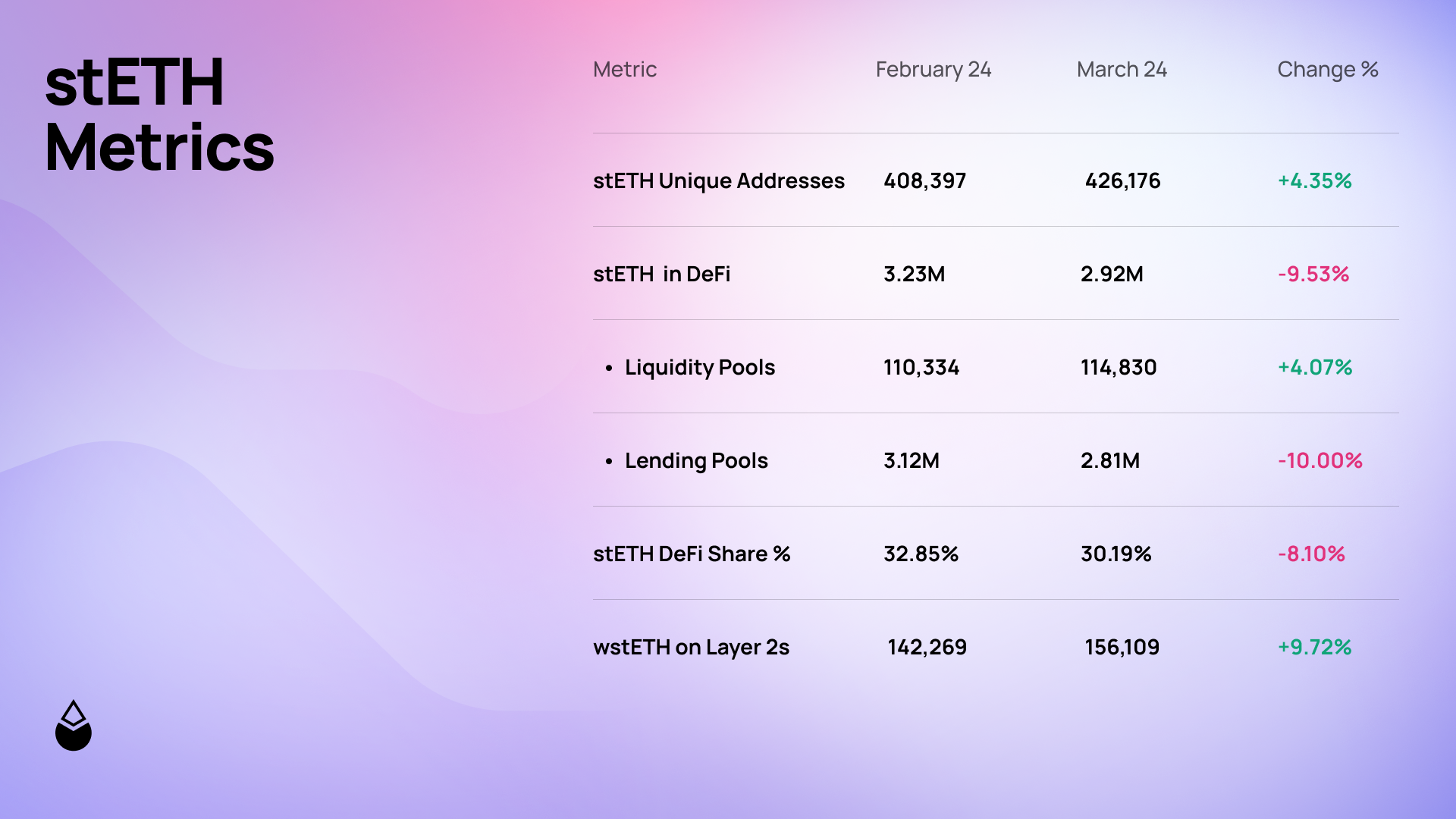

stETH Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the Lido's Ethereum staking token over the month of March.

- It is important to note that these metrics also include wstETH - the wrapped, non-rebasing version of stETH.

- While liquidity pools saw an increase in stETH, a decrease in lending pools offset this gain, resulting in a net decrease of stETH in DeFi overall.

- Increased incentives on Layer 2 networks led to a surge in wstETH, particularly on Base where the amount nearly doubled from 4,011 to 9,436.

Governance

In this section, notable proposals from the Research Forum and their progress through the voting processes on Snapshot and Aragon are presented.

Snapshot

Among the various Research Forum proposals considered and deliberated upon during the past month, four proposals were subjected to Snapshot votes:

- wstETH Bridge Canonical Endpoints on Scroll: details

This proposal suggested granting Lido DAO control over the wstETH token bridging endpoints on Scroll as a proxy admin with upgrade authority, while the native bridge management remains outside Lido DAO's control.

Proposal Outcome: Successful ✅

2. InfStones Return to Active Status Proposal: details

This proposal requested Lido DAO to vote on whether InfStones could rejoin the Lido Node Operator set. InfStones had undergone penetration testing and implemented security measures to address vulnerabilities identified in December 2023.

Proposal Outcome: Successful ✅

3. Rewards-Share Program 2024: details

This proposal by the Lido Rewards Share Committee suggested a new program replacing the existing tiered one. It focused on attracting larger institutions by setting a minimum staking threshold and offering flexible rewards calculated by the committee.

Proposal Outcome: Successful ✅

4. Simple On-Chain Delegation: details

This proposal outlined a "Simple On-chain Delegation" system for Lido DAO. LDO token holders could delegate voting rights to others, aiming to increase on-chain voting participation. It prioritized a quick solution to address low quorum rates while acknowledging a more comprehensive system is in the works.

Proposal Outcome: Successful ✅

Aragon: Omnibus Votes

Following every Snapshot vote, such proposals are consolidated into a final Omni-Vote within Aragon's 2-Phase voting process:

- Vote #173 : details

This Lido DAO proposal suggested incorporating Easy Track Factories to streamline treasury management, as recommended by the Treasury Management Committee (TMC). These factories would facilitate swaps between stETH and stablecoins, along with swaps between different stablecoins (DAI/USDC/USDT).

The process involved transferring funds to secure Stonks Contracts and using the Easy Track UI to ensure a minimum return on the swaps.

Proposal Outcome: Successful ✅

Community

In this section, you will find recaps of vital community gatherings, with a particular emphasis on the Node Operator Community Calls. These recaps serve to capture and share insights from these gatherings, fostering active engagement and meaningful discussions within this expanding community.

NOCC Call #16

The latest Node Operator Community Call covered several important topics:

- Dmitry, a Lido DAO contributor, provided an educational overview of the Community Staking Module (CSM) architecture that is currently under development.

- In January, Felix Lutsch - a long-term contributor to the staking ecosystem -received a LEGO grant to produce a research report that would provide a comprehensive list and comparison framework for Lido DAO to evaluate distribution mechanisms of ETH to the Staking Router modules. Felix presented his insightful findings during this call.

- Lionscraft's Julian unveiled the finalised version of D.U.C.K., a comprehensive framework designed to empower Node Operators and propel them towards excellence. The highly anticipated Alpha release is scheduled for 2 April.

For more details, see below for the full call:

Collaborations

In this section, you will find all the collaborations that have been established in the past month, as leading companies and protocols integrated with the Lido middleware, further expanding the reach and impact of its liquid staking tokens.

Integrations

- New lending protocol eBTC accepts stETH as collateral and automatically stakes all deposited ETH and WETH through the Lido middleware.

- Bebop, a DEX offering near-instant swaps with no slippage, now allows users to seamlessly convert stETH back to ETH. This eliminates the traditional unstaking wait times, offering a more convenient experience.

- wstETH is officially deployed on Scroll - the ZK-rollup on Ethereum.

Additional

- Lido DAO contributor adcv recently discussed the future of institutional Ethereum staking at Blockworks DAS.

Watch Lido contributor @adcv_ discuss the next generation of institutional Ethereum staking at @blockworksDAS 🧑💻https://t.co/8Lu9ve49sP

— Lido (@LidoFinance) March 26, 2024

- The Lido middleware is officially using IPFS to make its staking widget more decentralized, secure, and accessible.

The Lido staking widget goes IPFS 🪐

— Lido (@LidoFinance) March 20, 2024

The move is a significant advancement in data resilience for UI components.

Future development will center around enhancing user experience through increased decentralization and a transparent governance process.https://t.co/Uy9hs0tRVk

- In this recent monthly update, Lido DAO contributors reported on developments around staking modules, highlighting testnet participation and improvements for node operators and validators.

Lido Validator Set Updates: February 🔧

— Lido (@LidoFinance) March 11, 2024

- RFP | CSM & sDVT integration

- Community Staking Fleet proposal

- Simple DVT developments

- Community Staking Module

Keep up with the latest NO & Validator Set ecosystem developments below👇https://t.co/65foicYgm5 pic.twitter.com/3uP4Hjqqca

- Following the successful Dencun Upgrade, this report delved into the future roadmap of the Lido middleware on Layer 2 networks.

Dencun is here and with it comes a new era for staked ETH on L2.https://t.co/KvnS9wMULu

— Lido (@LidoFinance) March 18, 2024

Read on to learn more about future plans for Lido on L2, including improved bridging architecture, continued network expansion and rebasable stETH on L2.

Stay Connected

To conclude, another chapter is brought to a close in the Lido Monthly Report.

To remain continuously updated, be sure to subscribe to receive all upcoming reports. Furthermore, to stay connected with the growing community, follow Lido DAO through the various channels provided below.