Lido Monthly Report: January 2024

Welcome to the January edition of the Lido Monthly Report, a comprehensive source for insights into all of the latest developments.

This report reviews another month of noteworthy metrics, new collaborations, and ongoing developments that highlight the overall performance and progress of the Lido middleware solution.

TLDR:

- Despite the discontinuation on Lido on Solana, TVL surged by approximately $420 million, t0 $21.6b / 9.4m ETH, driven by increased staked ETH through Lido.

- 7,648 users chose to stake their ETH using Lido for the first time in January.

- Liquidity incentives across all chains saw a substantial decrease of over 76%.

- A Snapshot vote passed a TempCheck proposal for selecting a team to develop a wstETH bridge on the Binance Smart Chain.

- The Node Operator Community Call #14 featured updates on the Simple DVT staking module and the introduction of the Mempool Stream service by Eden Network.

- Collaborations expanded with wstETH support on zkSync, Mantle, and Linea, while lending protocol Spark introduced incentives for wstETH depositors.

- Node Operators within the Lido middleware solution are actively diversifying Execution Layer (EL) clients, aiming to reduce reliance on the majority client (currently Geth).

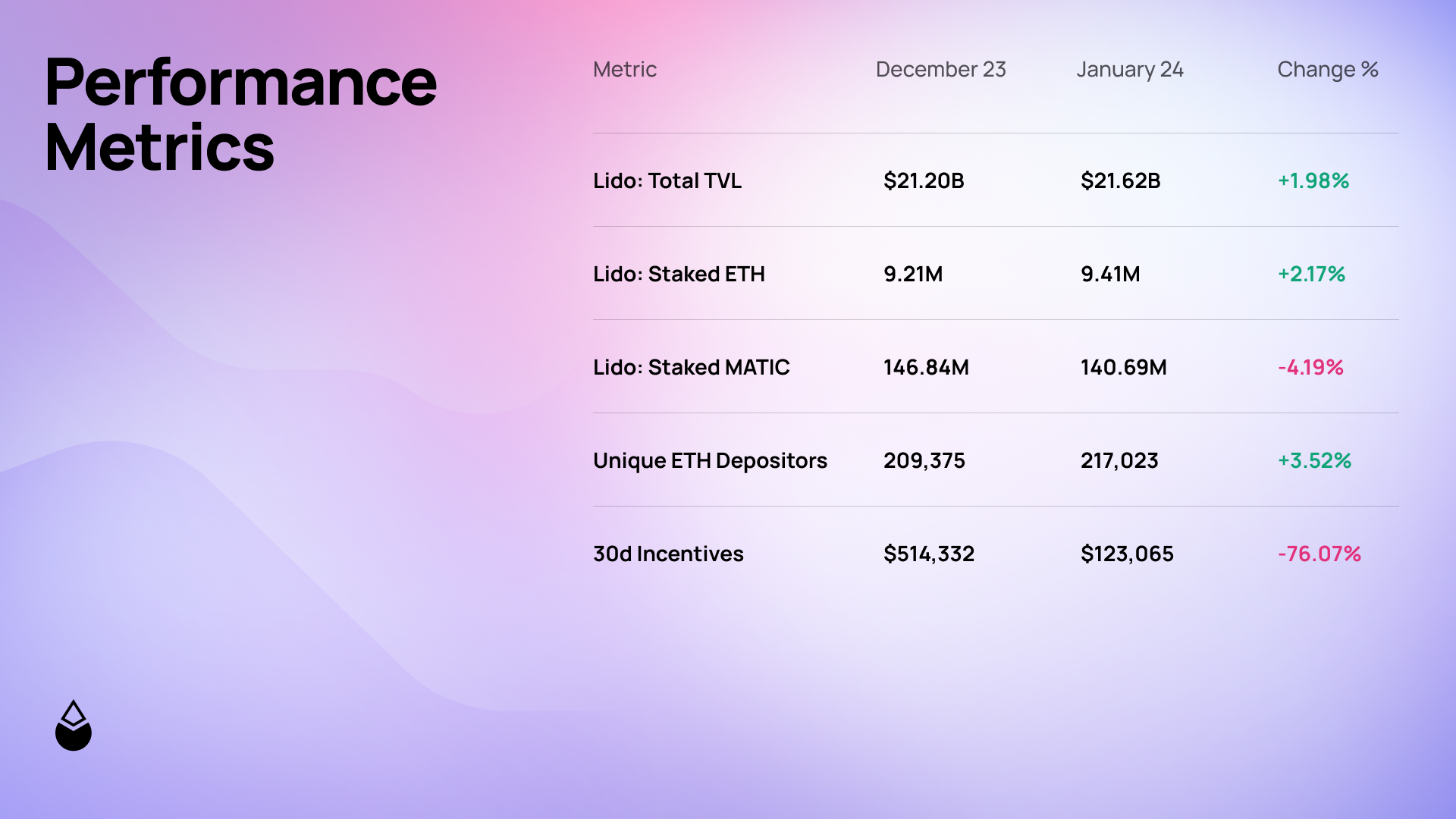

Protocol Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the protocols over the month of January.

- Despite the official discontinuation of Lido on Solana, the increase in staked ETH through the Lido middleware solution contributed to the Total Value Locked (TVL) increasing by approximately $420-million.

- Throughout the first month of 2024, precisely 7,648 users opted to stake their ETH through the Lido middleware solution for the first time.

- The Liquidity Observation Lab reduced liquidity incentives across all chains by over 76%.

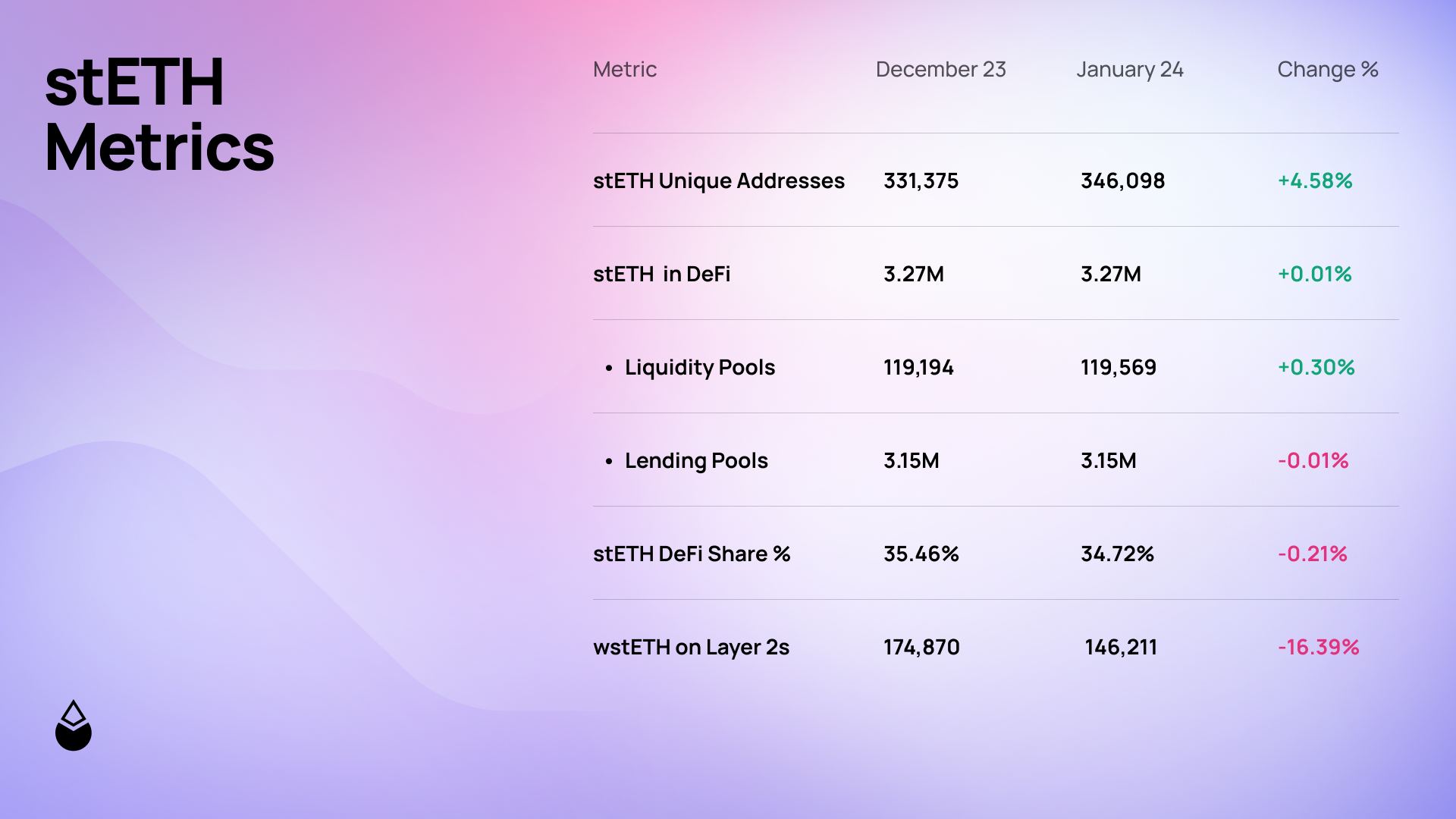

stETH Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the Lido's Ethereum staking token over the month of January.

- It is important to note that these metrics also include wstETH - the wrapped, non-rebasing version of stETH.

- With precisely 14,723 users choosing to hold stETH for the first time, the total number of stETH holders is expected to exceed 350,000 within the coming month.

- As a result of the decrease in liquidity incentives, wstETH on Layer 2s experienced a notable decrease on Arbitrum and Optimism respectively.

Governance

In this section, you will find notable proposals that have arisen from the Research Forum, along with their advancements through the voting processes on Snapshot and Aragon.

Snapshot

Among the various Research Forum proposals considered and deliberated upon during the past month, six proposals were subjected to Snapshot votes this month.

- TempCheck: Choosing team to build wstETH bridge on BNB: details

This proposal conducted a 'temperature check' vote to select a team for developing a wstETH bridge on the Binance Smart Chain (BNB). Four eligible submissions were received from:

- LayerZero

- Wormhole & Axelar Multibridge

- Chainlink CCIP

- Hyperlane & Hadron Labs.

Of these options, the final results revealed that 81.13% of votes were in favor of Wormhole & Axelar Multibridge.

Proposal Outcome: Successful ✅

Aragon: Omnibus Votes

Following the successful Snapshot votes, a selection of these proposals were consolidated into one Omni-Vote within Aragon's 2-Phase voting process:

- Vote #171 : details

This on-chain vote primarily included:

- Replace Jump Crypto with ChainLayer in Lido on Ethereum Oracle.

- Deactivate node operators Jump Crypto (ID 1) and Anyblock Analytics (ID 12) in Curated Node Operators Registry.

- Update the names of node operators: Change "HashQuark" (ID 20) to "HashKey Cloud," and "Prysmatic Labs" (ID 27) to "Prysm Team at Offchain Labs.

- Upgrade Easy Track setups to allow funding in DAI, USDT, and USDC, audited by Oxorio, including permissions for EVMScripExecutor to transfer USDT and USDC with a single transfer limit of 2M.

- Switch DAI top-up setup to DAI, USDT, and USDC top-up setup for all Lido Contributors Group multisigs (RCC, PML, and ATC), as well as LEGO multisig.

- Decrease Easy Track limit for TRP multisig as recommended by the TRP committee.

Proposal Outcome: Successful ✅

Community

In this section, you will find recaps of vital community gatherings, with a particular emphasis on the Node Operator Community Calls. These recaps serve to capture and share insights from these gatherings, fostering active engagement and meaningful discussions within this expanding community.

NOCC Call #14

The latest Node Operator Community Call covered several important topics:

- Will, a Lido DAO contributor, provided a update on the Simple DVT staking module. He discussed the successful completion of ObolNetwork's DVT testnet metrics and progress with SSV Network, indicating upcoming activities and testing phases.

- Andreas from Eden Network introduced the Mempool Stream service, enhancing block value and ETH rewards. Additionally, historical Ethereum MEV ecosystem datasets are now freely accessible in Eden Network's documentation.

- Lido DAO contributor Dmitry Gusakov presented the Request for Proposals for the Community Staking Module (CSM), Lido's first permissionless module, fostering community involvement and innovation.

For more details, see below for the full call:

Collaborations

In this section, you will find all the collaborations that have been established in the past month, as leading companies and protocols integrated with the Lido protocols, further expanding the reach and impact of its liquid staking tokens.

Integrations

- wstETH expanded its support on three new major networks, namely zkSync, Mantle and Linea.

- Leveraging native integrations with Wormhole and Uniswap V3 pools,

seamless cross-chain transfers of wstETH across Ethereum, Arbitrum, Optimism, Polygon, and Base are now enabled. - Lending protocol Spark introduced an incentives program for wstETH depositors, with the current wstETH supply on the platform standing at approximately 584,000.

Additional

- With the imminent implementation of the Community Staking module, Lido DAO contributors have unveiled a comprehensive blog post series aimed at explaining this innovative staking design.

On December 15th, the Lido DAO voted to greenlight the Community Staking Module (CSM), paving the way for community stakers to use Lido to run permissionless validators.https://t.co/jeKV3t6nR5

— Lido (@LidoFinance) January 19, 2024

Here's everything you need to know about Lido's Community Staking Module 👇 pic.twitter.com/QfKoEYquLn

- Node Operators within the Lido middleware solution are striving to diversify Execution Layer (EL) clients following the stabilization and maturation of minority clients post-Merge. They aim to reduce reliance on the majority client (currently geth) to enhance network resilience.

👀 Client diversity awareness is on the rise!! 📈@LidoFinance DAO Node Operators are being encouraged to publicly commit to further decreasing the use of majority EL clients for Lido validators! 👏

— Obol Labs (@ObolNetwork) January 30, 2024

For more details: https://t.co/jYkYRJpz39

- Lido Analytics has built a comprehensive range of Dune dashboards, enabling stakeholders to access a wide range of data for informed decision-making and transparency.

At @LidoFinance , we prioritize transparency and well-informed decisions.

— frontalpha.eth 🛡️ (@frontalpha_eth) January 15, 2024

That's why Lido Analytics created an all-in-one location for all our metrics and dashboards, each offering a unique perspective - from bird's-eye views of general metrics to deep dives into the specifics…

- The Lido middleware solution remains steadfast in its efforts to diminish the risk associated with supermajority client dominance in the Ethereum network.

Since Q4 2022 (post-Merge), Geth usage across Lido protocol validators has gone from 93% to 67% (preliminary Q4/23 data).

— Lido (@LidoFinance) January 23, 2024

Final Q4 Validator & Node Operator Metrics are still being compiled, but efforts are well underway to help reduce supermajority client risk in Ethereum. pic.twitter.com/fpADYabKXe

Stay Connected

To conclude, another chapter is brought to a close in the Lido Monthly Report. To remain continuously updated, be sure to subscribe to receive all upcoming reports. Furthermore, to stay connected with the growing community, follow Lido DAO through the various channels provided below.