Lido Monthly Report: December 2023

Welcome to the December edition of the Lido Monthly Report, a comprehensive source for insights into all of the latest developments.

This report reviews another month of noteworthy metrics, new collaborations, and ongoing developments that highlight the overall performance and progress of the Lido protocol.

TLDR:

- Despite a slight decrease in staked ETH due to withdrawals, TVL surged by over 10%, exceeding $21 billion.

- The Lido protocol welcomed 7,618 new ETH stakers in December.

- Snapshot votes successfully approved a number of proposals, including the Community Staking Module and wstETH bridge components on Mantle, zkSync, and Linea.

- NOCC Call #13 provided updates on the Simple DVT module, as well as presentations on Proposal Slot Timing and the impact of artificial latency in PBS.

- Collaborations featured institutional staking solutions and further stETH support on Morpho Blue, Sommelier Finance, and Aave.

- Lido DAO contributors showcased their insights in the Epicenter Podcast, celebrated Lido's third birthday, and delved into discussions about solo staking with the upcoming Simple DVT module.

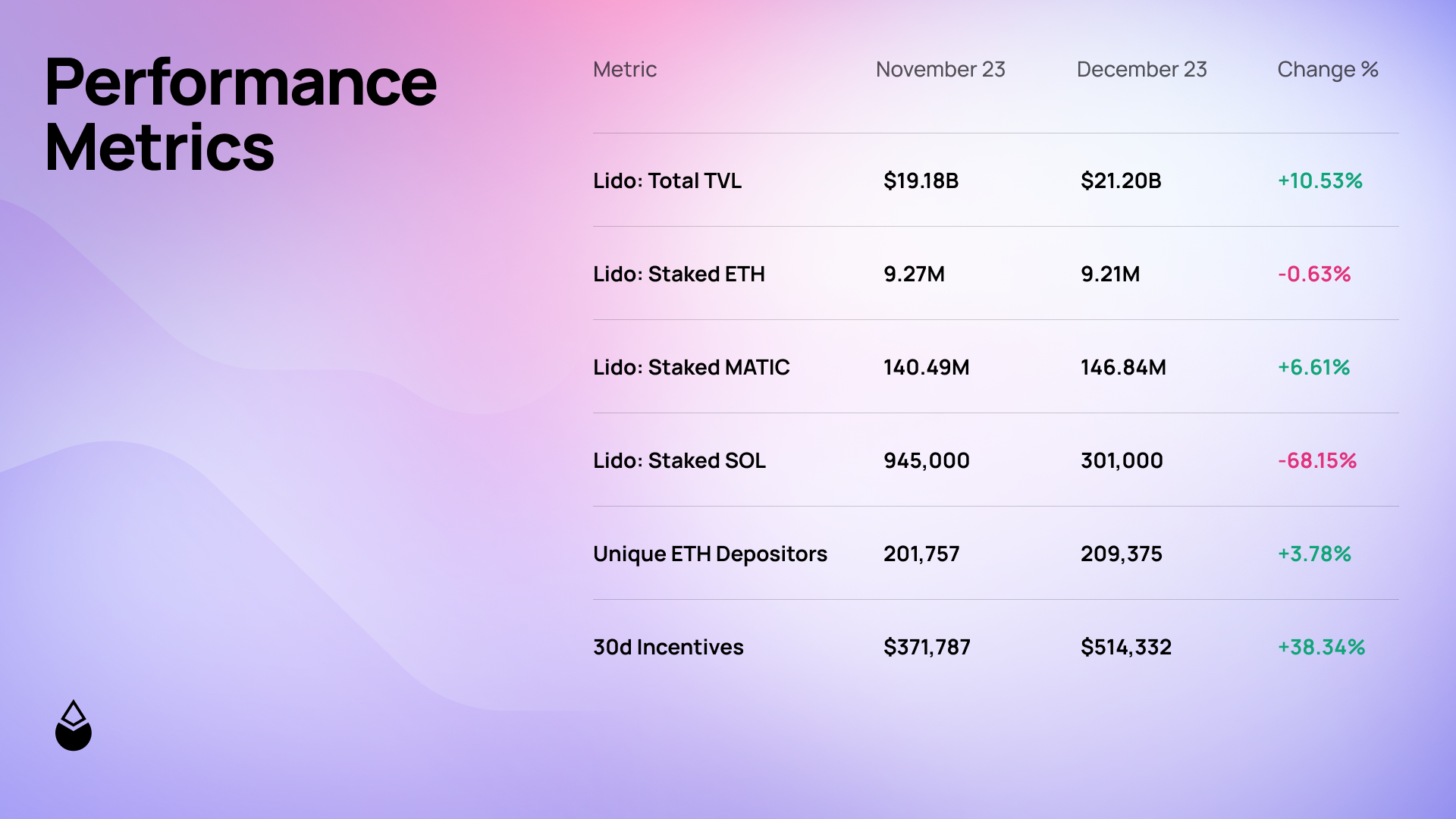

Protocol Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the protocols over the month of December.

Additional Notes

- Despite a slight decrease in staked ETH through the protocol due to increased withdrawal requests, the Total Value Locked (TVL) surged by over 10% - more than $2 billion - propelled by the positive ETH price performance.

- In the course of the month, a total of 7,618 new ETH stakers chose to utilize the Lido protocol for the first time.

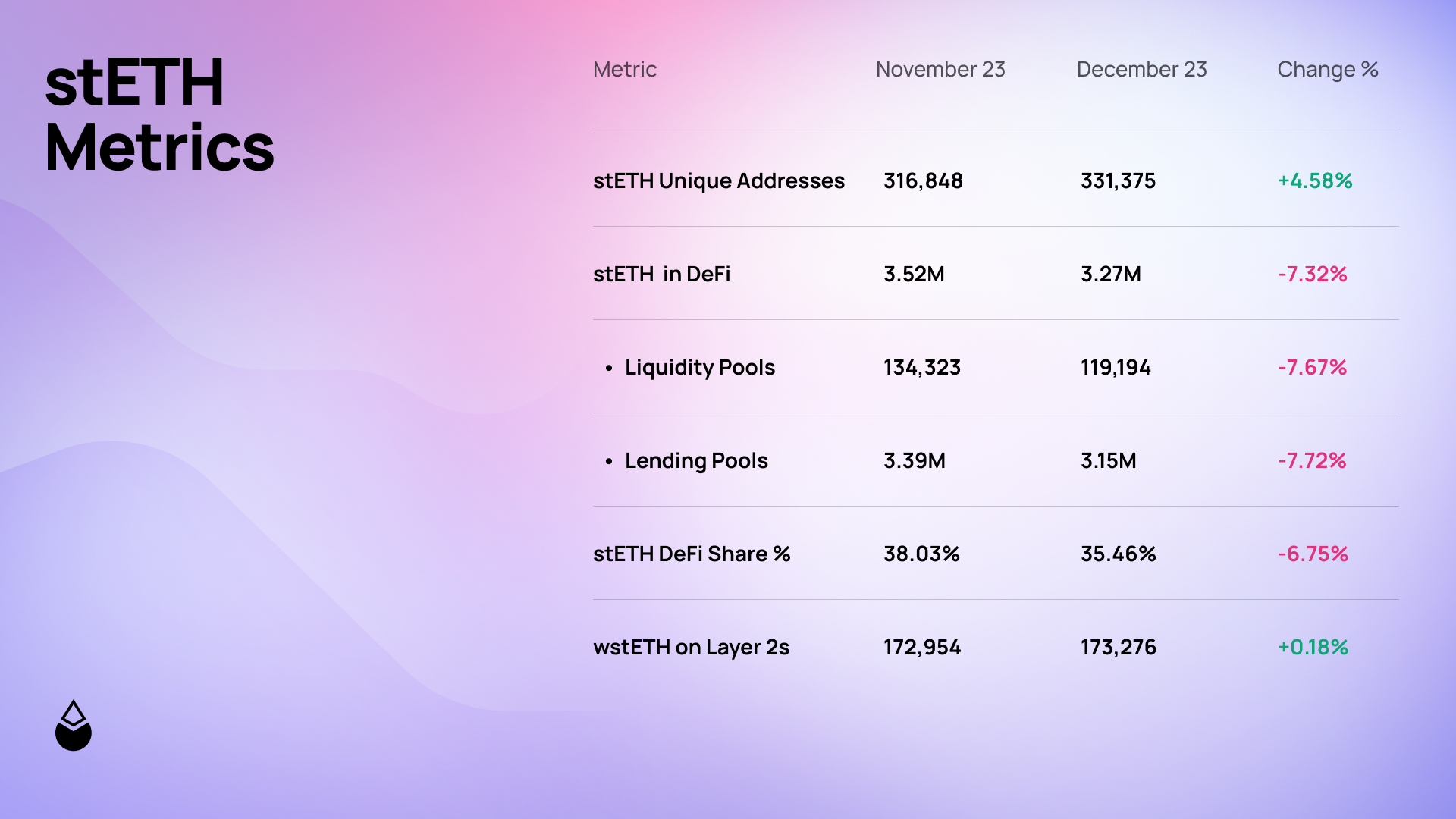

stETH Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the Lido's Ethereum staking token over the month of December.

Additional Notes

- It is important to note that these metrics also include wstETH - the wrapped, non-rebasing version of stETH.

- Despite witnessing over 14,000 new addresses acquiring sTETH for the first time, the total stETH locked in DeFi applications, particularly lending protocols, experienced a notable decrease of approximately 7.67%.

- wstETH on Layer 2 solutions saw a modest uptick, notably on Arbitrum, Polygon, and Base. Conversely, Optimism experienced a marginal decrease of 6.74%.

Governance

In this section, you will find notable proposals that have arisen from the Research Forum, along with their advancements through the voting processes on Snapshot and Aragon.

Snapshot

Among the various Research Forum proposals considered and deliberated upon during the past month, six proposals were subjected to Snapshot votes this month.

- wstETH Bridge Canonical Endpoints on Mantle: details

The proposal suggested granting Lido DAO control over the wstETH token bridging endpoints on Mantle as a proxy admin with upgrade authority, while the native bridge management remains outside Lido DAO's control.

Proposal Outcome: Successful ✅

2. wstETH Bridge Canonical Endpoints on zkSync: details

Similar to the previous proposal, this proposal suggested granting Lido DAO control over the wstETH token bridging endpoints on zkSync as a proxy admin with upgrade authority, while the native bridge management remains outside Lido DAO's control.

Proposal Outcome: Successful ✅

3. wstETH Bridge Canonical Endpoints on Linea: details

Similar to the previous two proposals, this proposal suggested granting Lido DAO control over the wstETH token bridging endpoints on Linea as a proxy admin with upgrade authority, while the native bridge management remains outside Lido DAO's control.

Proposal Outcome: Successful ✅

4. Grant Proposal to Advance Lido DAO's GOOSE Goals: details

This proposal recommends extending a 6-month grant to the Lido Contributors Group for the advancement of GOOSE goals, focusing on the development of Staking Router modules, Dual Governance, L2 integrations, and zkOracles. Additional funding is allocated to support ongoing projects and liquidity incentivization efforts by the Liquidity Observation Lab.

Proposal Outcome: Successful ✅

5. InfStones Curated NO Set Participation: details

This proposal addresses the participation status of InfStones, a Curated Set Node Operator in the Lido DAO, following identified vulnerabilities in their validator infrastructure. The DAO is prompted to decide whether to allow InfStones to resume submitting validator keys, initiate their removal from the Node Operator set, or request additional time for further assessment.

Of these options, the final results revealed that 88.93% of votes were in favor of resuming the key submission.

Proposal Outcome: Successful ✅

6. Community Staking Module: details

This proposal requested approval from the Lido DAO for the Community Staking Module (CSM) design, aiming to introduce permissionless entry to the Lido on Ethereum validator set with an ETH bond requirement. If endorsed, the Lido Community Staking team will proceed with further research, development, and security audits, anticipating a mainnet release by the end of 2024.

Proposal Outcome: Successful ✅

Community

In this section, you will find recaps of vital community gatherings, with a particular emphasis on the Node Operator Community Calls. These recaps serve to capture and share insights from these gatherings, fostering active engagement and meaningful discussions within our expanding community.

NOCC Call #13

The latest Node Operator Community Call covered several important topics:

- Will, a Lido DAO NOM contributor, presented an update on the Simple DVT module, providing updates on the respective Obol and SSV testnets performances. He further noted that the Aragon vote to officially deploy the module on mainnet is tentatively set for February 2024.

- Vlad Kurenkov and Pavel Yashin of P2P Validator delivered an in-depth presentation on Proposal Slot Timing, covering its concept, functionality, and future implications.

- Umberto Natale of Chorus One delivered a detailed presentation on the impact of artificial latency in the context of the PBS, offering an impartial assessment of the potential improvements in MEV. The presentation also shared insights from the Adagio pilot - a real case implementation.

For more details, see below for the full call:

Collaborations

In this section, you will find all the collaborations that have been established in the past month, as leading companies and protocols integrated with the Lido protocols, further expanding the reach and impact of its liquid staking tokens.

Integrations

- Hashnote has created an institutional staking solution with stETH, setting a new standard for regulated institutional liquid staking.

- Lending protocol Morpho Labs announced that stETH will be supported as a collateral type in the Morpho Blue ecosystem.

- Sommelier Finance announced that stETH users can now leverage their assets in the newly launched Turbo stETH (stETH deposit) vault, gaining access to different LST DeFi strategies.

- Following a successful governance vote, wstETH is available in the Base Aave V3 pool.

- stETH is now supported for both trading and liquidity provision on perpetual DEX Aark Digital.

Extra

- Lido DAO contributor Izzy joined the Epicenter Podcast to discuss a number of exciting topics.

🚀NEW EPISODE🚀

— Epicenter Podcast (@epicenterbtc) December 30, 2023

This week @crainbf & @FelixLts chat with @IsdrsP about the Ethereum (liquid) staking landscape and how @LidoFinance helps preserve staking decentralisation.

Hear about:

➡️Lido’s core architecture & modules

➡️Lido governance

➡️stETH in DeFihttps://t.co/jaQctPA61Y

- The Lido protocol celebrated its third birthday on 19 December 2023!

3 years later here we are 🥳 https://t.co/MhDlRVGx4s

— Lido (@LidoFinance) December 19, 2023

- Lido DAO contributor Eridian sat down with Stakely to discuss solo staking and the upcoming Simple DVT module.

I spoke to @Pacobits from @Stakely_io as an Ethereum solo staker in the @LidoFinance Simple DVT trials.@EridianAlpha: "What would you say to home stakers about the Simple DVT trial?"@Pacobits : "I would tell them don’t let this opportunity pass them by"https://t.co/o5WOID6MKj pic.twitter.com/iNyDW6RdRW

— eridian.eth (@EridianAlpha) December 13, 2023

Stay Connected

To conclude, another chapter is brought to a close in the Lido Monthly Report. To remain continuously updated, be sure to subscribe to receive all upcoming reports. Furthermore, to stay connected with the growing community, follow Lido DAO through the various channels provided below.