Lido Monthly Report: August 2023

Welcome to the August edition of the Lido Monthly Report, a comprehensive source for insights into all of the latest developments. This report reviews another month of noteworthy metrics, new collaborations, and ongoing developments that highlight the overall performance and progress of the Lido protocols.

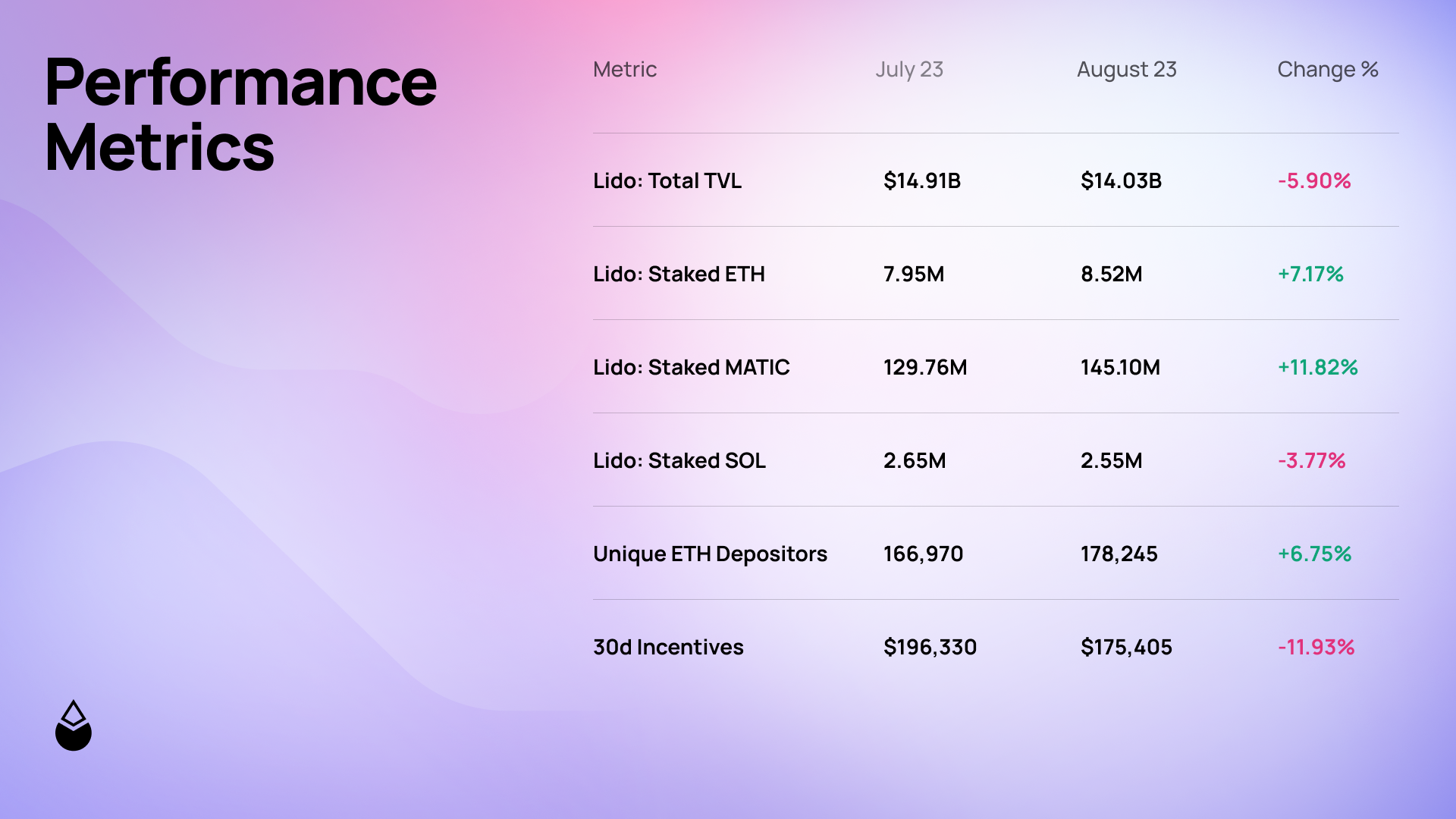

Protocol Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the protocols over the month of August.

Additional Notes

- Despite a retracement in the total TVL (Total Value Locked) to $14-billion, attributed to a drop in the price of ETH, there was a significant 7.17% increase in the amount of net ETH staked through the protocol over the course of the month.

- In a span of two days, between August 28th and 29th, the Lido protocol saw an influx of over 116,000 ETH being staked.

- July 2023 saw over 10,000 new stakers choosing to utilize the Lido protocol for the first time, marking a 50% increase compared to the previous month. This growth trend continued into August, with the protocol welcoming over 11,000 new stakers.

- Incentives provided in August included approximately 93 wstETH, which were allocated to a range of liquidity venues.

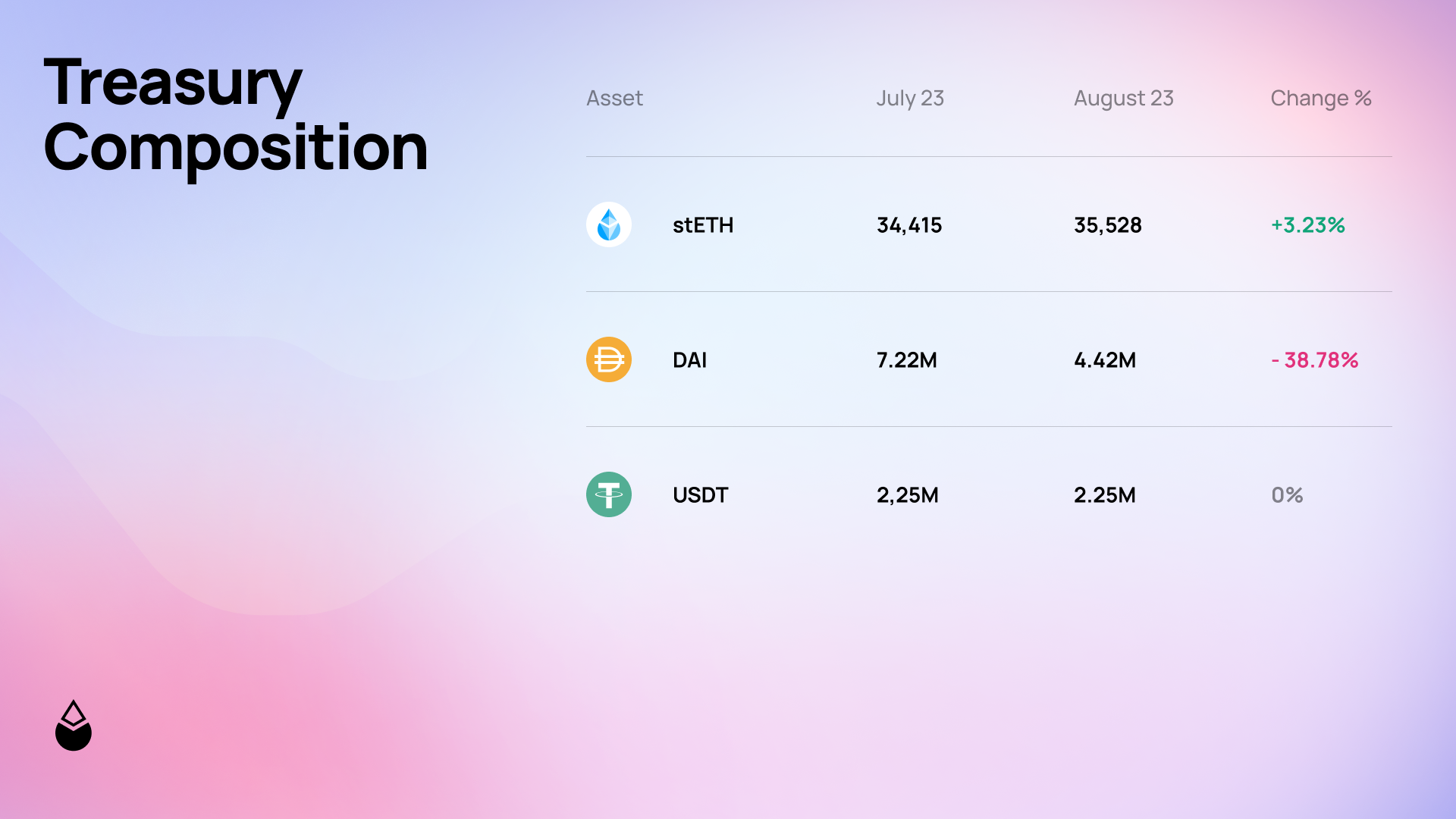

Treasury Composition

In this section, you will find an overview of the changes in the Lido DAO Treasury over the month of August, emphasising its commitment to transparency.

Additional Notes

- This Treasury Composition excludes LDO holdings.

- The reduction in DAI occurred as part of a reallocation process to provide ongoing funding to DAO-approved grantees.

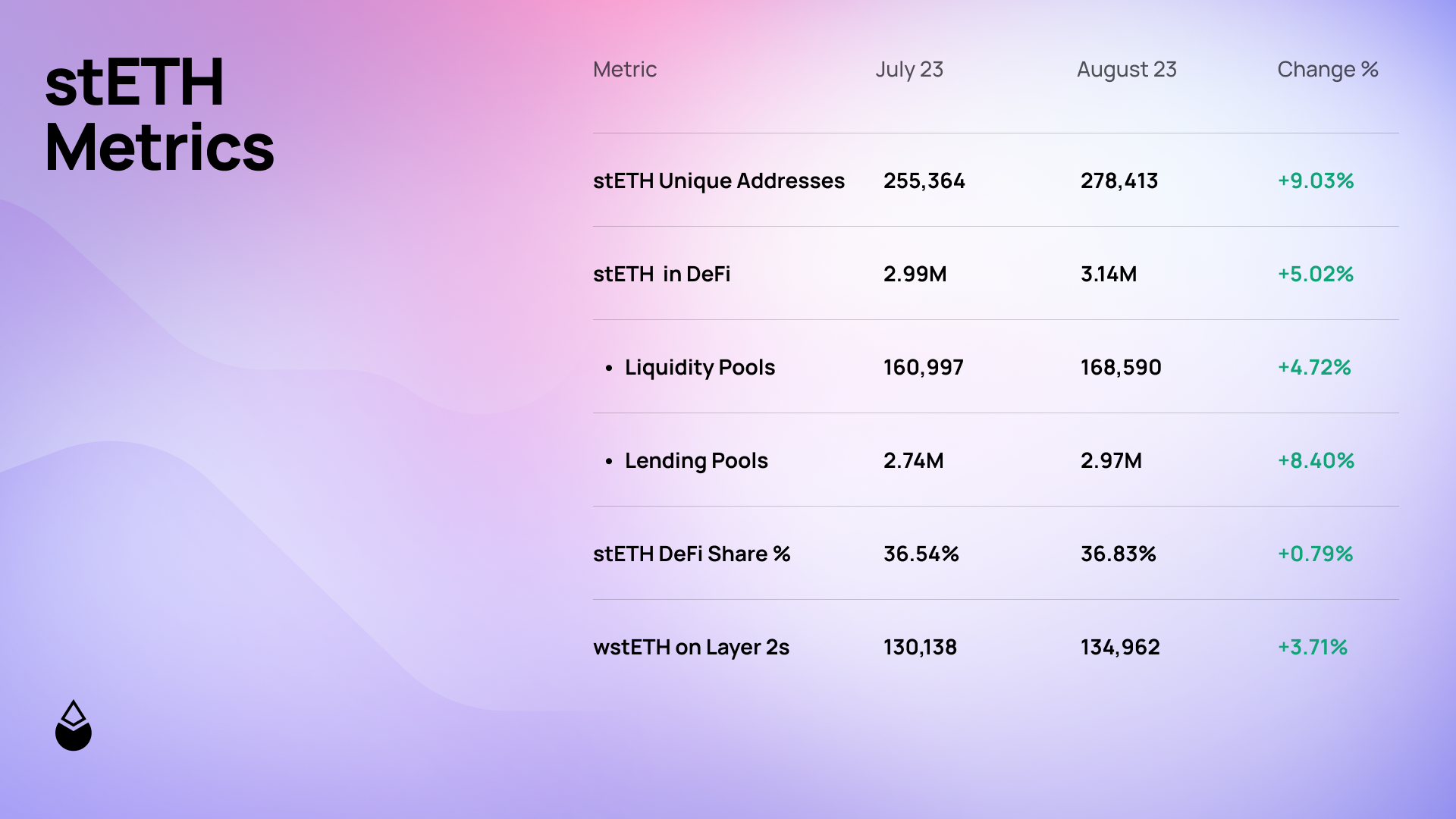

stETH Performance

In this section, you will find key metrics that offer valuable insights into the overall performance of the Lido's Ethereum staking token over the month of August.

Additional Notes

- It is important to note that these metrics also include wstETH - the wrapped, non-rebasing version of stETH.

- Lending protocols continued to receive an abundance of stETH inflows, as many market participants opt to back their loans with LST collateral.

- The demand for wstETH on L2s continued to rise, with Arbitrum bridges in particular experiencing a 9.37% increase in wstETH deposits.

Governance

In this section you'll see significant proposals that emerged from the Research Forum and their progression through the voting process on Snapshot and Aragon.

Snapshot

Among the various Research Forum proposals considered and deliberated upon during the past month, only one proposal was subjected to a Snapshot vote.

- April Slashing Incident - Key Limit Follow-Up: details

This Snapshot vote was seeking community sentiment on whether and when RockLogic GmbH, following the April slashing incident involving their validators, could increase their validator count.

The options included:

- Immediately lifting the key limit

- Lifting it after the next cohort of NOs catch up

- Disagreeing with both options.

Of these options, the final results revealed that 97.48% of votes were in favor of lifting the key limit after this next cohort of NOs catch up.

Proposal Outcome: Successful ✅

Aragon: Omnibus Votes

Following the successful Snapshot votes, a selection of these proposals were consolidated into one Omni-Vote within Aragon's 2-Phase voting process:

- Vote #162 : details

This on-chain vote primarily included adding both Launchnodes and SenseiNode to the Node Operator set, as part of the Stage 1 onboarding round for Wave 5.

Proposal Outcome: Successful ✅

Community

In this section you will find key community calls, with a special focus on the Node Operator Community Calls, where engagement and discussions are promoted within the growing community.

NOCC Call #9

The latest Node Operator Community Call covered several important topics:

- Will, a contributor to the Lido DAO NOM Workstream, provided an update on the progress of Node Operators selected during Stage 1 of Ethereum Wave 5 onboarding. Stage 2 shortlisting is on the horizon, with the aim of onboarding successful applicants in mid-September.

- Eridian, a member of DV Stakers, shared his experience in establishing a DVT validator node in Kenya. They managed to source all the necessary components locally, except for the node itself, which was generously donated.

- Eridian also operated within the Obol Network DVT cluster in Kenya. The DVT validator, named DVStakersKenya, achieved impressive performance metrics. It maintained a daily uptime rate of 99.1% and a monthly uptime rate of 83.24%.

- Dapplion, a Core Developer at ChainSafe, emphasized the importance of having diversity among Ethereum clients. Dapplion introduced Lodestar as the fifth-largest client with promising performance and upcoming compatibility with the DVT protocol.

- Stephane from Frontier Research delved into Frontier's ongoing research efforts and introduced their MEV Boost Relay. Currently, this relay is undergoing testing on the Ethereum Goerli testnet, with the goal of exploring new frontiers in blockspace efficiency and management.

For more details, see below for the full call:

Collaborations

In this section, you will find all the collaborations that have been established in the past month, as leading companies and protocols integrated with the Lido protocols, further expanding the reach and impact of its liquid staking tokens.

Integrations

- Following the successful BitDAO governance proposal, Layer 2 network Mantle staked 40,000 ETH through the Lido protocol as part of its Treasury Management Strategy.

- Pendle Finance, the fixed yield protocol, has successfully integrated with OKX Wallet - extending the offerings for both stETH and wstETH through the exchange.

- Ethena Labs, with its upcoming decentralised stablecoin USDe, announced its end-to-end integration with Bybit and Copper.co for its stETH collateral. As a result of this, stETH will be supported by both the institutional-grade custody solution and the leading derivative exchange.

Extra

- Sacha unveils some insights into the stETH holder behaviour over the past year.

35% of stETH holders have held for > 1 year pic.twitter.com/2ki2R5tEAg

— sacha💧 (@sachayve) August 25, 2023

- Lido DAO contributors published a blog piece detailing the second round of SSV-based distributed validator testing that took place through the Lido NO registry.

The 2nd round of testing SSV-based distributed validators through the Lido NO registry on Goerli is complete, with 38 new Node Operators participating in the Lido DVT trials!

— Lido (@LidoFinance) August 23, 2023

Check the full trial breakdown below 👇https://t.co/CVWSvjbSTC

- VaNOM revealed some insightful metrics in its 2023 Q2 report.

📊The Q2 2023 edition of Lido's VaNOM (Validator and Node Operator Metrics) report is now available.https://t.co/6nrfxuBDbl

— Lido (@LidoFinance) August 18, 2023

More info below 👇 pic.twitter.com/fzG2OMFbDE

- Lido DAO strategic advisor Hasu joined the Bankless podcast to discuss questions and concerns surrounding the protocols’ developments.

Lido has over 30% of ETH staked

— Bankless (@BanklessHQ) August 7, 2023

Is it a threat to Ethereum? Or are criticisms of @LidoFinance unfair?

Hasu (@hasufl) returns to the podcast to unpack these questions 👇 pic.twitter.com/WH10gtttYw

Looking Ahead - September 2023

- In collaboration with Neutron and Axelar Core, Lido DAO contributors are actively working to introduce wstETH into the Cosmos ecosystem, with the anticipated launch tentatively set for September.

- The Lido DAO Finance Workstream has proposed a significant shift in strategy by relaunching the reWARDS Committee as the Liquidity Observation Lab (LOL). This move is driven by the need to optimize liquidity within the stETH ecosystem and provide a seamless experience for users across various blockchains and decentralised applications.

- The shortlist of new Ethereum Node Operator applicants for Stage 2 of Wave 5 will be announced in early September. Following a successful vote, the successful applicants are expected to be onboarded towards the end of the month.

- It’s an exciting month for conferences with both Korea Blockchain Week and TOKEN2049 in Singapore. Lido DAO contributors will be attending and presenting at both events, so stay tuned for updates.

Conclusion

In closing, this wraps up the third edition of the Lido Monthly Report. To stay updated on the ongoing progress, please consider subscribing below for our next report. Additionally, you can stay engaged with the Lido community by following us on the various resources listed below.