Lido on Ethereum VaNOM - Stake Allocation & Distribution

Six months ago, the release of VaNOM allowed for easier understanding and comparison of Lido on Ethereum’s node and validator set metrics. The initial version of VaNOM focused on geographical, infrastructural, client, and jurisdictional diversity.

With Lido V2 now live on the Ethereum mainnet, the advent of the Staking Router and upcoming modules will likely lead to substantial changes in the Node Operator set, both in terms of the absolute number of independent node operators participating in the Lido on Ethereum protocol, but also in terms of how stake is distributed across the set.

With the Q1/23 release of VaNOM, information regarding the distribution of stake across the set will play a more prominent role, and hopefully serve to guide the DAO in its decision-making around things like operator onboarding, module assessments, and future staking infrastructure collaborations.

Additionally, starting from this quarter, Lido on Polygon's node and validator set metrics are also published in the report. The expansion of reporting to other networks reflect Lido's commitment to increased transparency and accountability.

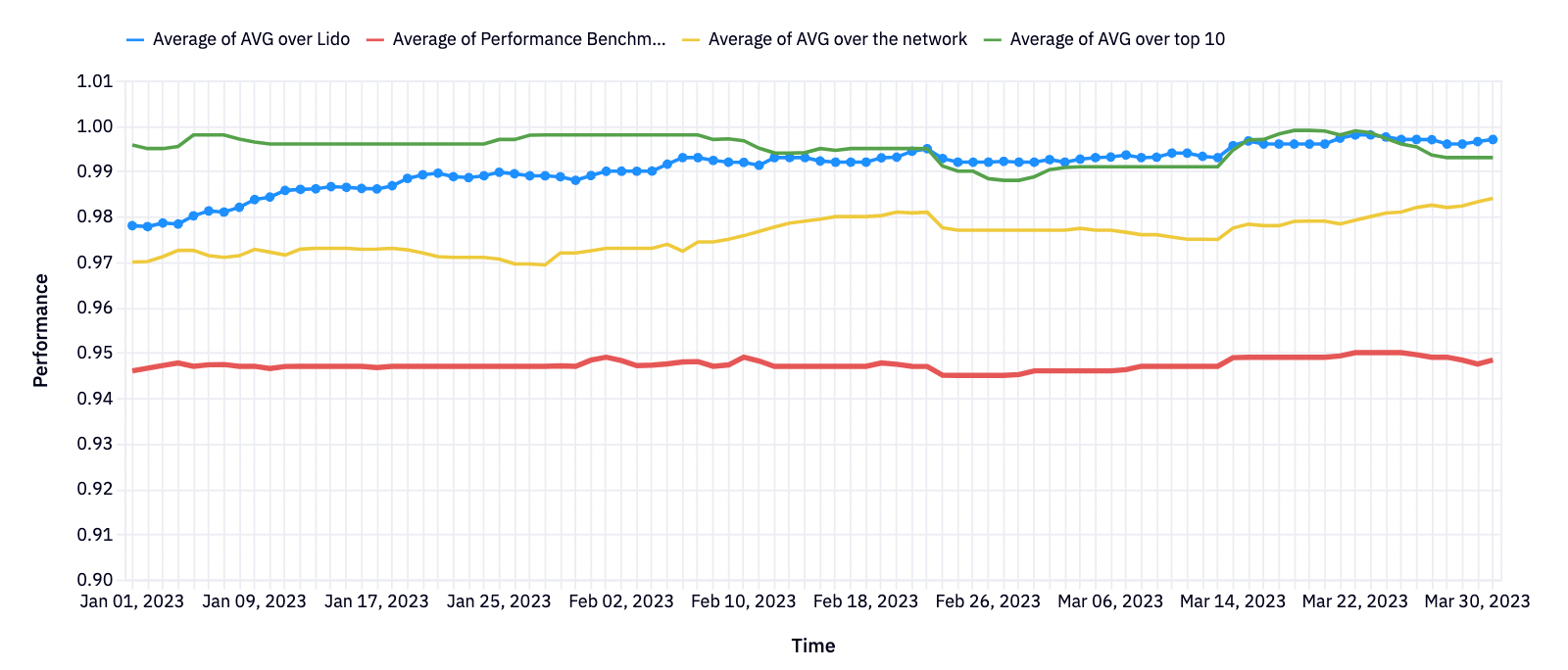

As of end of March '23, 6 node operators participate in Lido on Polygon, and an average of 16.67% of stakes are delegated to each node operator. Validators perform well above Polygon Performance Benchmark as well as comparing to the average over polygon network.

Stake Allocation

Well-distributed stake allocation is important and desirable because it can help improve a network's security, decentralization, and overall reliability.

When stake is concentrated amongst too few operators, there may be increased network impact due to severe outages, or risk of them acting maliciously or colluding, which could endanger the network.

On the other hand, more evenly allocated stake reduces the risk of such events, especially as the number of operators in the set grows, and strengthens the network's overall resilience. Additionally, it allows for a more diverse and inclusive community of operators, promoting decentralization and ensuring that the network remains accessible to a wider range of participants.

The Lido on Ethereum stake allocation algorithm allocates new stake deposits to operators with the least amount of active validators (assuming the operator has available keys). This effectively allows operators with less keys to catch up to operators with higher amounts of keys as new stake flows in, and gradually balances stake distribution over time.

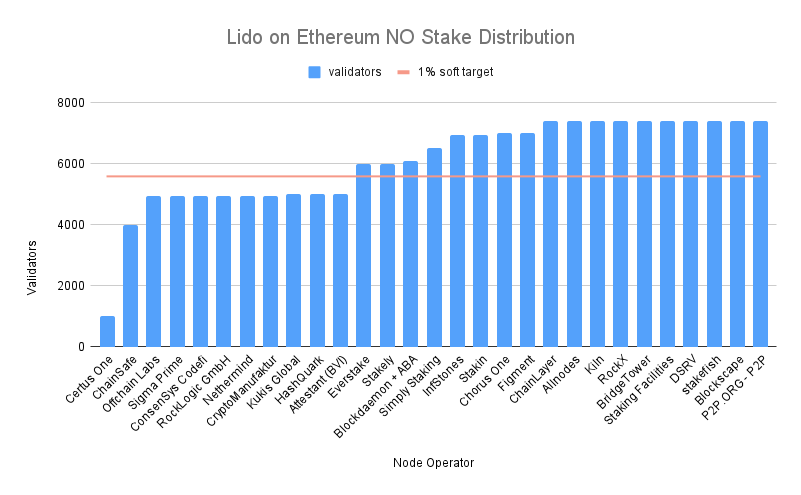

Since the most recent Lido on Ethereum onboarding round in summer ‘22, the latest onboarded cohort is now running a similar amount of validators as operators onboarded earlier. Most NOs operate 5000-7500 validators.

Stake Distribution

Following the launch of Lido V2, stETH withdrawals have now been enabled. This will help improve stake distribution across the node operator set, as the algorithm to make ETH available for withdrawals (if necessary) will prioritize exiting validators (keys) from operators with more active keys while still allocating new deposits to operators with less validators.

In the 2023/Q1 reported data, VaNOM now more clearly depicts intra Lido on Ethereum stake distribution metrics, namely:

- Number of Node Operators

- Number of validators per Node Operator

- Soft-target 1% threshold market

- Stake distribution equality metrics (Gini coefficient and Herfindahl-Hirschman Index (HHI))

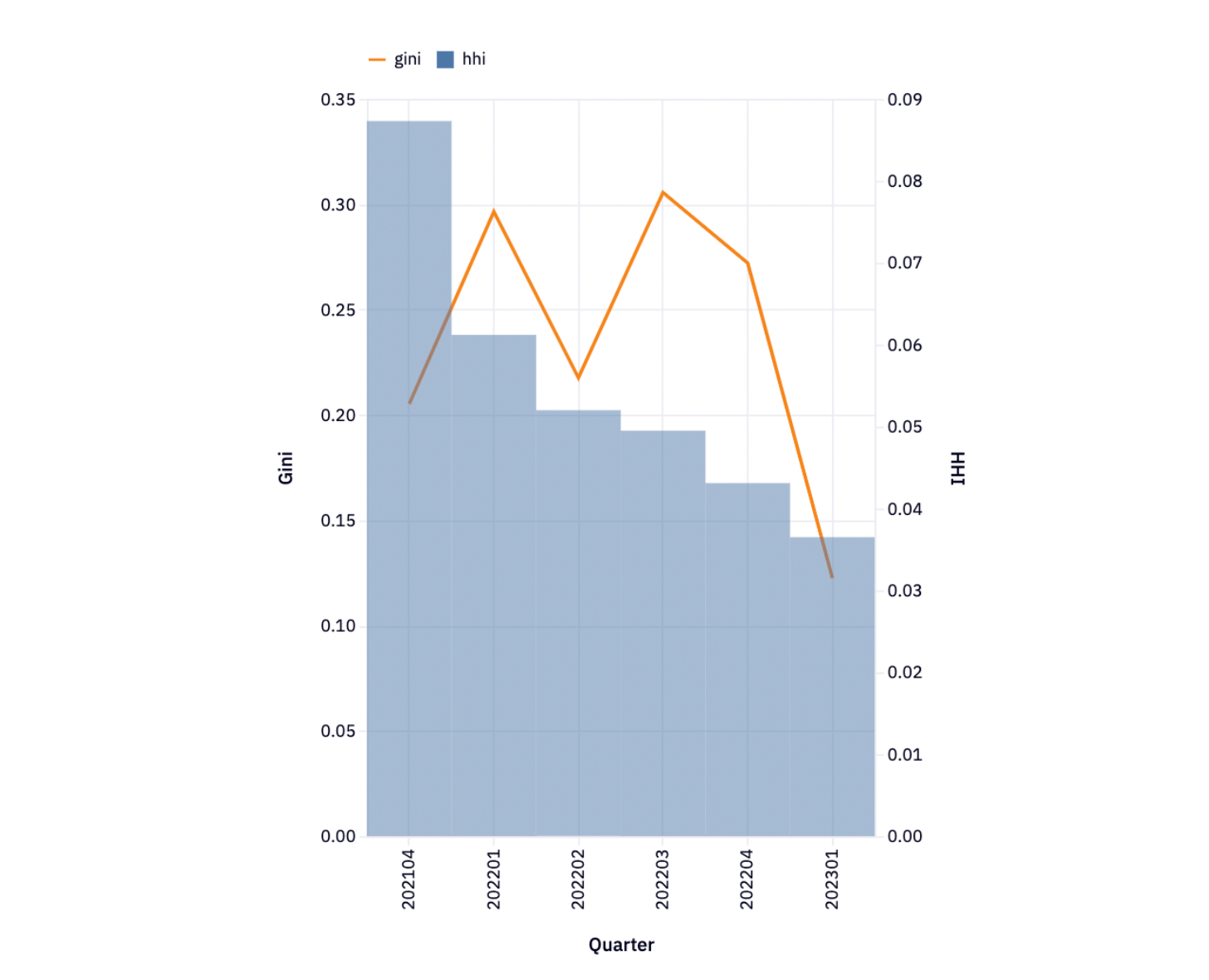

To quantify stake distribution two commonly used indicators, the Gini coefficient and Herfindahl-Hirschman Index (HHI), were considered. Additional indicators, such as the Nakamoto coefficient, will be considered for inclusion in the future.

The Gini coefficient is a statistical measure of dispersion of distribution, and ranges from 0-1, the lower the value the more equally the shares are distributed. It is a relative measure between participants in the pool.

The HHI is a measure of market concentration that is commonly used to evaluate the level of competition within a market. A higher the value indicates higher concentration.

As can be noted in the above diagram, based on the Gini score and HHI score, stake distribution amongst the node operator set can be considered well balanced. Additionally, one can observe that the distribution has improved (i.e. become better dispersed) throughout the lifetime of the protocol.

Although the stake distribution is pretty equal, some operators are running more than 1% of soft-target as described in Lido scorecard, which would indicate that it would be beneficial to onboard additional Node Operators, something already being discussed on the Lido community forum.

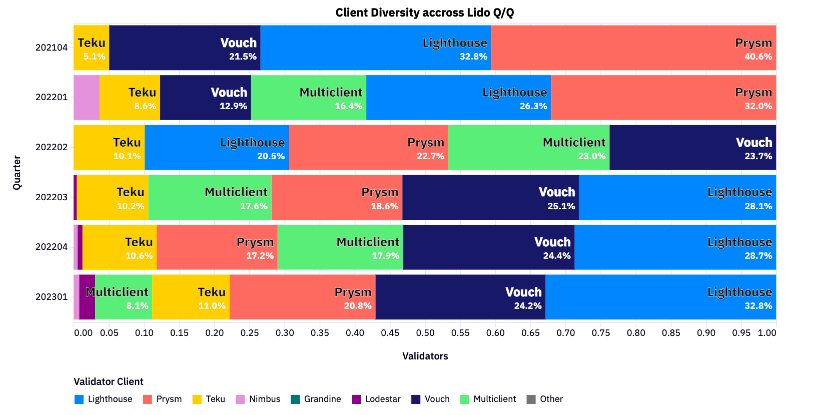

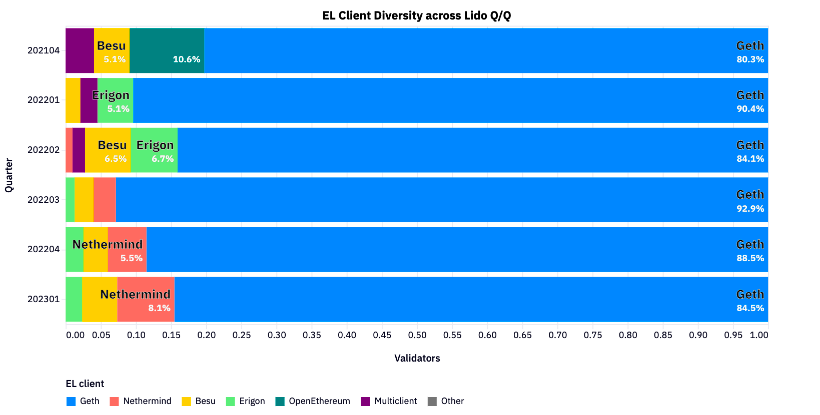

Node operators participating in Lido on Ethereum are committed to making improvements in Client diversity - both on Consensus Layer and Execution Layer. On the Consensus Layer, the shares of minority clients have consistently improve over time.

For Execution Layer clients, non-Geth implementations have stabilized post-Merge, and many performance improvements have also been made, so Node Operators have also been re-emphasizing the need to also diversify in this regard as well. But, there is still progress to be made.

Considerations

When considering these metrics, it should also be taken into account that the total number of Node Operators is currently 29 and the set is permissioned.

As the future of the Lido on Ethereum protocol unfolds with V2, and new staking router modules are likely introduced empowering a wide swathe of new operators to join, it could be expected to see big changes in these metrics. Dispersion metrics tend to skew as the number of participants increases, especially in permissionless systems.

Thus, the tracking of a multitude of decentralization metrics (number of operators, distribution of stake, diversity of operator setups) and being able to provide analysis around their evolution will be crucial in understanding the decentralization journey of the Lido on Ethereum protocol.