The Decentralized Validator Vault ft. Mellow, Obol & SSV.

TL;DR:

- The Decentralized Validator Vault (the “Vault”) - implemented by Mellow - is designed to boost the number of Distributed Validators active in the Simple DVT Module, advance the decentralization and resilience of the Lido on Ethereum node operator set, improve network security, and allow stakers to potentially benefit from DVT provider incentives.

- This Vault will stake ETH through Lido on Ethereum, with 90% of potential Obol and SSV Network incentives directed to vault stakers, with 10% going towards Node Operators.

- The Vault offers stakers the chance to receive rewards from both stETH rewards, and DVT provider incentives from protocols like SSV, Obol, and Mellow.

- The Vault will initially open with limited capacity, gradually increasing alongside the Simple DVT Module’s growth following a successful DAO vote. The goal is to reach approximately 11,868 validators, evenly distributed between Obol and SSV, over the coming months.

This expansion could ultimately amount to around 380,000 ETH, representing roughly 4% of Lido’s total staked assets.

In Brief: What is the Simple DVT Module?

DVT (Distributed Validator Technology) enhances the security, resilience, and decentralization of Ethereum validators.

It allows a single validator’s duties to be distributed across multiple nodes, reducing the risk of a single point of failure and ensuring higher network uptime. When node operators integrate this technology, Ethereum benefits from improved fault tolerance and a more diverse validator set, which includes both professional and home operators.

Simple DVT supports the distribution and robustness of the Ethereum network by enabling a more decentralized and secure staking environment, facilitating broader participation and collaboration among various types of node operators.

To date, the Simple DVT Module has onboarded nearly 180 net-new node operators to the Lido protocol, including over 100 solo and community stakers. These node operators are using the protocol to run validators on six different continents, utilizing every type of execution layer and consensus layer client, and operate nodes using a diverse mix of infrastructure.

The Decentralized Validator Vault: An Overview

The Decentralized Validator Vault, initiated by the Mellow team (a member of the Lido Alliance), aims to serve as a focal point for user stake to access DVT benefits and incentives.

The Mellow developed vault accepts (W)ETH, and stakes it within the Lido on Ethereum protocol to channel new stake into the Simple DVT Module, thereby enhancing network security and decentralization.

Under this plan, 90% of Obol Contributions and SSV mainnet incentives eligible for validators tied to the Simple DVT Module are directed to the vault, benefiting its users, while the remaining 10% goes to supported Node Operators in their respective Simple DVT clusters. In addition, stakers to the Vault will also receive points from Mellow.

The Vault strategy facilitates faster activation of Simple DVT validators, therefore improving the overall resilience and security of the Lido on Ethereum validator set. It also creates additional resilience and decentralization of the underlying Ethereum network by driving more validators to underrepresented geographies, diverse infrastructure and client types, and importantly, to many net-new solo and community stakers.

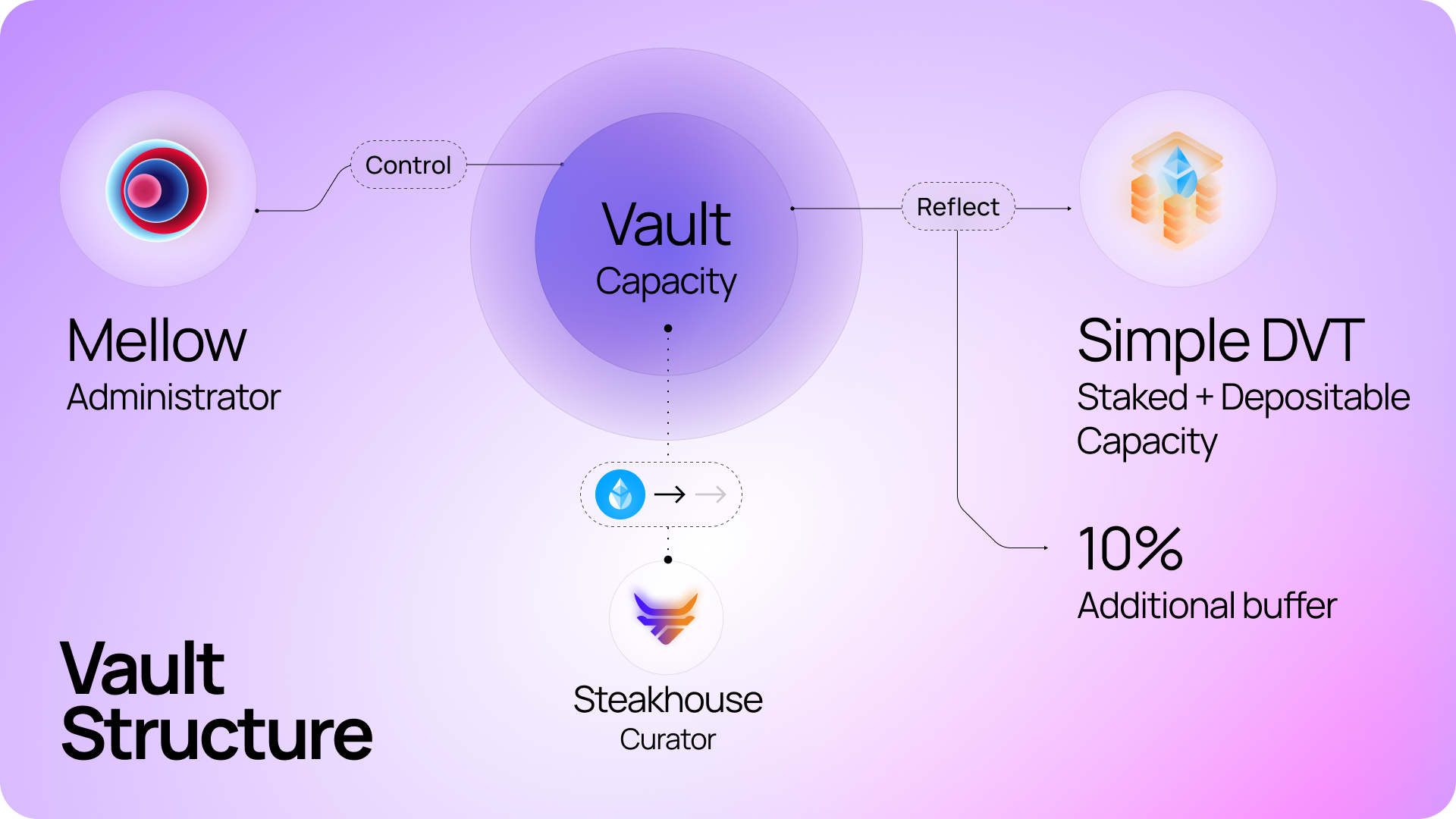

The Vault Structure

The capacity of the Vault would be controlled via the Mellow administrator, reflecting the current stakeable capacity of the Simple DVT Module, with up to a 10% additional buffer.

These parameter changes would reflect when key limits of clusters within the Simple DVT Module are raised, as explained in the Simple DVT Proposal and Expansion Proposal 1.

Steakhouse Financial will act as the curator of the vault, responsible for processing withdrawal requests (in wstETH) on a daily basis.

Incentives Eligibility

To dissuade possibly harmful effects to the Lido on Ethereum protocol due to farming incentives, an analysis will be conducted on Vault stakers. In order to be eligible to potentially receive full vault incentives for the capital provided, stakers must:

- Hold a position for a minimum of 3 days in the Vault through the conclusion of the Snapshot period. Every two weeks from the launch of the vault a Snapshot will be taken after which point totals will be updated.

- Not unstake existing stETH or wstETH that is then re-staked via the Vault from the moment of Vault launch. The points are calculated based on ETH staked to and persisting within the Vault during the relevant snapshot period minus any stETH withdrawn after the launch of the vault.

- Not dispose of (or swap) existing stETH on DEXs/CEXs: Similar to the above, the points would be calculated based on non-swapped ETH staked to and persisting within the vault during the relevant snapshot period.

For more info, here's an F.A.Q the Vault guidelines.

The Obol Vault

The Obol Collective is a community of 50+ entities and thousands of individuals focused on enhancing Ethereum’s security, resiliency, and decentralization through distributed validators (DVs).

The vault operates on the only DV middleware on the market, Charon.

This initiative aims to support scaling and decentralizing Ethereum, ensuring a robust foundation for the network’s growth and stability. Each Obol DV deployed in the vault will contribute to the Collective’s “1% for Decentralization” retroactive fund (RAF), which redistributes 1% of staking rewards from DVs to ecosystem projects working to scale and decentralize Ethereum.

This creates a positive flywheel effect: as more projects build on DVs, it boosts their adoption, which then unlocks additional funding for further projects. As stakers on Obol DVs contribute to the RAF, they will earn Obol Contributions, which will provide access to future governance and ownership within the Obol Collective.

With $1.5B of ETH expected to be staked via validators utilising the Obol Collective’s technology in the near-term, this fund is set to drive innovation and adoption of DVs, creating a sustainable and secure future for Ethereum.

The SSV Vault

Since ssv.network launched on mainnet in January this year, the protocol has seen significant success. It currently secures over 1.1M staked ETH supported by over 800 operators running nearly 38,000 validators. Clearly, SSV plays an important role in the overall health of the Ethereum validation ecosystem.

The SSV Network was developed as an infrastructure layer that allows re/staking applications to seamlessly plug into a globally distributed network of nodes. The goal is to create as many diverse onramps to DVT-powered staking as possible to help decentralize and secure Ethereum’s base layer.

To date, 26 grantees have built tooling or staking applications on SSV, with another 46 in progress. With SSV, anyone can easily and permissionlessly distribute a validator across trust-minimized operators around the world, providing additional resilience and peace of mind for solo and professional stakers alike.

The launch of Lido’s Simple DVT module marks an opportunity for the ssv.network DAO to give back to the community that has supported the SSV protocol. In tandem with SSV joining the Vault, a Learn campaign will be activated in which participants can gain insight into SSV, Lido, the Simple DVT Module, and the Decentralized Validator Vault while having a chance to share in a pool of rewards.

Moving Forward

The Decentralized Validator Vault, featuring contributions from SSV, Mellow, and Obol, represents a significant step towards enhancing the adoption of Distributed Validators via the Simple DVT Module.

By supporting increased stake to operators running DV infrastructure, and through the offer of DVT provider incentives, the Vault aims to bolster the security, resilience, and decentralization of the Lido protocol and Ethereum network.

Follow Lido on X and join the Discord to stay updated with all new developments in the staking and DVT space.