Lido Community Staking Testnet: Overview

One month has passed since Lido's Community Staking Module (CSM) launched its testnet on Holesky. On July 11, the CSM testnet transitioned from the initial Early Adoption phase to a fully permissionless mode, open to everyone.

When CSM was first introduced, the following goals were proposed:

- Allow for permissionless entry to the Lido on Ethereum Node Operator set and enfranchise solo-staker participation in the protocol;

- Increase the total number of independent Ethereum Node Operators.

Let's examine how the module was deployed on testnet to create a more practical solution for community stakers and make Ethereum validation participation through CSM more appealing to solo stakers:

- Smoothing of both Consensus Layer (CL) and Execution Layer (EL) rewards across the largest Ethereum validator set;

- Competitive bond structure;

- User-friendly experience with low operational gas fees;

- Exclusive use of ETH (stETH) for bonds and rewards;

- Potential for increased rewards per ETH of staked capital compared to vanilla solo staking.

Note: The feature implementations on testnet described below represent what certain contributors believe makes sense for building a competitive and robust permissionless staking entry for the Lido on Ethereum protocol. The parameters for mainnet deployment will be finalised after community discussion and DAO voting.

1. Smoothing of CL and EL rewards across the largest Ethereum validator set

Reward smoothing is implemented by the Staking Router. This process averages the rewards across various modules (CSM, Simple DVT, and the Curated Module), taking into account the number of active validators in each.

Cross-module reward smoothing for EL rewards effectively reduces reward variance for Node Operators within CSM. Now, CSM operators with fewer validators receive consistent rewards, irrespective of block proposal frequency, thereby alleviating concerns about low or infrequent earnings.

Within CSM, the reward distribution is determined by a Performance Threshold for each claim frame (~7 days on testnet). The testnet threshold is set at 5%, meaning any operator whose validators with an attestation rate above (network average - 5%) is eligible for reward distribution.

Node operators share the Node Operator rewards equally based on the number of validators whose performance exceeds the threshold. If all validators underperform, the operator will be ineligible for reward distribution in that period; however, their bonds will still generate default stETH staking rewards.

This approach provides reasonable performance flexibility, ensuring that Node Operators do not experience reduced rewards due to short-term fluctuations in their validators’ performance.

2. Competitive Bond Structure

Running a vanilla validator demands substantial ETH capital (i.e. 32 ETH), often exceeding the financial capacity of many potential operators. To address this barrier, CSM introduces a competitive bond structure utilising a customizable bonding curve mechanism that aggregates bonds across a node operator.

On the testnet, as per the configured bond curve, the required bond amount per validator decreases from 2 ETH to 1.5 ETH as the number of validators increases, eventually stabilising at 1.5 ETH. The bond requirement significantly reduces the entry threshold, making it more affordable for a broader range of operators. Additionally, this requirement is notably lower than current alternative solutions:

- RocketPool: 8 ETH + extra RPL

- Stader: 4 ETH + extra SD

- Puffer: 2 ETH + prepayment for Validator Tickets

For those eligible for Early Adoption, the bond requirement is even lower at 1.5 ETH for their first validator.

Unlike some other systems, CSM's bond is based on the Node Operator rather than individual validators. This means that the aggregate total of bonds provided by an operator running multiple validators can cover potential penalties caused by any of its validators. This approach enhances security while maintaining flexibility for operators.

3. User Optimised With Low Operational Gas Fees

When using Lido on Ethereum or other existing solutions to run validators, Node Operators must pay gas fees to interact with on-chain smart contracts for operator initialization and validator management.

CSM dramatically reduces the cost compared to existing solutions. Node Operators save approximately 64% on gas fees for initialising an operator with a single validator, compared to platforms like Rocket Pool or Stader.

Regarding scalability advantage, the gas fee savings become even more pronounced when creating multiple validators. For instance, initialising an operator with five validators in CSM costs about 14% of the gas fees required by RocketPool or Stader for the same operation.

4. Exclusive Use of ETH (stETH) for Bonds & Rewards

Only ETH and its Lido-generated staked ETH are used for bonding and rewards. It eliminates the complexity of involving additional tokens for Node Operators. By avoiding the introduction of new bonded tokens, CSM shields Node Operators from potential price fluctuations of platform-specific tokens.

Node Operators have the flexibility to deposit and claim their bond in three forms: ETH, stETH, or wstETH. Within CSM, bonds are converted to stETH, which receives normal Lido staking rewards (the “bond rebase”). In addition, Node Operator rewards are denominated in stETH, which continues to generate further rewards through rebasing.

5. Potential for increased rewards per ETH of staked capital compared to vanilla solo staking

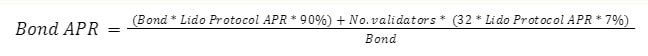

Assuming that Lido protocol APR is approximately equal to vanilla validation APR, the per-ETH bond capital efficiency of running validators using CSM may be up to 2.39 times higher than that of running vanilla validation. This potential advantage stems from CSM's dual-reward system:

- Bond Rebase: Node Operators benefit from Lido staking rewards from the stETH bond;

- Node Operator Rewards: Node Operators receive a share of staking rewards, with a reward rate of 7% on testnet.

It's important to emphasise that Node Operators continue to accrue bond rewards (rebase) even if their validators’ performance falls below the predetermined Performance Threshold. While performing below this threshold does result in the forfeiture of Node Operator rewards for a given frame, the bond rebase rewards per validator potentially exceed those obtained through vanilla solo staking.

Wrapping Up

Based on the implementations outlined, Lido CSM contributors aim to lower the barriers to Ethereum validation participation by providing more consistent and potentially higher rewards, reducing the required capital, and decreasing operational costs. These efforts are designed to onboard an increasing number of independent operators to Ethereum.

The CSM testnet is still ongoing, and the higher-performing testnet participants may qualify for the mainnet Early Adoption phase: csm.testnet.fi/.