reGOOSE: An Update to Lido DAO GOOSE Goals

TLDR: reGOOSE & Lido Alliance

Last week, Hasu published reGOOSE: Updated goals for Lido in the light of MVI and restaking. Hasu’s proposal to update the GOOSE goals to accommodate new developments in the market feature a few key principles:

- Stay focused on security and decentralization

- Participate in Ethereum staking roadmap research

- Reaffirm that stETH should remain a foundational tool and an LST, rather than step into the high-risk, money-manager-like LRT market

- Support Ethereum-aligned validator services, starting with preconfirmations without exposing users to additional risk

- Make stETH the #1 collateral in the restaking market

Furthermore, Steakhouse have proposed the adoption of the Lido Alliance, a framework for growing an Ethereum-aligned ecosystem around stETH, with a shared mission of decentralizing Ethereum validation.

What has happened since the first GOOSE?

hasu’s recent proposal looks at the state of the current GOOSE goals and evaluates whether the market has changed enough to warrant modifying them.

The GOOSE process is a way for the DAO to signal the ‘Why’ and the ‘What’ of strategic direction. The community and contributors are then invited to reply with proposals for ‘How’.

This article wanted to take the opportunity to go deeper into some of hasu’s ‘What’ points and share some early perspectives on ways that the ‘How’ could be achieved.

The biggest headline feature is ultimately that the mission remains the same. Users value Lido stETH for being robust, minimal middleware for staking, and that is what it is likely to remain.

What changes is the market facing now?

The staking market has since changed in two fundamental ways

- MVI

- Restaking

The issuance debate is focused on whether Ethereum should limit the growth of the validator set and limit the % of ETH staked explicitly. The clearest point is that much more research is needed as the debate is far more nuanced than simplistic representations of each position on crypto twitter.

Reductions to Ethereum’s security budget would likely have severe consequences on the decentralization of the network, in particular affecting solo-stakers and supplier technology such as DVT.

The rapid emergence of restaking is another market change, and one that few people expected to be so quick. Or, to be specific, few expected restaking protocols to be able to reallocate enormous amounts of capital on the basis of points farming, before the launch of any real, organic restaking yield.

Restaking is a promising new technology that is still in the process of maturation. Through the introduction of new slashing conditions, stakers are exposed to a new universe of rewards and opportunities, as well as its commensurate risks.

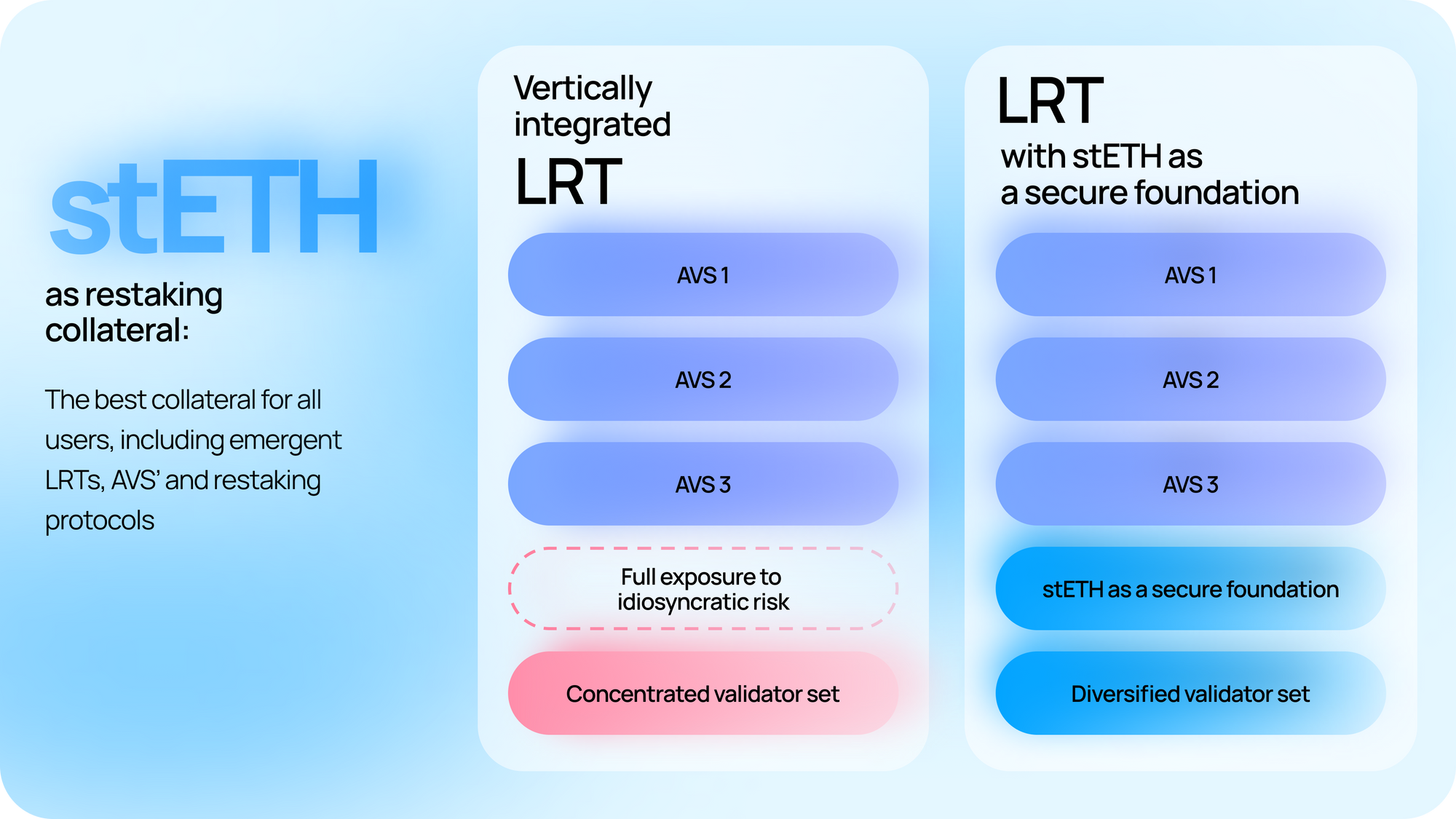

The best way to secure the foundational layer of restaking and prepare it for this universe of new applications is to use stETH as a secure base asset.

How are the GOOSE goals changing?

1. Stay focused on security and decentralization

Maximizing the strengths of the validator set and minimizing the risks from LSTs on long-tail security are both important goals.

stETH meaningfully contributes to Ethereum decentralization and the DAO should want to continue improving the stETH validator set and decreasing smart contract and governance risks, regardless of the outcome of the issuance curve debate.

2. Participate in Ethereum staking roadmap research

Education was an important goal in the first iteration of the GOOSE goals, but vaguely defined. This goal is much more specific in asking for a Lido DAO funded Research arm that can help provide insight into crucial issues such as the issuance debate.

This initiative should engage in research, suggest specific proposals, and contribute to an endgame vision for ethereum staking that can protect against both centralization of the validator set and long-tail risks.

Cyber.fund has already begun an independent research grant program. hasu has asked Lido DAO to answer the call and provide its own framework for developing and funding research grants. Lido Research is an attempt to answer that call.

3. Reaffirm that stETH should stay an LST, not become an LRT

In spite of the current popularity of restaking/LRTs, it would likely be a mistake for Lido DAO to jump on the LRT bandwagon.

More institutional than retail capital is expected to join Ethereum over the next three years (and it would be very surprising if a significant portion of it were used in restaking). To ensure the staking layer of Ethereum remains decentralized, Lido or another decentralized staking pool needs to win the institutional opportunity.

Secondly, while LRTs may offer higher rewards than staking, their nature is closer to an ETH-denominated credit or mutual fund. Liquid staking, on the other hand, is a commoditized software offering.

The DAO should stay open to launching additional products on top of stETH, incl. an LRT, when there is sustained market demand and alignment with the Lido mission. However, stETH should always stay the DAO’s priority, and it should always stay an LST.

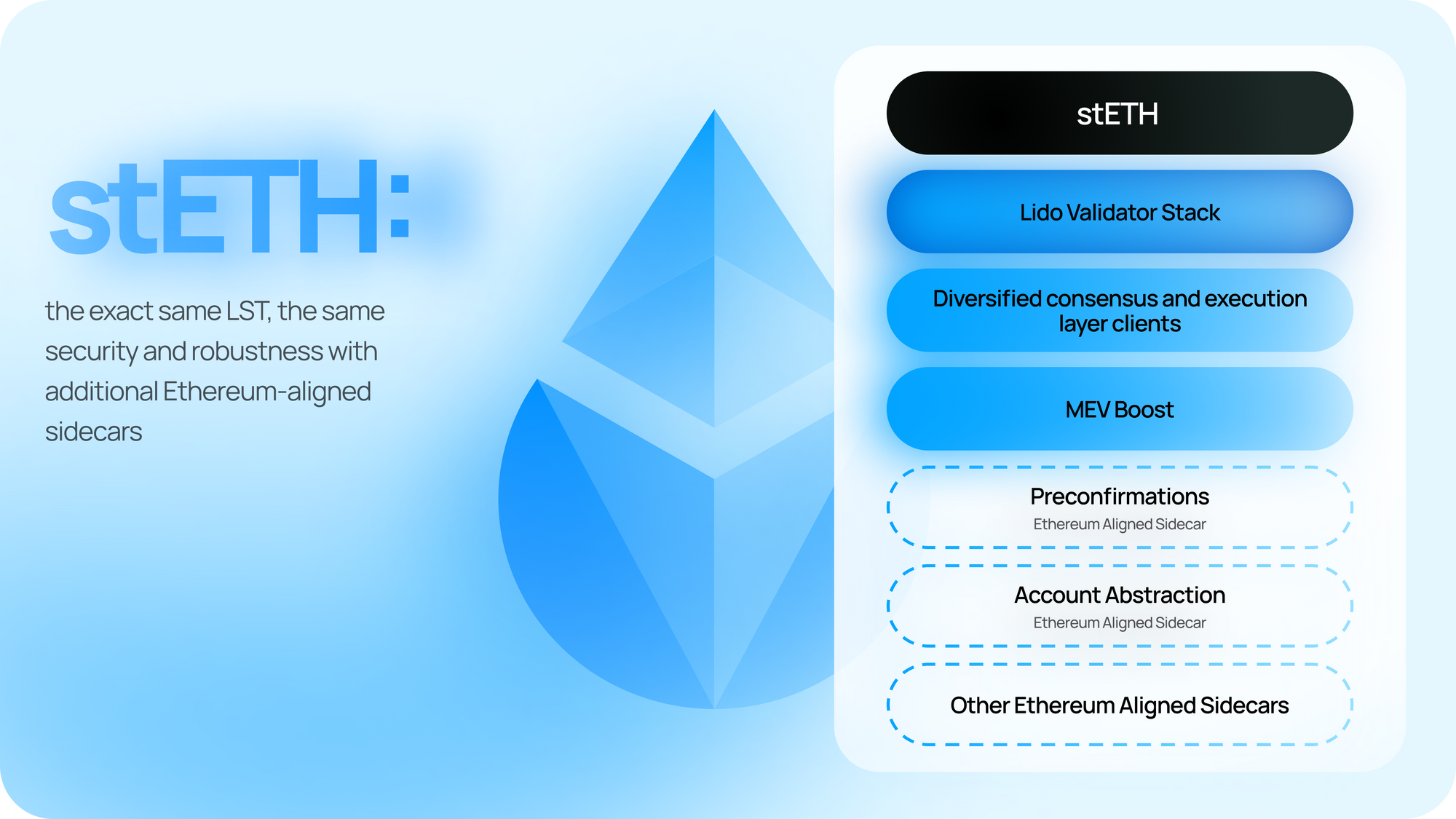

4. Internalize validator services that align with Ethereum’s roadmap, starting with preconfirmations, without exposing stakers to additional risk

In collaboration with Lido Research, the Ethereum Foundation and the rest of the Ethereum community, Lido should stay at the forefront of what “staking” means. This includes actively exploring a new service when there is strong indication that all validators will adopt it.

The obvious first-step here is support for preconfirmations, which allow validators to commit to include a transaction outside of the regular auction cadence. Supporting Ethereum-aligned sidecars, such as preconfirmations, has the potential to help grow the Ethereum ecosystem without increasing risk to stETH users.

5. Make stETH the #1 collateral in the restaking market, allowing stakers to opt into additional points on the risk and reward spectrum

The big opportunity in restaking, in our view, lies at the intersection of LRTs / restaking platforms and modularity.

For stETH, the opportunity is to remain the top collateral used in the construction of restaking protocols, and to give stETH holders the ability to opt into additional points on the risk/reward spectrum. For LRTs, it is to delegate the staking layer to stETH and take control of LRT unit economics to deliver the risk-adjusted restaking rewards that LRT holders expect.

Proposing: Lido Alliance

Finally, since DAOs are chronically bad at negotiating strategic partnerships, hasu suggests the creation of a new ecosystem-building team or initiative for that purpose inside Lido DAO.

Lido is a unique software protocol that uses market forces to create incentives for decentralizing Ethereum. Market incentives can be one of the strongest forces for good in the world, and cryptoeconomic mechanisms are one of the strongest possible ways of enforcing their outcomes.

As neutral software, Lido stETH balances interests between node operators and stETH users. Another proposal for a Lido Alliance is intended to create a social contract for protocols that share Lido’s mission of “keeping Ethereum decentralized, accessible to all, and resistant to censorship”. Growing the stETH ecosystem has proven to be a powerful way of accelerating Ethereum decentralization and accessibility.

Lido Alliance is a governance framework for allowing the DAO to ‘onboard’, or ‘endorse’ projects on the basis of their adherence to Lido’s mission, their security culture, and to what extent they expand the stETH ecosystem. Hopefully the rigor of Lido DAO’s security expectations as part of the Alliance onboarding process will prove to be an effective way of exporting Lido DAO’s security culture to the rest of Ethereum.

While the Alliance framework proposal is theoretically open to any new protocol, Steakhouse wrote it with restaking in mind, and have three points to their ‘wishlist’, as an open call to the community:

- New staking and restaking protocols that aim to create permissionless restaking architecture and facilitate open markets

- Permissionless LRTs, i.e. services that curate AVS’ but allow users to delegate ETH in a trustless and multisig-less way (similar to yearn strategies or MetaMorpho vaults)

- Pre-confirmation services and other AVS protocols that are Ethereum-aligned and can help make the network stronger.

Any of the above are invited to contact the Alliance Workgroup (details to come, should the proposal pass) to explore the Alliance and begin the governance process for endorsement. The framework is generalist and other protocols that share the same aim are equally invited to participate.

This is one of many ways to participate and partner with Lido DAO, and hopefully it will lay the foundation for projects to get more deeply involved with the ecosystem.

What's Next?

In the coming days, both reGOOSE and Lido Alliance will be discussed across the Lido DAO forum. Following discussion, both initiatives will put up for a Snapshot vote for Lido DAO members to vote on the enactment of both. This post will be updated to include information on these votes, in addition to voting information being shared across Lido Twitter and other community channels.

In addition to this, a community call will be hosted this Thursday to discuss both initiatives in more detail, providing DAO members with a chance to ask questions and provide feedback in real-time.

Finally, it goes without saying, but the success of Lido in securing Ethereum validation would not have been possible without the support and passion of a dedicated community, or the commitment and mission-driven focus of ecosystem participants.